Should I Take a $50,000 Loan for MSTY Investment – Exploring My Options

Exchange-traded funds (ETFs) pool investor money to buy diversified assets like stocks or bonds, trading like individual shares on exchanges. YieldMax ETFs, such as YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY), take a bolder approach, using covered call strategies on volatile stocks like Strategy (NASDAQ:MSTR) (formerly MicroStrategy) to deliver sky-high yields, often exceeding 100% annually. […] The post Should I Take a $50,000 Loan for MSTY Investment – Exploring My Options appeared first on 24/7 Wall St..

Exchange-traded funds (ETFs) pool investor money to buy diversified assets like stocks or bonds, trading like individual shares on exchanges. YieldMax ETFs, such as YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY), take a bolder approach, using covered call strategies on volatile stocks like Strategy (NASDAQ:MSTR) (formerly MicroStrategy) to deliver sky-high yields, often exceeding 100% annually.

However, MSTY’s net asset value (NAV) can erode due to return of capital and market swings, making it a risky play. A Redditor on the r/YieldMaxETFs subreddit already holds $10,000 in MSTY and YieldMax COIN Option Income Strategy ETF (NYSEARCA:CONY). He is considering a $50,000 loan at a 10% annual percentage rate over five years with no prepayment penalties to boost his MSTY position. He’s confident in his strategy and ability to cover payments, but wanted some feedback from the Reddit community.

So, is borrowing big to chase MSTY’s juicy dividends a smart move, or a financial tightrope?

Juicing Returns Through Debt

Borrowing to invest, called leverage, can supercharge returns, but it also magnifies losses. MSTY’s distributions, currently at $1.47 per share monthly, could yield around $42,000 annually on a $50,000 investment at its current $21 per share price, which is tempting for income seekers.

Yet you also need to factor in the 10% APR loan’s $5,000 annual interest, potential NAV erosion from the return on capital portion, and taxes on distributions. The distribution fluctuates monthly (it was $2.37 per share in May), and a drop in MSTR’s volatility could also crater its price.

This means MSTY’s yield must consistently top 10% after taxes and fees to break even — a tough hurdle given its volatility.

Investors need to exercise caution with such leverage,a there are no slam dunks in investing. Other risks include market corrections or margin-call-like pressures. For example, a 20% drop in MSTY’s price, as seen in past swings, could erase any gains, leaving the investor owing $50,000 plus interest.

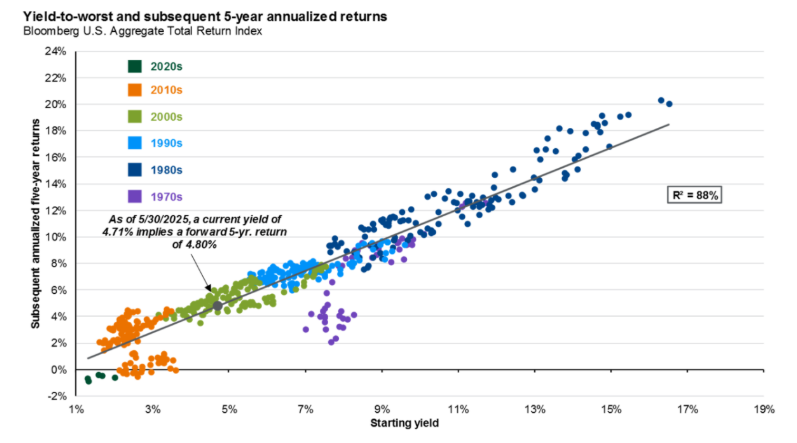

Interest rates add another layer of complexity. The loan’s 10% APR is fixed, but rising market rates, like the recent increase to 4.51% on 10-year Treasury yields, could pull capital toward safer assets, pressuring MSTY’s price.

The Redditor’s ability to handle $1,200 monthly payments (based on a standard amortization schedule) is encouraging, but unexpected costs or income dips could strain his finances, especially with a high-risk asset.

MSTY’s distributions, often taxed as ordinary income, further cut net returns, demanding meticulous planning to stay profitable.

Take Baby Steps

Rather than jumping in with a $50,000 loan, it’s wiser to take a cautious approach. Start with a smaller loan, such as $10,000, to test MSTY’s performance against the 10% APR cost. This minimizes risk while allowing you to refine your strategy.

Develop a clear plan for the funds: reinvest dividends to compound returns or use them to prepay the loan, reducing interest expenses. The Redditor could also diversify by pairing MSTY with lower-risk ETFs like the Invesco NASDAQ 100 ETF (NASDAQ:QQQM) or the JPMorgan Nasdaq Equity Premium Income ETF (NYSEARCA:JEPQ) to buffer volatility. Also, closely monitor MSTY’s NAV and market trends to avoid buying at inflated prices.

Calculate potential returns by factoring in the loan’s interest and taxes, and ensuring yields exceed 10% to justify the risk. Above all, evaluate your financial health — emergency savings, income stability, and existing debt — to confirm you can manage payments without stress. This disciplined strategy balances MSTY’s high-reward potential with the realities of leveraged investing.

Key Takeaway

If MSTY’s yield holds above 10% and the investor’s budget remains solid, a modest loan could amplify returns. However, the risks of NAV erosion, market volatility, and loan obligations demand a conservative approach.

By starting small, planning fund allocation, diversifying, monitoring trends, and stress-testing your finances, an investor can pursue MSTY’s potential upside while safeguarding their financial stability.

The post Should I Take a $50,000 Loan for MSTY Investment – Exploring My Options appeared first on 24/7 Wall St..