Robinhood launches prediction market with March Madness, Fed rates as first offerings

The move underscores Robinhood's push into the fast-growing field of prediction markets.

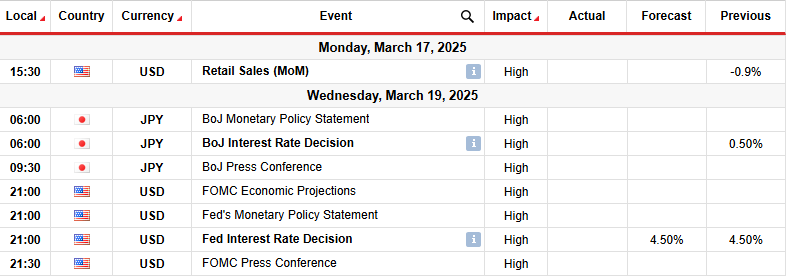

Robinhood has been dabbling for months in the field of prediction markets, which let users wager on the outcome of future events. Now, the company is going all-in, unveiling a dedicated hub on Monday that offers contracts related to the March Madness college basketball tournament, and one to predict the direction of the Federal Reserve’s target interest rate. The finance app is planning to add a variety of other contracts related to markets, sports and politics in coming months.

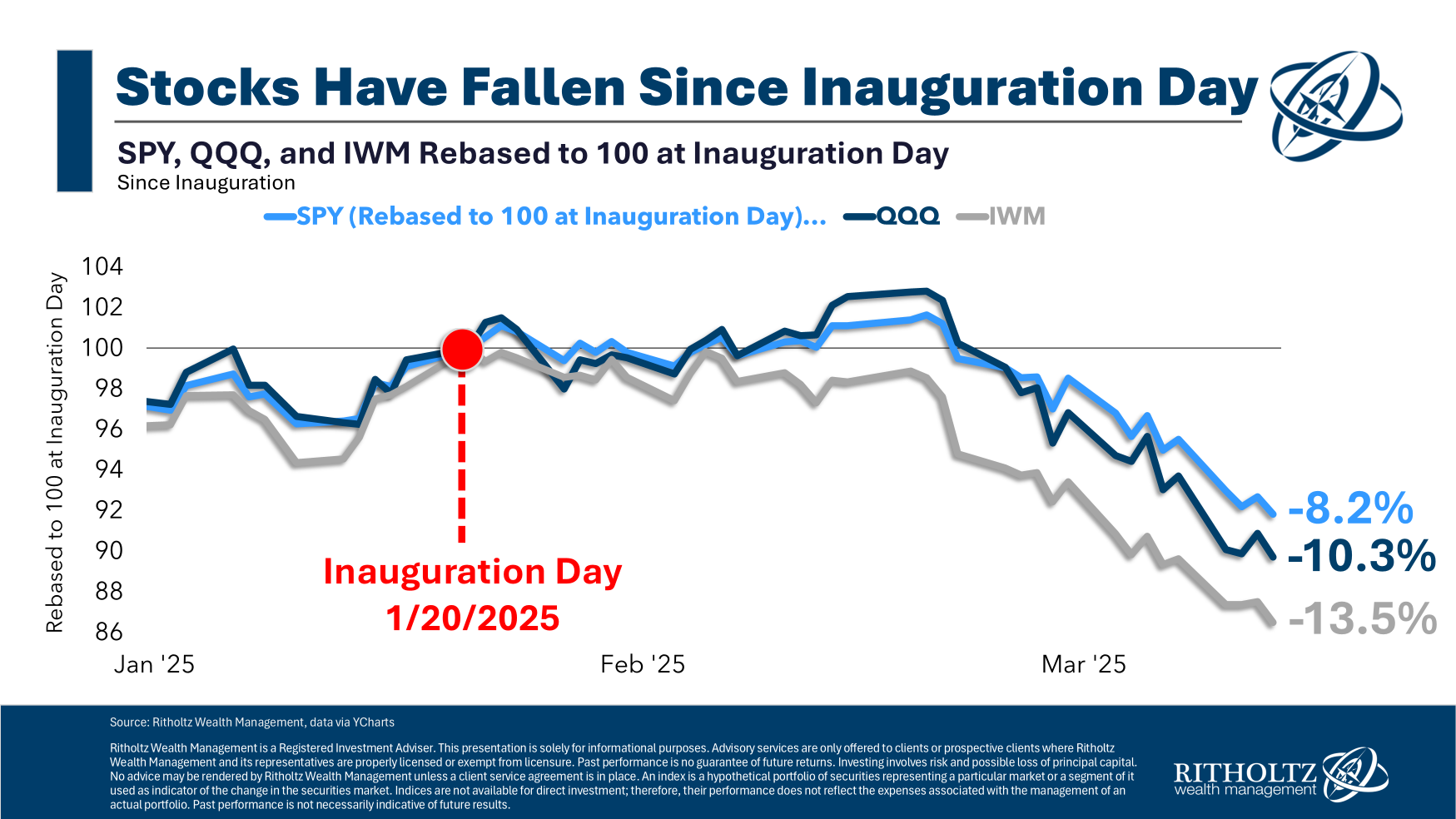

Prediction markets are based on the premise that, because those who put money on them have a vested interest in the outcome, they can provide a more accurate guide to the future than polls or surveys. They are not a new idea but, due to regulatory issues, did not gain traction in the U.S. until the last Presidential election when platforms like Polymarket and Kalshi attracted billions of dollars of bets and, in doing so, correctly forecast Donald Trump's victory.

Robinhood briefly opened a prediction market service of its own before the election, and then announced a market for the Super Bowl outcome, though it yanked the latter offering after failing to receive requisite clearance from the Commodity Futures Trading Commission. It now appears the company has obtained the requisite permissions from the CFTC.

"”[These markets] play an important role at the intersection of news, economics, politics, sports, and culture. We're excited to offer … prediction markets and look forward to doing so in compliance with existing regulations,” said Robinhood executive, JB Mackenzie, in a statement.

For its debut offerings, Robinhood will rely on Kalshi to supply the portion of the service that matches users with a counter-party to take the other side of a contract. According to a Robinhood spokesperson, this is not a permanent arrangement, implying the company could work with another platform in future, or built a contract-matching exchange of its own. The spokesperson also confirmed that Robinhood has not invested in Kalshi.

Customers who use the new prediction markets hub will pay a fee of two cents a contract, with one penny going to Kalshi and the other going to Robinhood.

The service is being rolled out on Monday to every state except Nevada. To use it, customers are required to have a Robinhood individual investing account with either margin investing enabled, or options trading approved.

This story was originally featured on Fortune.com