Should You Buy Stocks During the Nasdaq Correction? Evidence Is Piling Up and Here's What It Shows.

The Nasdaq Composite (NASDAQINDEX: ^IXIC) blasted higher over the past two years, climbing in the double digits in both 2023 and 2024, as investors placed big bets on growth. They were optimistic about a potentially lower interest-rate environment ahead and how that could favor growth stocks, and piled into stocks in the hot area of artificial intelligence (AI). All of this fueled a general excitement about investing, and this momentum continued in 2025 -- until recently.Just last week, the Nasdaq tumbled into correction territory, falling more than 10% from its latest high on Dec. 16. And last year's biggest winners -- including AI giants Nvidia (NASDAQ: NVDA) and Palantir -- have seen their shares slide in the double-digits over the past month.How did we go so quickly from optimism about growth to worries about what's ahead? Certain economic indicators started the ball rolling, from a drop in consumer confidence in February to a weaker-than-expected jobs report. And policies from newly inaugurated President Donald Trump added to concerns -- particularly, the launch of tariffs on imported goods from China, Canada, and Mexico.Continue reading

The Nasdaq Composite (NASDAQINDEX: ^IXIC) blasted higher over the past two years, climbing in the double digits in both 2023 and 2024, as investors placed big bets on growth. They were optimistic about a potentially lower interest-rate environment ahead and how that could favor growth stocks, and piled into stocks in the hot area of artificial intelligence (AI). All of this fueled a general excitement about investing, and this momentum continued in 2025 -- until recently.

Just last week, the Nasdaq tumbled into correction territory, falling more than 10% from its latest high on Dec. 16. And last year's biggest winners -- including AI giants Nvidia (NASDAQ: NVDA) and Palantir -- have seen their shares slide in the double-digits over the past month.

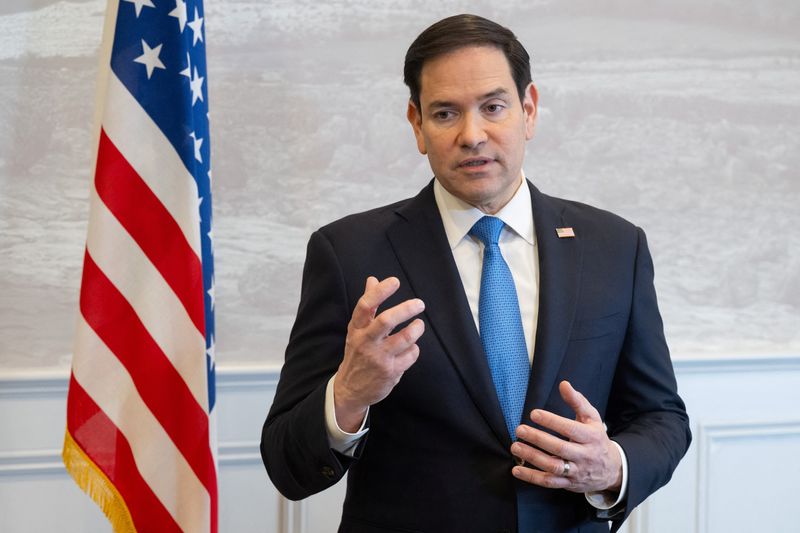

How did we go so quickly from optimism about growth to worries about what's ahead? Certain economic indicators started the ball rolling, from a drop in consumer confidence in February to a weaker-than-expected jobs report. And policies from newly inaugurated President Donald Trump added to concerns -- particularly, the launch of tariffs on imported goods from China, Canada, and Mexico.