Should You Buy Enterprise Products Partners While It's Below $33?

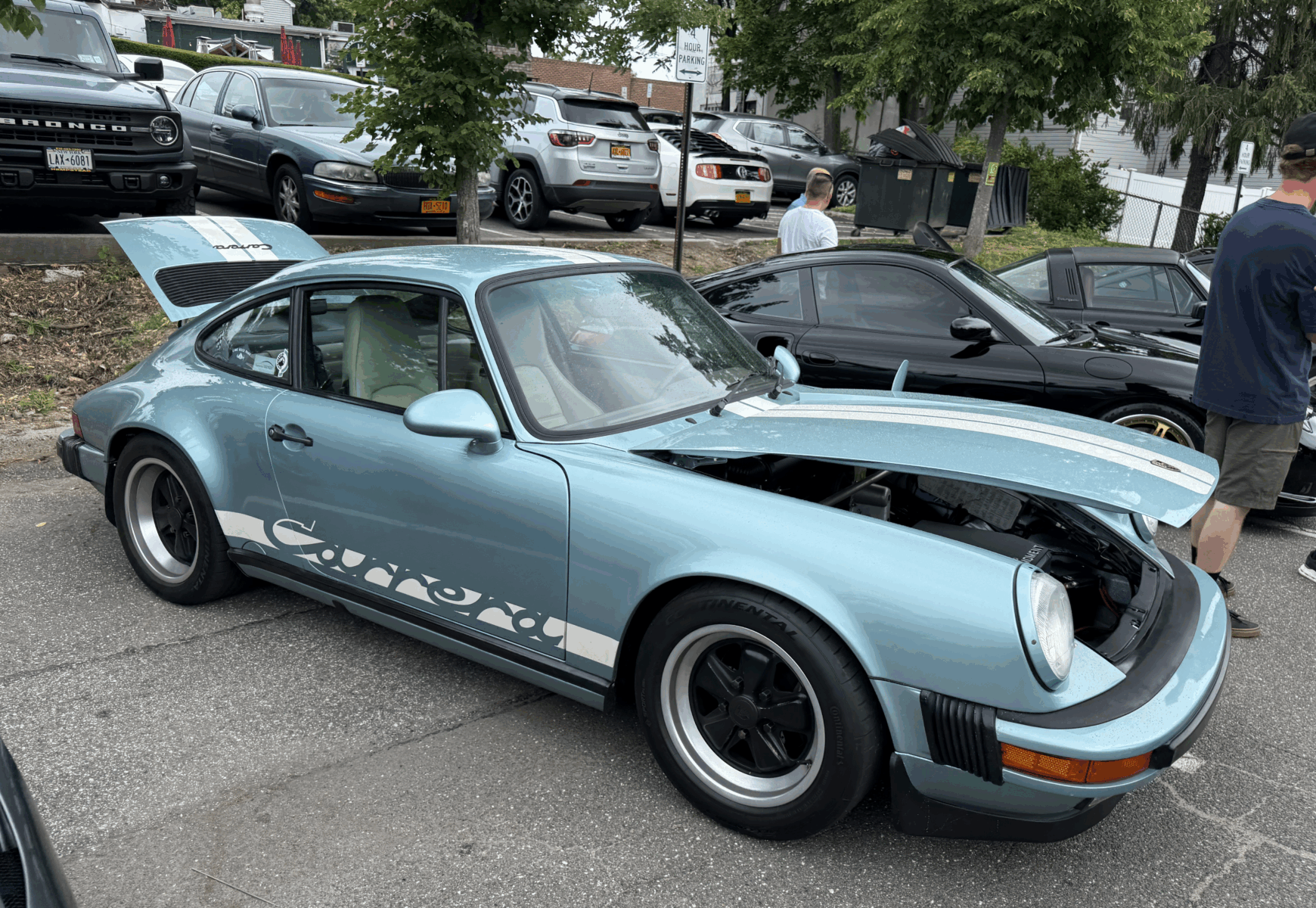

Enterprise Products Partners (NYSE: EPD) is offering investors an attractive 6.7% distribution yield. That compares to the tiny 1.2% yield for the S&P 500 (SNPINDEX: ^GSPC) and a 3.5% or so average yield in the broader energy sector. The big draw here is, obviously, the yield. But is that enough to make Enterprise a buy while it's trading below $33 a unit? Here's what you need to know.Enterprise Products Partners is a fairly boring business, which is a bit unusual in the energy sector. Upstream companies, which produce oil and natural gas, have volatile earnings because oil and natural gas prices dictate their top- and bottom-line results. Downstream companies, which make chemicals and refined products like gasoline, have volatile earnings because volatile oil and natural gas are key inputs, and the products they make are often volatile commodities, too. But midstream businesses like Enterprise are just toll takers.Image source: Getty Images.Continue reading

Enterprise Products Partners (NYSE: EPD) is offering investors an attractive 6.7% distribution yield. That compares to the tiny 1.2% yield for the S&P 500 (SNPINDEX: ^GSPC) and a 3.5% or so average yield in the broader energy sector. The big draw here is, obviously, the yield. But is that enough to make Enterprise a buy while it's trading below $33 a unit? Here's what you need to know.

Enterprise Products Partners is a fairly boring business, which is a bit unusual in the energy sector. Upstream companies, which produce oil and natural gas, have volatile earnings because oil and natural gas prices dictate their top- and bottom-line results. Downstream companies, which make chemicals and refined products like gasoline, have volatile earnings because volatile oil and natural gas are key inputs, and the products they make are often volatile commodities, too. But midstream businesses like Enterprise are just toll takers.

Image source: Getty Images.