Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500?

Wondering which dividends are worth your attention in 2025? The three richest yields in the S&P 500 tell a couple of different stories.

Most of the stocks in the S&P 500 (SNPINDEX: ^GSPC) pay dividends. The average dividend yield of this popular market index is 1.3%, as shown by the 1.3% yields of index-tracking exchange-traded funds such as the iShares Core S&P 500 ETF (NYSEMKT: IVV) and Vanguard S&P 500 ETF (NYSEMKT: VOO).

Some S&P 500 components rise far above this modest average. About 100 of the 503 member stocks offer yields of 3.5% or more, and the most generous dividend payers nearly reach double-digit percentages.

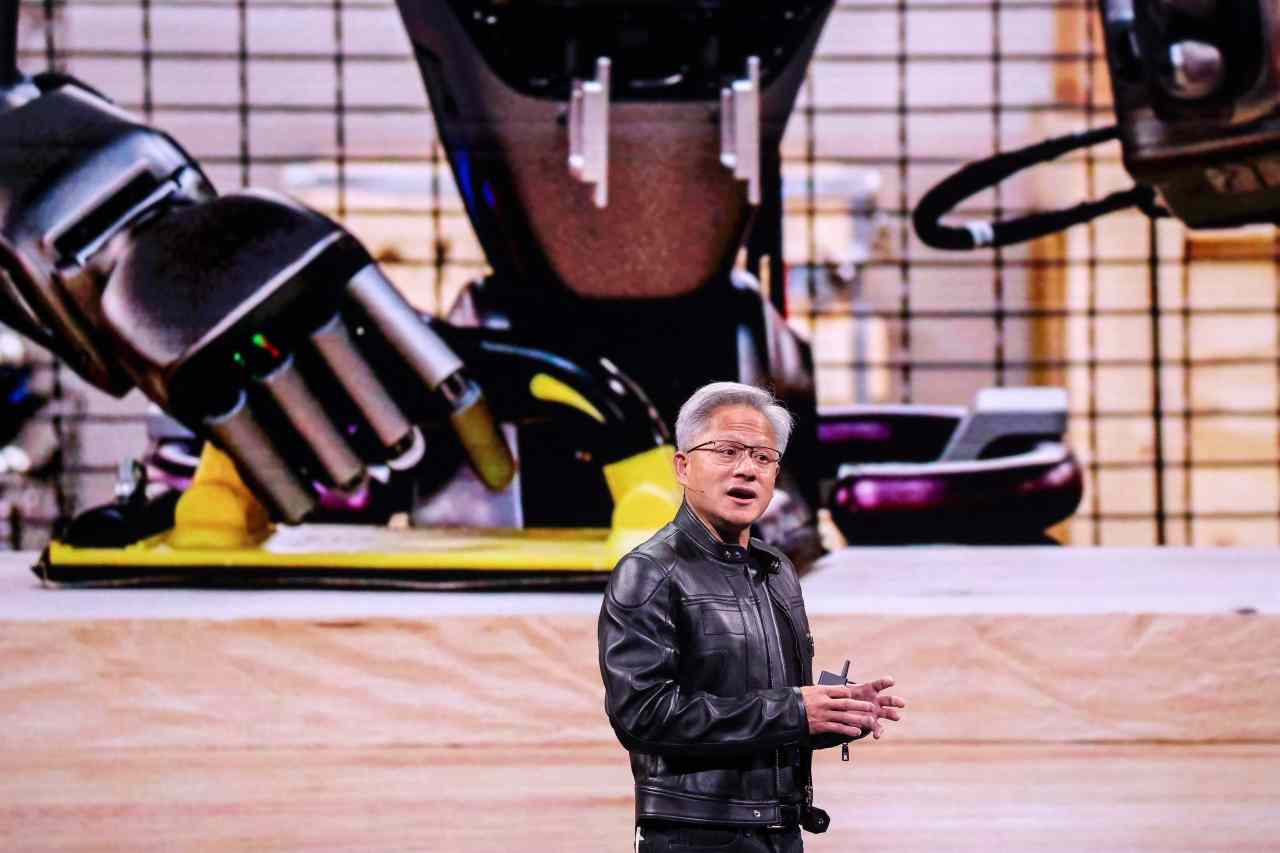

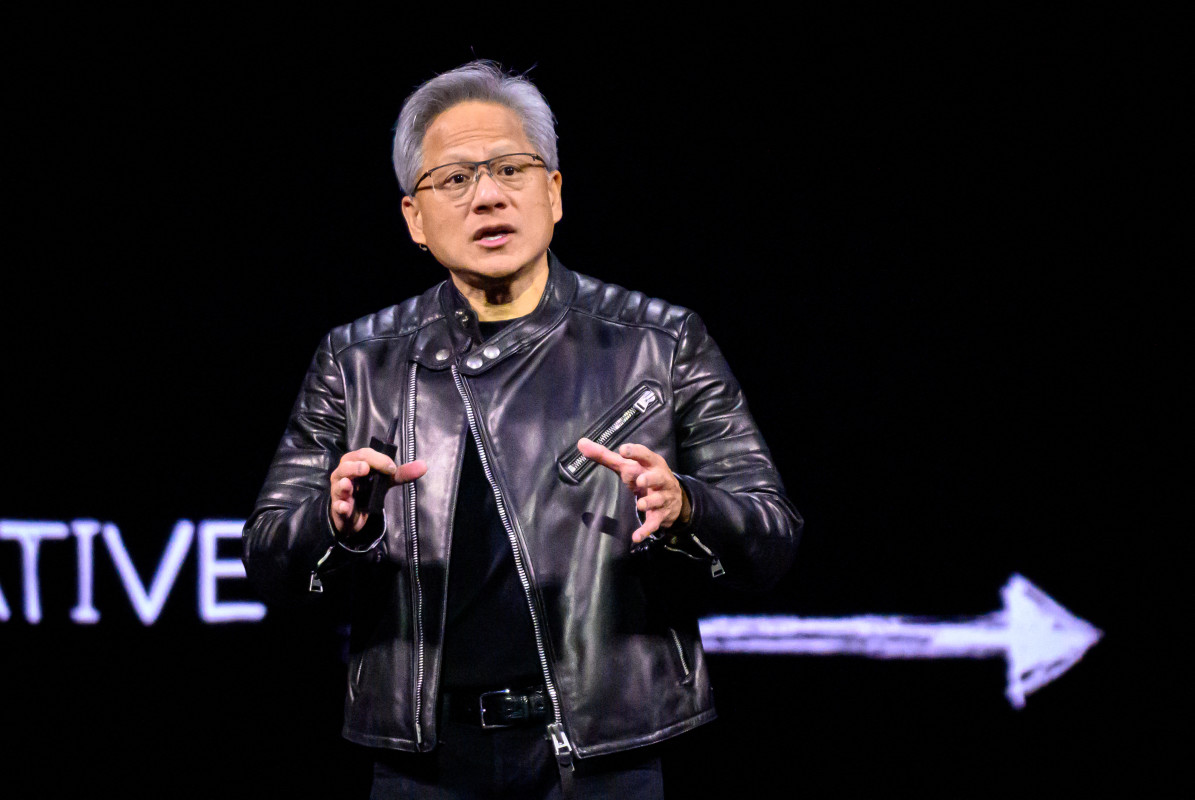

Image source: Getty Images.