Puig outperforms beauty market in 2024 with €4,790 million in sales

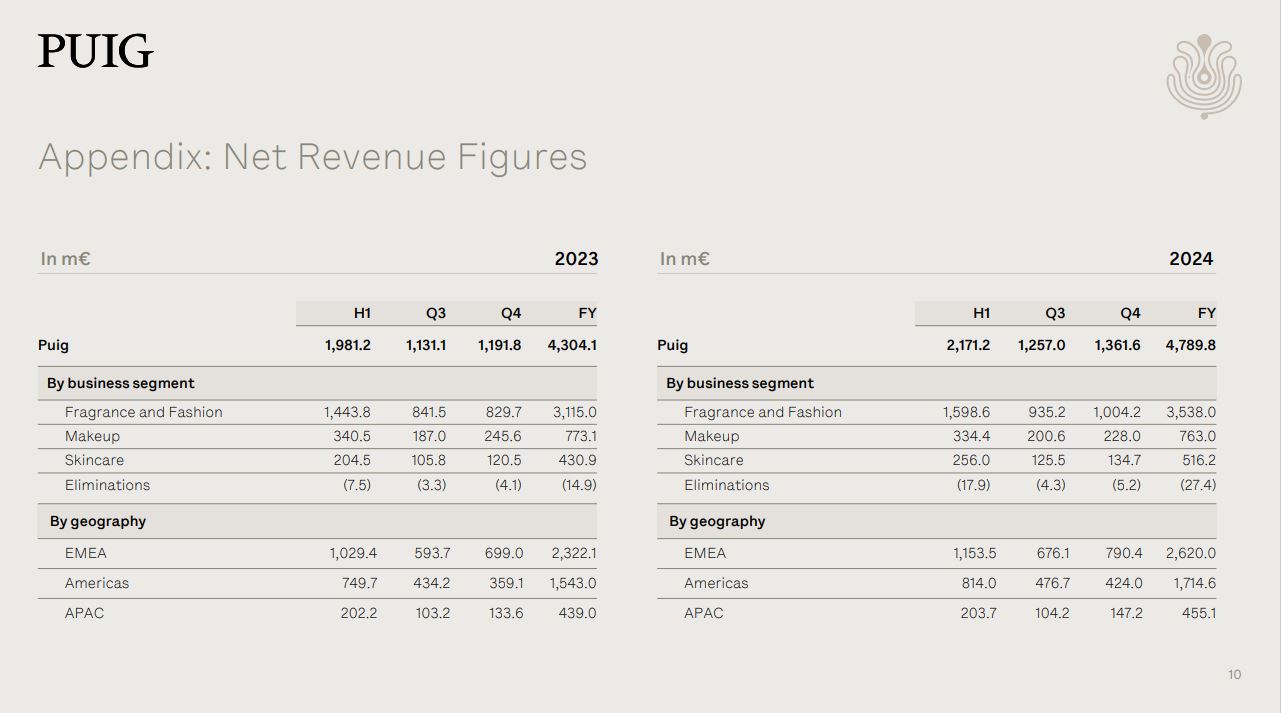

Puig’s core Fragrance and Fashion division emerged as the top contributor, generating €3,538 million (US$3,750 million) in net revenue.

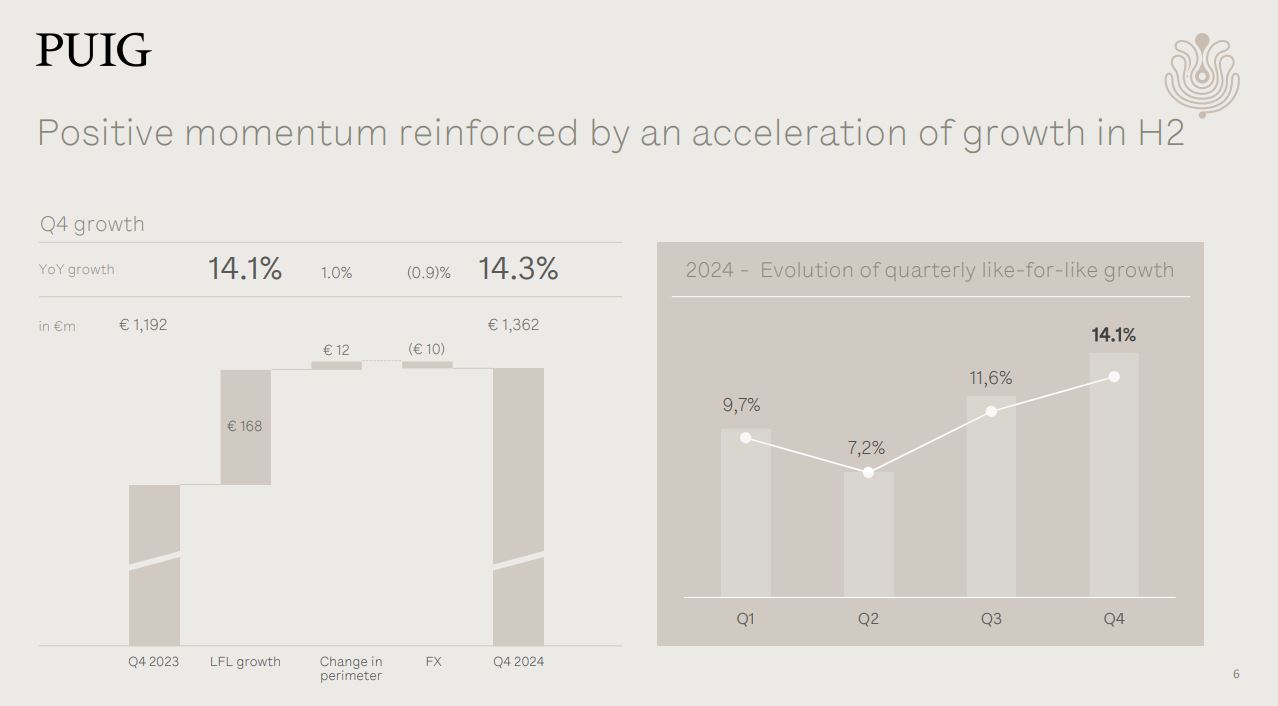

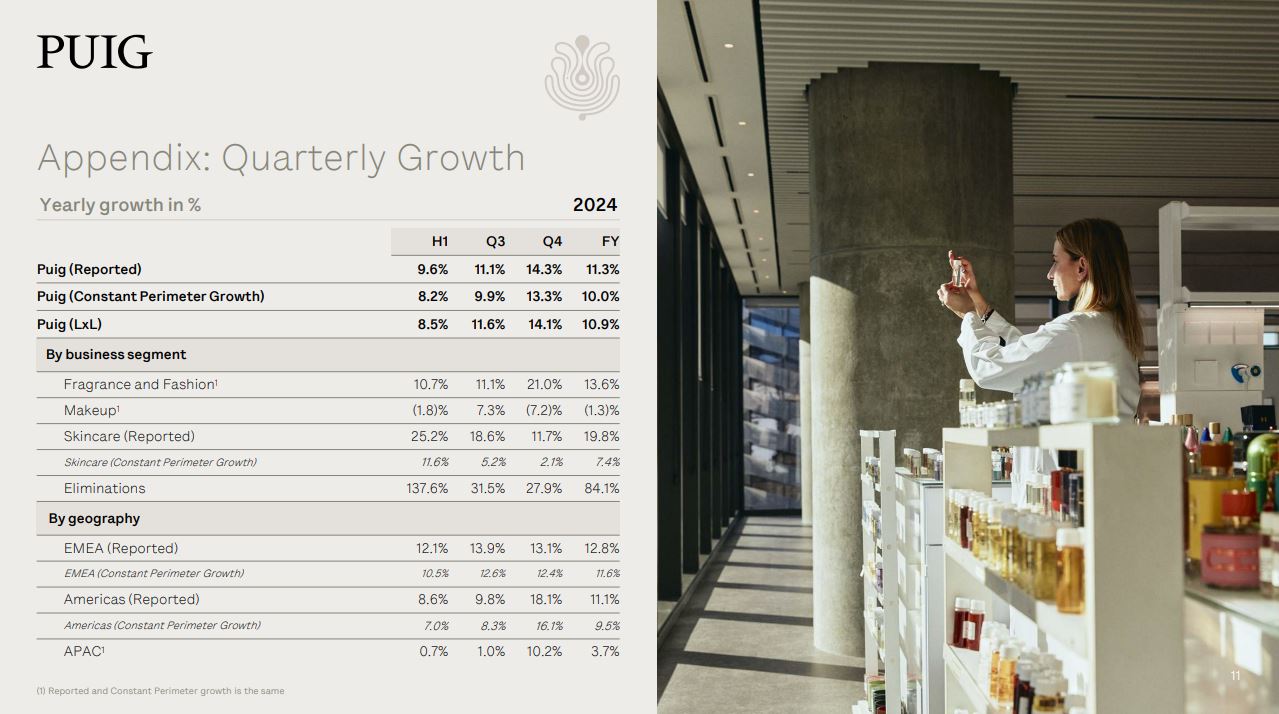

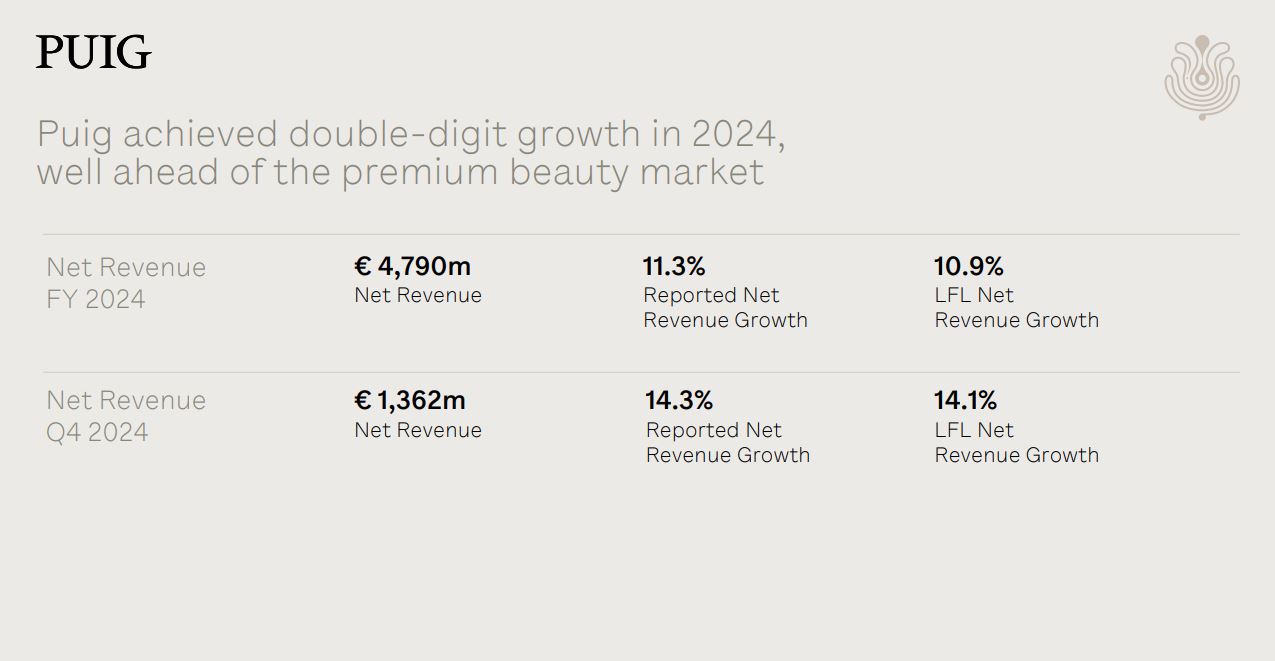

Family-owned global premium beauty and fashion house Puig has posted a net revenue of €4,790 million (US$5,077 million) in 2024, marking a year-on-year rise of +11.3% on a reported basis (+10.9% like-for-like).

The company outperformed the premium beauty market despite a -0.8% negative impact from exchange rates. Like-for-like (LFL) growth was driven by a +1.1% adjustment for hyperinflation in the Argentine Peso, contrasting with the adverse effect recorded in 2023.

Puig’s Q4 revenue exceeded that of the previous quarters, with a sharp LFL growth of +14.1%, totalling €1,362 million (US$1,443 million). Perimeter changes added +1.0% growth, while a negative FX impact of -0.9% slightly offset gains, leading to +14.3% reported growth. The hyperinflation adjustment for Argentina provided a +4.0% boost to LFL growth.

Puig Chairman and CEO Marc Puig said: “2024 was a historic year for Puig, in which we celebrated our 110th anniversary and became a publicly listed company. Once again, we delivered record revenues, driven by the exceptional performance of our core fragrance business and our core geographies, EMEA and the Americas.

“We also continued developing our Makeup and Skincare segments achieving meaningful milestones such as the acquisition of Dr. Barbara Sturm and the extension of our partnership agreement with Charlotte Tilbury. The desirability and strength of our brands and geographic footprint have enabled us to outperform the premium beauty market as well as our mid-term revenue growth guidance.”

Continued momentum in Fragrance and Fashion

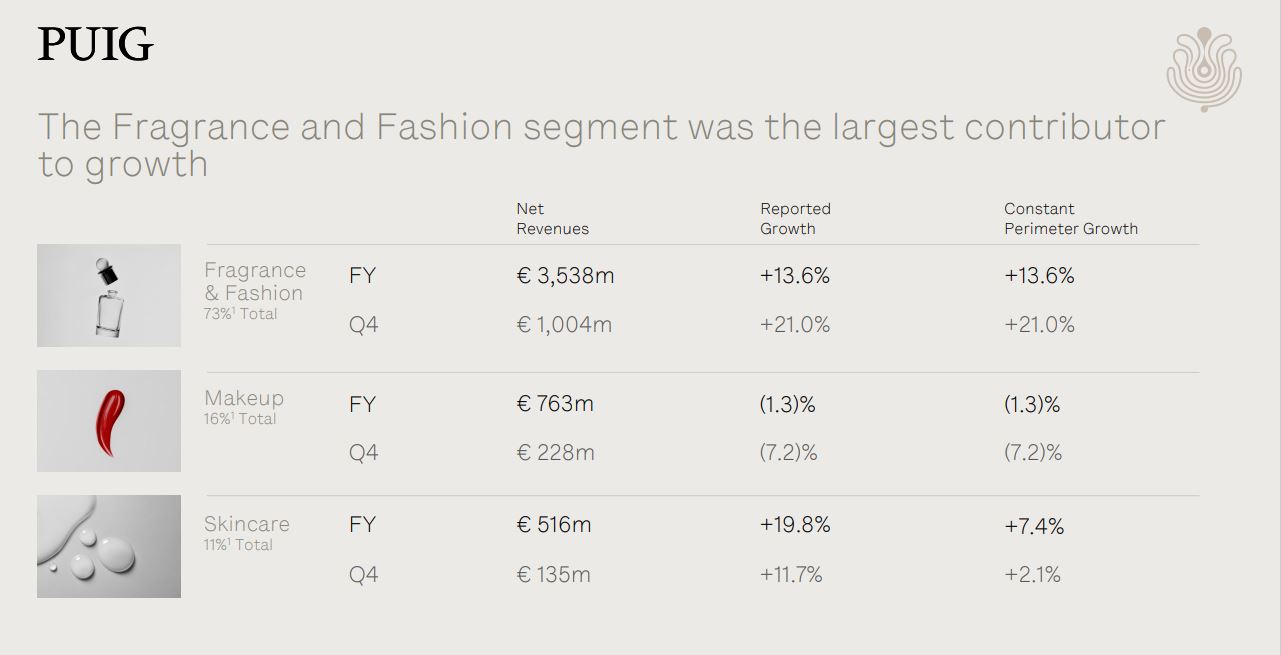

Across its key business segments, Puig’s core Fragrance and Fashion division emerged as the top contributor, generating €3,538 million (US$3,750 million) in net revenue. This segment accounted for 73% of Puig’s total net revenue, reflecting a +13.6% increase on both a reported and constant perimeter basis compared to 2023.

Among the notable highlights last year, Puig’s fastest-growing brand Jean Paul Gaultier made its debut in the top 10 fragrance rankings, while Le Male is on track to become the third-leading men’s fragrance line globally. Good Girl by Carolina Herrera delivered a strong performance, retaining its position as the number two global women’s fragrance line and marking a major achievement as the number one women’s fragrance line in the USA.

Niche brands also maintained strong growth, with double-digit growth from Penhaligon’s, L’Artisan Parfumeur and Dries Van Noten.

In Q4, the category sustained its strong momentum, achieving +21% revenue growth, led by EMEA and the Americas. Excluding the impact of Argentina’s hyperinflation adjustment, growth rate reached +15.3%. Prestige fragrances remained a key growth driver, complemented by double-digit growth across all Niche fragrance brands, with Byredo leading the charge.

Puig’s makeup business delivered €763 million (US$780 million), representing 16% of net revenue, with a decrease of -1.3% on a reported and constant perimeter basis against 2023. As the leading brand in this category, Charlotte Tilbury posted flat growth after challenging year-on-year comparisons and specific sell-in/sell-out dynamics.

The makeup segment was weighed down by the weaker performance of some of Puig’s smaller brands, with revenues dropping by -7.2%. This was partly due to the voluntary withdrawal of select batches of Charlotte Tilbury’s Airbrush Flawless Setting Spray in December.

The overall segment performance was also influenced by more challenging year-on-year comparisons, largely due to the sell-in impact of Charlotte Tilbury’s Ulta launch in late 2023 and a slowdown in other makeup product sales across the portfolio.

Skincare sales grew strongly by +20% on a reported basis and +7.4% at constant perimeter compared to the prior year, reaching €516 million (US$527 million) and accounting for 11% of Puig’s total net revenue.

Notably, Puig’s Dermo-Cosmetics brands maintained their strong performance, with Uriage delivering double-digit growth. This was supported by the successful launch of Uriage Age Absolu Serum and the accelerated growth of its hero franchise, Xémose. The company further diversified its portfolio with the addition of Dr. Barbara Sturm.

Q4 Skincare sales grew +11.7% on a reported basis and +2.1% at constant perimeter year-on-year. The category was impacted by a tougher comparison, mainly due to Charlotte Tilbury’s pipelining into Ulta and significant product launches in the second half of 2023.

Growth by region

In terms of geography, EMEA emerged as the top-performing region with overall sales of €2,620 million (US$2,680 million), representing 55% of Puig’s net revenue. This marks an increase of +12.8% reported and +11.6% at constant perimeter compared to 2023.

The sharp growth was underpinned by solid performance across all segments, with EMEA emerging as Puig’s largest region in Q4, reflecting a +13.1% growth on a reported basis and +12.4% at constant perimeter.

Net revenues in the Americas reached €1,715 million (US$1,755 million), contributing 36% of Puig’s net revenue. This marks an increase of +11.1% on a reported basis and +9.5% at constant perimeter versus the same period in 2023.

The region posted a standout Q4 performance, with revenues surging by +18.1% on a reported basis and +16.1% at constant perimeter, largely due to sustained strength in fragrances across North America.

While reported growth in Q4 was impacted by a difficult year-on-year comparison from Charlotte Tilbury’s Ulta entry in 2023, the overall performance was reinforced by a +13.3% boost from the Argentine Peso’s hyperinflation adjustment, reversing the prior year’s negative impact.

In APAC, which contributed 10% to Puig’s net revenue, sales grew by +3.7% for the year despite challenging market conditions.

The region also delivered strong Q4 results, with a +10.2% increase on a reported and constant perimeter basis versus 2023. Despite a weaker performance in China, Puig’s growth was bolstered by the successful expansion into Korea, Japan and India, with newly formed subsidiaries playing a key role.