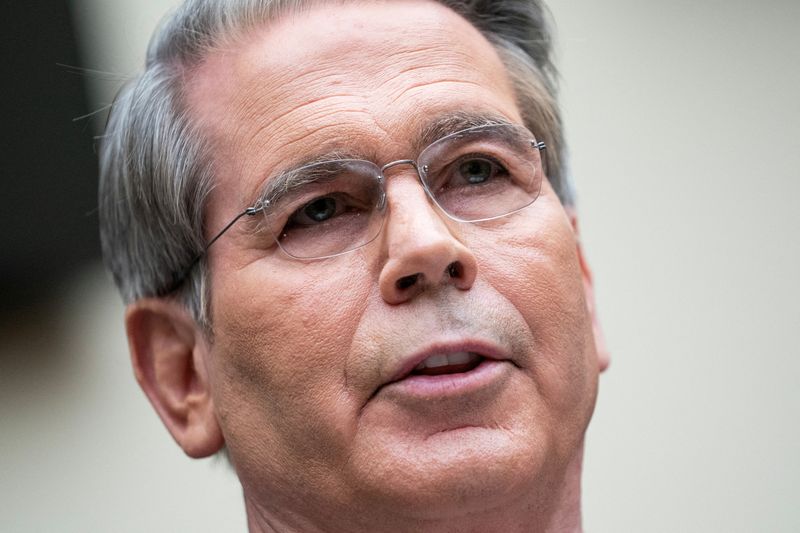

Secretary Bessent sends message on Walmart price increases due to tariffs

The Treasury Secretary weighed in on recent comments from Walmart's CEO Doug McMillon.

Consumers have been pinching pennies since skyrocketing inflation in 2022 took a toll on their wallets, and worries that prices may rise further in the wake of newly instituted tariffs have sparked considerable debate.

The Trump administration has rolled out a slate of tariffs in 2025, including 25% tariffs on Canada and Mexico in February, and a 10% baseline import tax in April. It also announced reciprocal tariffs on April 2, only to pause them for 90 days on April 9 following a steep sell-off in the stock and bond market.

Related: Walmart CEO has a harsh warning for customers

The pause gives the White House a window to negotiate trade deals that may lower the brunt of tariffs. However, it’s unlikely that those deals will eliminate tariffs, creating a problem for consumers.

Since China joined the WTO in 2001, most U.S. retailers, including Walmart (WMT) , have come to rely heavily upon Chinese imports for everything from clothing to electronics.

Walmart CEO warns on prices; Trump delivers rebuke

Walmart, the nation’s largest retailer, will likely squeeze suppliers and absorb some of the tariff cost increase. Still, the retail chain’s CEO recently said on its quarterly conference call with investors that it will pass along some of the increase.

Given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” said Walmart CEO Doug McMillon on May 15. “The higher tariffs will result in higher prices.”

Related: Walmart and Target may lose access to popular products in tariff war

The disclosure drew a stiff rebuke from the President.

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain,” wrote Trump in a post on Truth Social. “Between Walmart and China they should, as is said, 'EAT THE TARIFFS,' and not charge valued customers ANYTHING.”

Initially, the U.S. set reciprocal tariffs on Chinese imports at 34% on top of a 20% ‘fentanyl tariff’ placed in February.

The move sparked a retaliation from China, kicking off a tariff war that lifted tariffs on Chinese goods to 145% and China's tariffs on U.S. goods to 125%—levels that effectively cut off trade between the two major economies.

On May 13, after a meeting between key officials, including China's Vice Premier and Treasury Secretary Scott Bessent, the U.S. agreed to reduce its China tariffs to 30%.

Treasury Secretary Bessent confirms Walmart price increases are likely

Bessent, a long-time stock market veteran trained under legendary hedge fund manager Stanley Druckenmiller, has emerged as the voice of the Trump Administration’s tariff negotiations.

Following Walmart’s comments on prices and Trump’s social media post, Bessent said on Sunday that he had spoken with Walmart’s CEO Doug McMillon on May 17.

“Walmart will be absorbing some of the tariffs, some may get passed on to consumers,” Bessent conceded on CNN.

Bessent tried to soften the message on inflation to consumers by pointing out that gasoline prices have fallen this year, potentially offsetting retail price increases.

He also suggested that Walmart’s comments on prices represent the worst scenario.

Still, that may not be enough to assuage consumers, many of whom have grown increasingly nervous about inflation since the tariff announcements.

The University of Michigan’s consumer confidence survey index fell 27% year-over-year to 50.8 in May. Nearly three-quarters of survey respondents mentioned tariffs, and their inflation expectations for the year ahead surged to 7.5% from 6.5% last month.

"Sentiment is now down almost 30% since January 2025,” said Surveys of Consumers Director Joanne Hsu. “Many survey measures showed some signs of improvement following the temporary reduction of China tariffs, but these initial upticks were too small to alter the overall picture.”

Related: Goldman Sachs announces major change to S&P 500 forecast