My Dream of Living Off Dividends is Crumbling – How Section 899 is Shattering My Financial Plans

A dividend-based portfolio is a powerful tool for building a secure retirement, delivering steady passive income to fund a stress-free future. By investing in reliable dividend-paying stocks or exchange-traded funds (ETFs), investors can harness compounding over decades, creating a nest egg that supports living expenses without a 9-to-5 grind. The strategy is straightforward: select high-quality […] The post My Dream of Living Off Dividends is Crumbling – How Section 899 is Shattering My Financial Plans appeared first on 24/7 Wall St..

A dividend-based portfolio is a powerful tool for building a secure retirement, delivering steady passive income to fund a stress-free future. By investing in reliable dividend-paying stocks or exchange-traded funds (ETFs), investors can harness compounding over decades, creating a nest egg that supports living expenses without a 9-to-5 grind.

The strategy is straightforward: select high-quality funds with consistent yields, reinvest dividends, and let time work its magic. With global demand for income-generating assets rising, dividend portfolios appeal to those seeking financial independence.

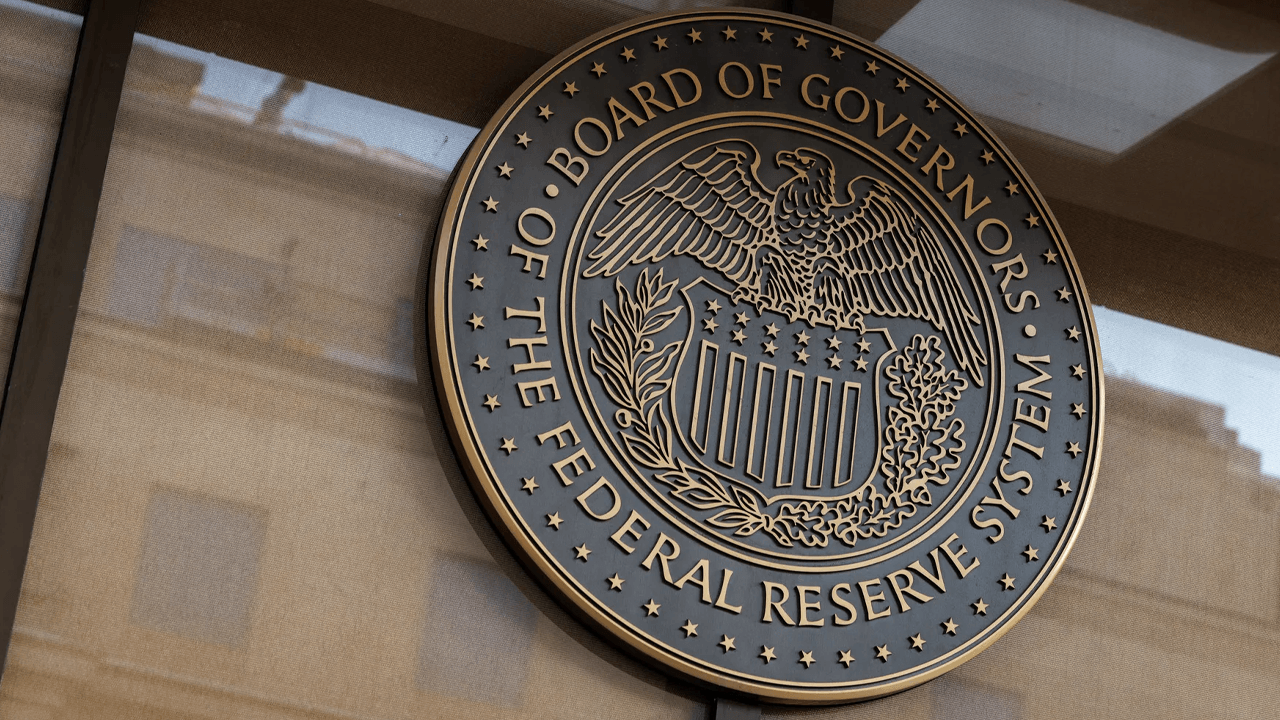

However, foreign investors face new risks from proposed U.S. tax law Section 899, part of the “One Big Beautiful Bill Act” passed by the House on May 22. This law could raise withholding taxes on U.S.-source dividends for residents of “discriminatory” countries, potentially eroding returns. Navigating these challenges requires strategic planning to protect the dream of a robust retirement portfolio.

Key Points in This Article:

-

A dividend-based portfolio offers a reliable path to retirement income, but Section 899’s proposed tax hikes threaten foreign investors’ returns.

-

Diversifying into international ETFs and consulting tax professionals can help mitigate risks while preserving long-term financial goals.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

The Section 899 Dilemma

A Redditor on the r/Dividends subreddit poured out his frustration over how Section 899 threatens his carefully crafted retirement plan. For years, this Polish investor built a dividend portfolio with U.S.-based ETFs like Schwab US Dividend Equity ETF (NYSEARCA:SCHD), iShares Core Dividend Growth ETF (NYSE:ARCA:DGRO), JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ), and NEOS Nasdaq 100 High Income ETF (NASDAQ:QQQI), chosen for their strong yields and growth potential.

The Redditor’s goal was financial independence, aiming to retire on passive income and eventually pass wealth on to his children. Section 899, however, could impose a 35% or even 50% U.S. withholding tax on dividends for countries like Poland, flagged for “discriminatory” taxes. Combined with Poland’s potential 19% tax, this means nearly half of his dividends could be lost.

Switching to European ETFs feels like a setback because they typically offer lower yields and weaker growth. The Redditor feels gutted, with his long-term strategy shaken by changes in U.S. tax policy. He’s left seeking advice, wondering how to salvage years of disciplined investing amidst this looming threat.

Actionable Advice for Investors

Foreign investors facing Section 899’s potential impact can safeguard their dividend portfolios with proactive steps.

- First, diversify into international ETFs like iShares MSCI EAFE Dividend Growers (CBOE:EFAD) or Vanguard FTSE All-World High Dividend Yield (NASDAQ:VYMI), which yield 3% to 4% and include stable firms from Europe and Asia, reducing reliance on U.S. assets.

- Second, explore tax-efficient vehicles in your country, such as Poland’s Individual Investment Accounts (IKZE), which may defer or lower domestic taxes on investment income.

- Third, consult a tax professional to evaluate options like U.S.-resident trusts, accelerating dividend payouts before 2026, or leveraging existing tax treaties, which could mitigate withholding increases.

- Finally, stay informed by monitoring IRS quarterly updates on “discriminatory foreign countries” to anticipate tax shifts.

Section 899 is still awaiting Senate approval, so isn’t yet law, but preparation is key. By diversifying, optimizing tax strategies, and staying vigilant, investors can protect their path to a dividend-fueled retirement.

The Broader Context of Section 899

Section 899, embedded in President Trump’s “One Big Beautiful Bill Act,” targets foreign investors from countries with tax policies deemed discriminatory by the U.S., such as digital services taxes. If enacted, it could raise withholding taxes on U.S.-source dividends from 15% to 35% or 50%, effective as early as 2026, impacting countries like Poland, France, and Italy.

This shift could disrupt millions of international investors’ retirement plans, as U.S. ETFs like SCHD and DGRO are staples for dividend seekers globally. The law aims to pressure foreign governments to align tax policies with U.S. interests, but critics argue it unfairly penalizes individual investors.

While the Senate’s vote is pending, the proposal has sparked panic on platforms like Reddit. For now, investors must balance optimism in dividend strategies with caution, adapting to potential tax headwinds while preserving long-term goals of financial independence.

The post My Dream of Living Off Dividends is Crumbling – How Section 899 is Shattering My Financial Plans appeared first on 24/7 Wall St..