Social Security income tax cuts may include a huge new deduction for retirees

Here's who is eligible for a new proposed Social Security tax break.

The House Ways and Means tax bill is out, and older Americans hoping for a tax break on their Social Security benefits received a different kind of relief than expected.

The tax proposal aims to provide tax relief for seniors age 65 and older by increasing their standard deduction by an additional $4,000.

The increased standard deduction for seniors would be in effect through 2028 and subject to income limits, according to Robert Westly, regional wealth advisor at Northern Trust.

Related: How the IRS taxes Social Security income in retirement

The new tax break is welcome news for the over 66 million Americans who collect Social Security income, including about six million baby boomers who signed up to receive benefits in 2024.

Social Security income is only designed to replace about 40% of a person's pre-retirement income, and many Americans count on it exclusively to support themselves in retirement. That's a problem because the average Social Security payment to retired workers is less than $2,000 monthly, yet average retirees' monthly expenses total $4,345, according to the Bureau of Labor Statistics.

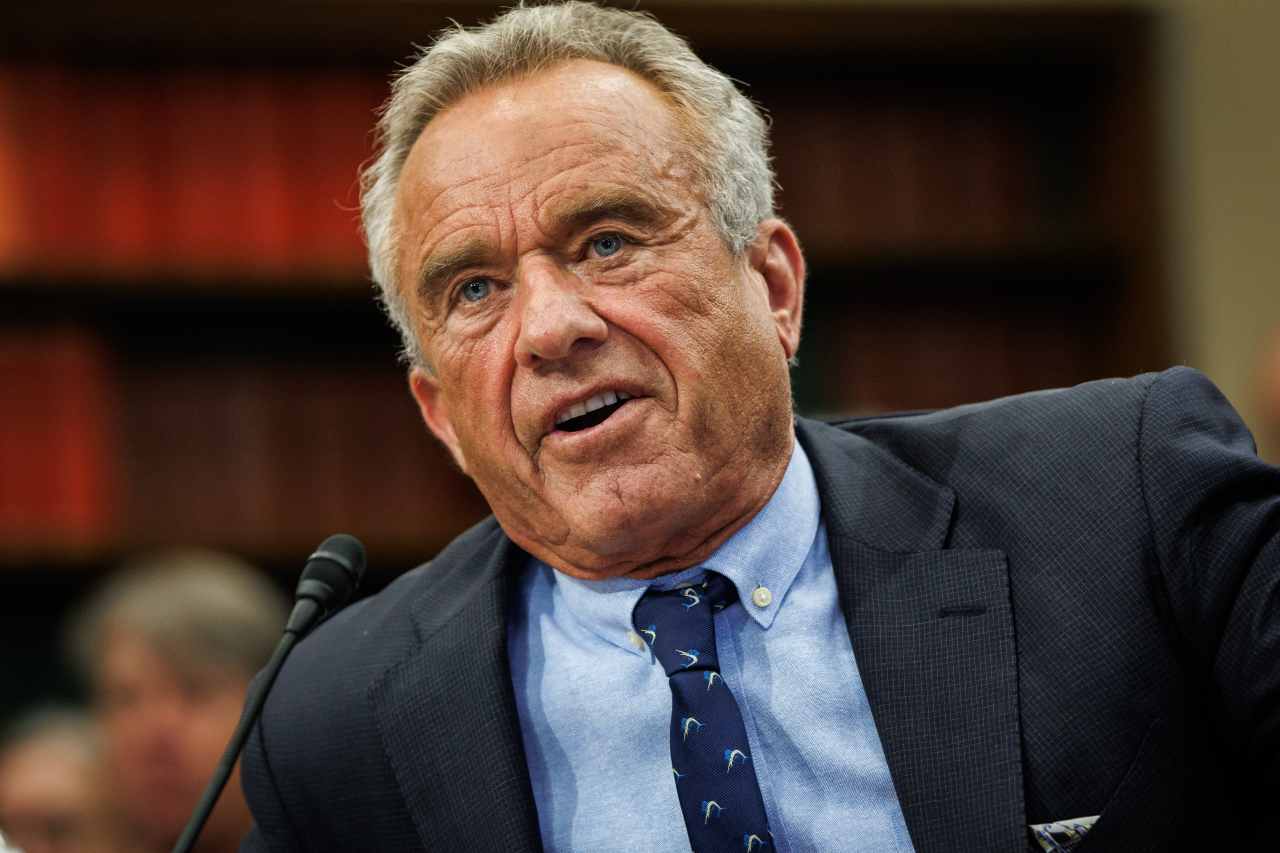

The shortfall between Social Security income and expenses means every dollar counts, making tax relief crucial. Image source: Shutterstock

Who qualifies for the proposed Social Security income tax deduction?

To qualify, he said a senior's adjusted gross income (AGI) must be no more than $75,000 for single filers or $150,000 for those married filing jointly.

Under current law, for the 2025 tax year, the standard deduction amounts are:

- Single: $15,000;

- Married filing jointly: $30,000;

- Head of household: $22,500; and

- Married filing separately: $15,000.

These amounts are adjusted annually for inflation, according to the IRS.

There’s also an additional standard deduction for those 65 or older or blind:

- Single or head of household: $2,000 (or $4,000 if both 65 or older and blind); and

- Married filing jointly or qualifying surviving spouse: $1,600 per spouse (or $3,200 per spouse if both 65 or older and blind).

According to Westley, the proposed deduction is an additional deduction on top of the regular standard deduction – not on top of the current additional deduction.

“So, it would increase the current additional deduction to $4,000 for a single filer age 65 and older, or $8,000 for a married couple filing jointly where both are age 65 or older,” he said.

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

“My thought is that the additional standard deduction should be a meaningful savings to the average older American,” said Westley. “Most seniors take the standard deduction and live on a fixed income, so the proposed deduction should provide meaningful tax relief.”

Meantime, Jeffrey Levine, the chief planning officer at Focus Partners, stated on X the following about this proposal. “This next proposed tax break for seniors is a doozy from a complexity POV,” he wrote. “The upshot is that "Seniors" would be entitled to up to an additional deduction of $4k, but (ready for this laundry list of caveats?)...”

He noted the deduction would:

- Only apply for four years (2025 - 2028);

- Be phased out by 4% of income in excess of $150,000 for joint filers and $75,000 for everyone else; and

- Be a below-the-line deduction, but would be available to both itemizers and non-itemizers.

“BTW, I'm pretty sure ‘senior’ here means ‘someone 65 or older by the end of the year,’ since they're basically bolting this provision onto the section covering ‘additional standard deduction’ amounts,” Levine wrote.

Don’t spend your Social Security tax savings yet

Westley and other experts, however, are urging Americans to hold off on calculating their tax savings for now. “The bill will be debated and likely change numerous times prior to becoming law, but it helps to see how it may progress directionally,” said Westley.

And Jean-Luc Bourdon, a wealth adviser with Lucent Wealth Planning, said, “I’m looking for anything that would prompt me to act before the proposals become law. So far, waiting for the final bill seems reasonable.”

Related: These are the most tax-friendly states if you work in retirement

And Jeffrey Levine, the chief planning officer at Focus Partners, stated on X the following: "Reminder that this is still just PROPOSED legislation. Things can (and likely will) change.”

A big, beautiful bill to help retirees

Broadly, the proposed bill aims to address the impending expirations of the 2017 Tax Cuts and Jobs Act (TCJA) while introducing additional changes to U.S. tax policy.

From Westley’s perspective, one of the most significant aspects is the bill’s move to codify and make permanent key provisions of the TCJA.

These include the current individual income tax rates, the increased Alternative Minimum Tax (AMT) threshold, the higher standard deduction, the elimination of miscellaneous itemized deductions, and the removal of the personal exemption.

“Overall, the bill would prevent tax increases on 62% of taxpayers that would occur if the TCJA expired as scheduled,” the Tax Foundation noted in its analysis.

The bill also proposes to raise the State and Local Tax Deduction (SALT) cap to $30,000 for filers earning $400,000 or less. It increases the exemption for estate, gift and GST (Generation-Skipping Transfer) Tax taxes to $15 million for 2026, adjusted for inflation, which is more than a simple extension would allow.

The SALT deduction is a provision in the U.S. federal income tax system that allows taxpayers who itemize deductions to reduce their taxable income by the amount of certain taxes paid to state and local governments, such as property taxes, state and local income taxes, and sales taxes.

For the tax years 2018 through 2025, the TCJA imposed a limit on the total amount of deductible state and local taxes. The current SALT deduction limit is $10,000 per household. For those married filing separately, the limit is $5,000. This cap is scheduled to expire at the end of 2025.

Under current law, which expires at the end of 2025, the federal estate tax exemption for 2025 is $13.99 million per individual. That means that an individual can transfer up to $13.99 million in assets during their lifetime and/or at death without incurring federal estate or gift taxes. For married couples, this exemption is effectively doubled to $27.98 million.

Related: Medicare recipients face a growing problem