Only 10% of Boomers Have Retired. Here are the Obstacles Standing in Their Way

Baby Boomers are reaching traditional retirement age, but are not following the old traditional path of giving up work and taking the time to enjoy life. Instead, a recent study by Indeed Flex shows that around 88% of Baby Boomers remain engaged in either full-time, part-time, or temporary employment. And that’s not changing any time […] The post Only 10% of Boomers Have Retired. Here are the Obstacles Standing in Their Way appeared first on 24/7 Wall St..

Key Points

-

The majority of Baby Boomers are still working in some capacity.

-

Many can’t retire because they have too little saved.

-

Long-term care costs and surging inflation have also prompted many boomers to work longer.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Baby Boomers are reaching traditional retirement age, but are not following the old traditional path of giving up work and taking the time to enjoy life.

Instead, a recent study by Indeed Flex shows that around 88% of Baby Boomers remain engaged in either full-time, part-time, or temporary employment. And that’s not changing any time soon either, with over a third of survey respondents indicating they don’t think they’ll be able to retire this year either.

So, what is keeping boomers from giving up their jobs and heading off into the sunset to travel, garden, or spoil the grandkids? Let’s take a look at some of the biggest obstacles standing in their way.

Saving obstacles

Many Boomers are not able to retire because they simply have saved too little.

According to Fidelity, the average 401(k) balance among baby boomers is $249,300, while the average IRA balance is $275,002. These averages are driven up by those with a substantial amount invested, so many Boomers have far less than these numbers suggest.

Boomers shouldn’t retire until they can comfortably replace around 70% to 90% of pre-retirement income at a safe withdrawal rate, which experts now say is 3.7% of your account balance. Since a $1 million account balance would only provide $37,000 in annual income, it’s not surprising that far too many boomers don’t feel like they’re anywhere close to being ready to retire.

Inflationary pressures

In the post-pandemic era, inflation surged far beyond the 2% target the Federal Reserve has set. With the prices of goods and services skyrocketing, many boomers faced even greater struggles to save and invest. Not only that, but inflation has left them looking at higher costs going forward, so their retirement dollars won’t stretch as far.

Since many are at the point where they’ll need to begin drawing from their investment accounts soon, boomers also can’t be invested too aggressively, so it is less likely that their investment accounts will be able to earn the returns they need to keep ahead of these rapid price increases. And tariffs that could cause further price surges aren’t helping matters either.

Aside from inflation’s impact on their savings, the Senior Citizens League has warned that Social Security benefits have not kept pace with inflation. In fact, benefits have lost around 20% of their buying power since 2010 — even though cost-of-living adjustments are supposed to prevent that from happening. This trend isn’t likely to reverse any time soon.

With all of these issues at the forefront of their minds, it’s no wonder boomers aren’t eager to retire and start trying to afford today’s high prices with limited fixed incomes.

Healthcare and long-term care expenses

Healthcare and long-term care expenses are a serious concern for boomers as well. Healthcare costs have been increasing at well above the rate of inflation, and long-term care expenses are astronomical at over $100K per year for a private room in a nursing home. This is an issue that every senior needs to be concerned about, as there’s a seven in 10 chance of needing nursing care at some point after turning 65.

Medicare, unfortunately, provides inadequate coverage for most due to exclusions and high coinsurance costs, so retirees need to be prepared to pay for Medicare Advantage or a Medigap policy. And while there are long-term care insurance policies, they’re often expensive and not very comprehensive, so they may not provide enough help.

Boomers are understandably reluctant to retire while coping with these concerns, and there’s not going to be an easy solution, other than eligible workers investing in their health savings accounts (HSAs) so they have funds available to cover these costs.

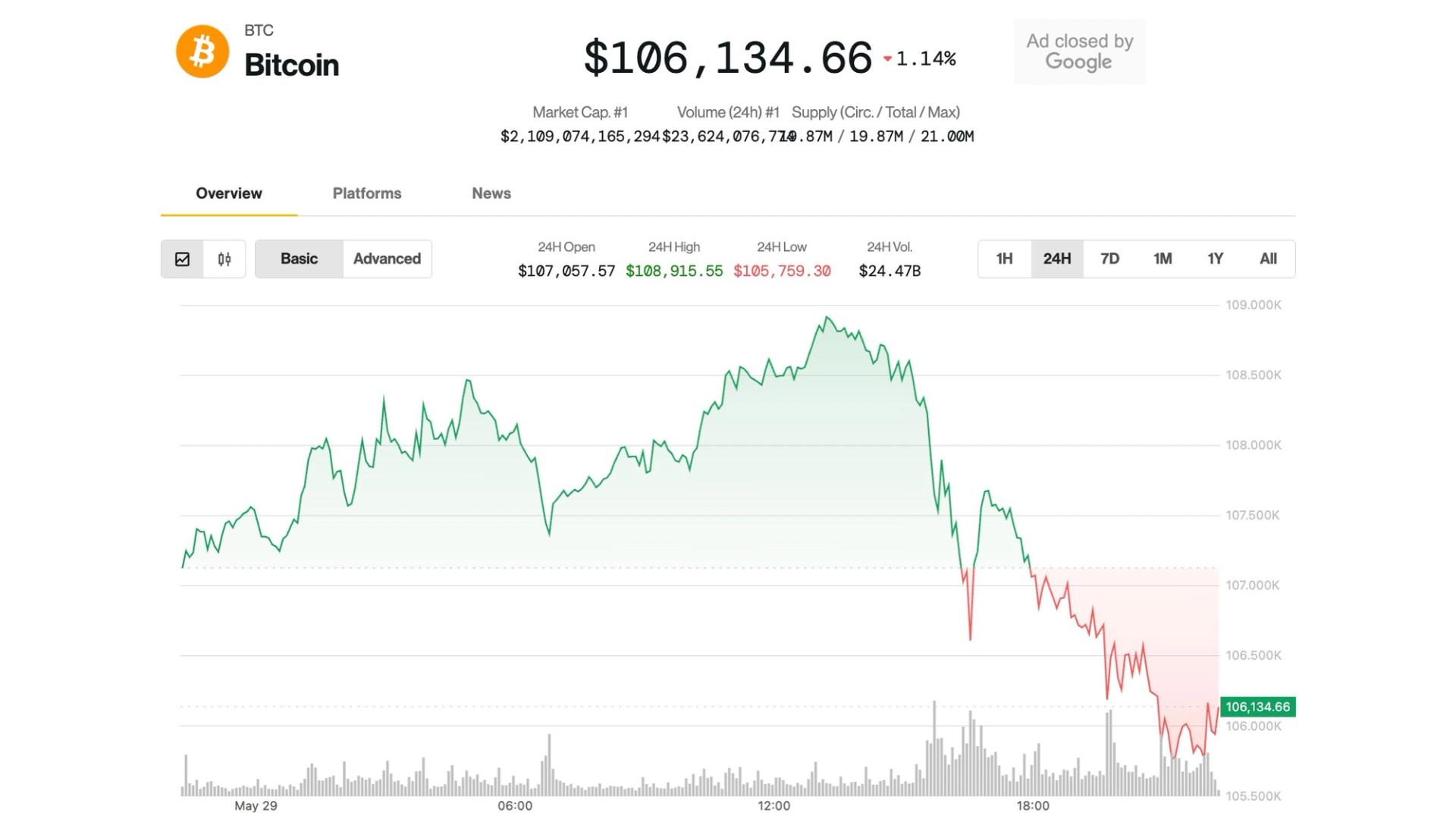

Market volatility

Finally, market volatility may be causing boomers to decide to stay on the job until things calm down. Political uncertainty and a complicated trade policy may have boomers worried that they’ll retire and immediately see their investment accounts plummet.

The good news is, boomers can overcome many of these obstacles by getting the right advice from a financial advisor who can help them save, invest wisely, and create a solid plan for covering healthcare and long-term care expenses. Getting professional help from an advisor ASAP can go a long way towards making retirement possible, and boomers who are tired of working should find the right advisor to help them achieve that dream.

The post Only 10% of Boomers Have Retired. Here are the Obstacles Standing in Their Way appeared first on 24/7 Wall St..