Only one stock can be bought—should $40K go into Meta or Tesla?

Over the past few years, a collection of technology stocks, i.e., Apple, Amazon, Alphabet (Google), Microsoft, Nvidia, Meta Platforms (Facebook), and Tesla – have become largely responsible for the surging US bull market and the commensurate growth in the S&P 500 Index. The Magnificent 7 stocks all have core businesses in somewhat different areas, but […] The post Only one stock can be bought—should $40K go into Meta or Tesla? appeared first on 24/7 Wall St..

Over the past few years, a collection of technology stocks, i.e., Apple, Amazon, Alphabet (Google), Microsoft, Nvidia, Meta Platforms (Facebook), and Tesla – have become largely responsible for the surging US bull market and the commensurate growth in the S&P 500 Index.

Key Points

-

Meta Platforms and Tesla are both Magnificent 7 stocks with completely separate core businesses (social media and electric vehicles).

-

Meta and Tesla both have their own respective AI R&D, which is part of what is fueling their continued growth tracks.

-

Perceptions of risk and valuation are elements to consider if one is deciding to choose to invest in only one or the other.

-

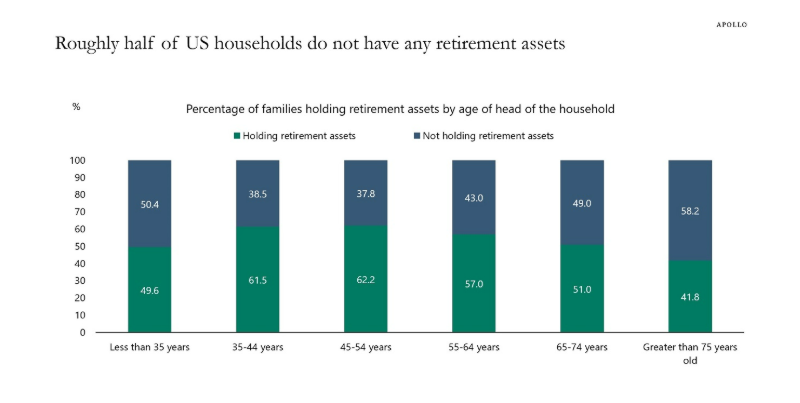

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

More Than Electric Cars

Elon Musk wears many hats. He is heading up the DOGE audits of the federal government and also founded SpaceX, for $44 billion, he bought Twitter, now renamed as X. Musk was also a co-founder of PayPal. However, he is best known as the CEO of pioneering electric vehicle (EV) company, Tesla, Inc. (NASDAQ: TSLA).

Tesla’s business divisions extend beyond its factory production of EV luxury sedans, SUVs, Cybertrucks, pickup trucks, and other vehicles. Some of its other developments and operations include:

- Tesla Full Self Driving (FSD), which is its core operation system behind the Tesla Robotaxi.

- The Tesla Cybercab Robotaxi is one of the few AI powered US made driverless taxis still being produced, besides Alphabet’s Waymo.. GM announced it was dropping its Cruise version last year.

- Tesla Energy has pioneered proprietary battery technologies, with products like its Powerwall lithium-ion home storage battery and Megapack, which was designed for large scale businesses and utility projects.

- Tesla Glass is a Tesla Energy subsidiary, specifically created for providing the glass roofs supplied with the Model 3 and for Tesla’s Solar Shingle panels for solar energy gathering.

- Robotics development became an obvious decision as mass production of Tesla vehicles ramped up. One new creation from its robotics work was the Tesla Bot, dubbed “Optimus”, after the lead robot character from the movie and toy franchise series, Transformers.

- Musk’s AI R&D is another Tesla division. The further development of Grok and X.AI will ostensibly benefit Tesla with cutting edge AI tools, keeping its competitive advantage over other automobile rivals trying to incorporate AI into their own cars.

Growth For Tesla

Tesla’s primary growth prospects in the future will come from the following areas:

- Tesla International: Expansion of Tesla overseas, thanks to its gigafactory deals to manufacture Tesla cars and batteries in Shanghai and Berlin for the PacRim and European markets. This also circumvents tariff obstacles for those markets.

- Optimus: Elon Musk himself has been quoted the following: “I think the long-term value of Optimus will exceed that of everything else that Tesla combined…I suspect that the long-term demand for general purpose humanoid robots is in excess of 20 billion units. …my rough estimate long-term of market cap is on the order of $5 trillion for — maybe more for autonomous transport, and it’s several times that number for general purpose humanoid robots….”

- Cybercabs: ARK Invest’s Cathie Woods has predicted that the combination of Supercharger expansions and Cybercab Robotaxi joint ventures with Uber and Lyft, for example, could make the Tesla Robotaxi be worth as much as 90% of the company’s enterprise value and future earnings. She thinks that a valuation of $8.2 trillion by 2029 is entirely possible.

- Tesla Cybertruck and Semi: These latest products are expected to also drive more growth to the company, especially since the January Las Vegas attempted bombing incident, where the Tesla Cybertruck successfully contained the blast and prevented bystanders from injury

The Real Life Social Network

Facebook is still Meta Platform’s (NASDAQ: META) primary vehicle. As the first commercially dominant social media platform, Facebook is the largest social media company in the world, and still has a huge user demographic, even despite new competitors, such as TikTok. As of 2023, Facebook had achieved 72.13% of the US. Statista reported Facebook had 246.73 million US users. Worldwide, Facebook has over 3 billion active monthly users, with 378 million in India alone.

Other Facebook owned subsidiaries that are interactive communications-based include:

- Messenger

- Workplace

- Horizon Worlds (gaming)

- Mapillary

- Beluga

- Armature Studio (gaming)

- Twisted Pixel (gaming)

- Onavo (VPN)

- Oculus (virtual reality)

Meta Platforms also has its own AI product, the most current model of which is known as Meta Llama 3.3,

Growth for Meta Platforms:

Meta is showing strong and steady growth trajectories continuing forward from the following:

- Increased ad revenues, user engagement, and increased traffic in the Metaverse.

- Stronger traffic towards it game oriented acquisitions as they are linked to other Meta properties for cross marketing.

- Meta recently added UFC’s Dana White, known to be a close friend of President Trump, to its Board of Directors. In addition to White’s political ties, he brings strong sports branding and marketing expertise to the table for Meta’s future Oculus offerings.

In the case of AI, Meta plans to use Meta Llama 3.3 and its future iterations to monetize higher returns for advertising customers with AI generated images, algorithms for more precise individually targeted marketing, and a host of other tools and options – for users of all of its platforms, in each country, in each language. Some of the areas that Mark Zuckerberg predicts how Meta AI will be massive in future includes:

- Scaling business messaging

- Ads and paid content linked with AI interactions

- Making bigger AI models and widening access to multiple computers on a fee or subscription based platform.

- Increasing the Meta chatbot through in-house developed Large Language Models (LLM) has allowed it to quickly catch up to OpenAI. Meta chatbot use increased 50% between September and December, 2024.

Takeaways – An Ace Pitcher vs. a Home Run Slugger

Head to head, Meta reported $164.5 billion revenues in 2024, up 22% year over year. Tesla reported $97.7 billion for 2024, notching only a 1% gain. Meta Platform’s P/E ratio is 27.42 compared to Tesla’s bloated 142.95.

Although both companies are powerhouse leaders in their respective sectors, Meta’s rise has been fairly steady and meticulous. Meta’s operations could be likened to the strategy of an ace pitcher on the mound who registers strikeouts but gets dangerous hitters to chase bad pitches for easy ground outs.

Conversely, Tesla’s volatility and triumphs interspersed with quarterly disappointments can be likened to a home run slugger who strikes out often but wins key games with timely home runs. The underlying potential of Cybercab and Oculus are huge, and Musk’s outside holdings, such as SpaceX and X, are hugely influential on Tesla stock pricing.

An investor looking to throw in their lot with one or the other will depend upon individual risk tolerance and analysis as to which one has the better long term potential that will serve his or her investment criteria.

The post Only one stock can be bought—should $40K go into Meta or Tesla? appeared first on 24/7 Wall St..