NVIDIA’s Tiny Dividend Is a Joke — But That Could Change Fast

Several years ago, NVIDIA (NASDAQ:NVDA) became the darling of the stock market due to its powerful artificial intelligence (AI) processors. In short order, NVIDIA joined the ranks of the Magnificent Seven and symbolized the rapid growth of Big Tech in the 2020s. NVIDIA doesn’t excel at everything, though. Frankly, the company isn’t known for rewarding […] The post NVIDIA’s Tiny Dividend Is a Joke — But That Could Change Fast appeared first on 24/7 Wall St..

Key Points

-

NVIDIA pays a paltry dividend, even by Big Tech standards.

-

However, NVIDIA previously hiked its dividend substantially, and shareholder demand could influence future dividend raises.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Several years ago, NVIDIA (NASDAQ:NVDA) became the darling of the stock market due to its powerful artificial intelligence (AI) processors. In short order, NVIDIA joined the ranks of the Magnificent Seven and symbolized the rapid growth of Big Tech in the 2020s.

NVIDIA doesn’t excel at everything, though. Frankly, the company isn’t known for rewarding its loyal shareholders with big dividends.

Nevertheless, it’s still possible for NVIDIA to become a dividend all-star someday. As we’ll discover, NVIDIA has the means to significantly hike its dividend and the company has already enacted a major yield hike. So, you never know when NVIDIA might evolve from a dividend underperformer to a passive income overachiever.

Don’t Laugh at NVIDIA’s Tiny Dividend

Although NVIDIA has paid quarterly dividends for over a decade, hardly anyone is impressed with the payouts. The company’s next cash distribution, which is set for July, will only be a penny per share.

But before you laugh at NVIDIA’s dividend, let’s put it into perspective. In May of last year, the company announced an increase in its quarterly cash dividend. Not long after that, NVIDIA enacted a ten-for-one forward stock split.

More specifically, NVIDIA hiked its dividend from $0.04 per share to $0.10 per share on a pre-split basis. This would convert to a dividend hike from $0.004 per share to $0.01 per share on a post-split basis.

No matter how you slice it, NVIDIA raised its dividend by a whopping 150%. Thus, even it’s tiny on a dollars-and-cents basis, NVIDIA’s current dividend reflects a massive increase on a percentage basis.

I’ll admit, I’m doing some strenuous mental gymnastics to see the glass as half-full here. Still, if NVIDIA was willing to hike its dividend by 150% last year, there’s the potential for more huge hikes in the future.

NVIDIA Can Afford to Pay Much More

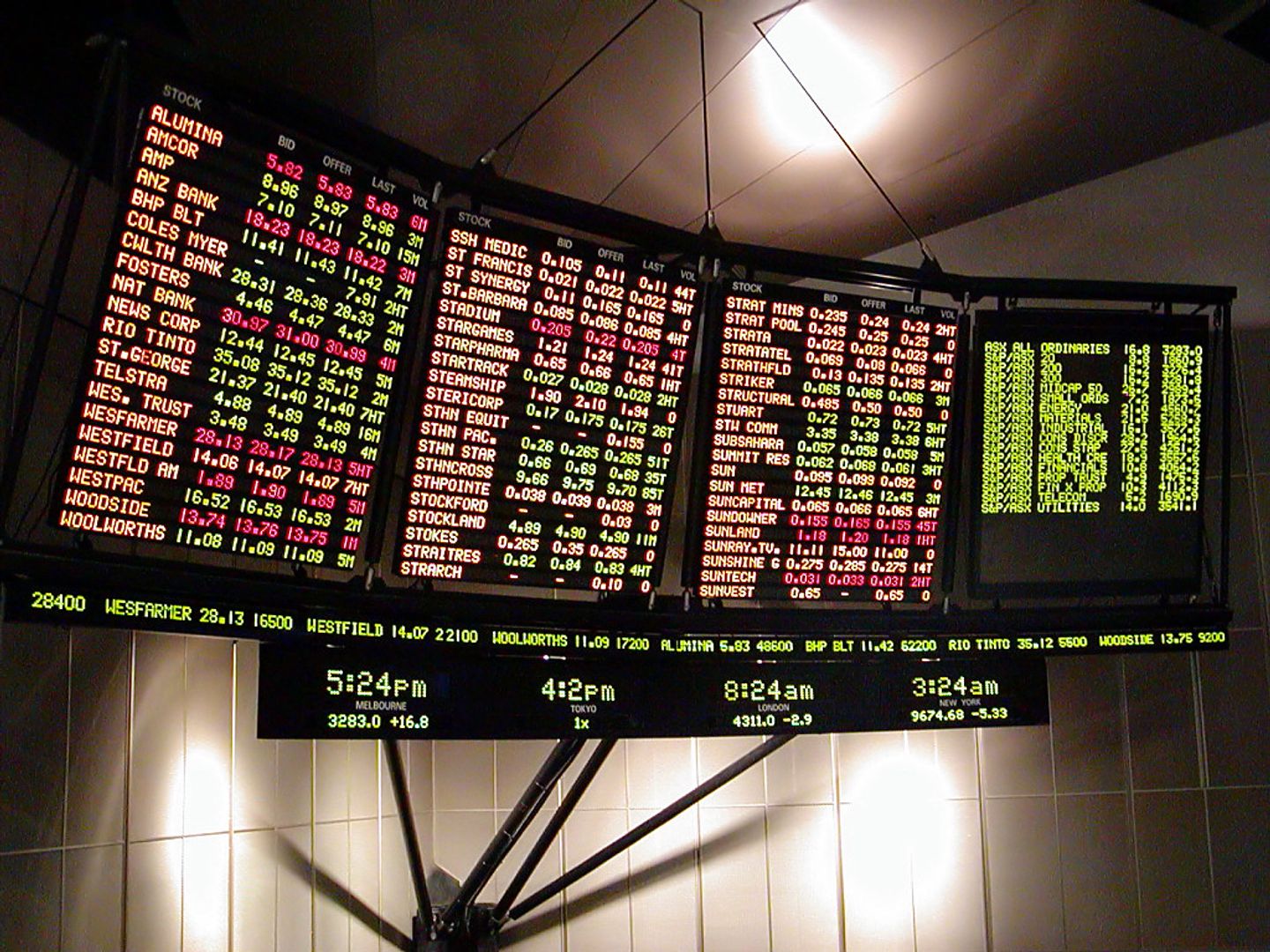

Furthermore, there’s no doubt that NVIDIA could easily afford to pay higher dividends. If you need evidence of NVIDIA’s strong capital position, simply take a glance at the company’s first-quarter fiscal 2026 financial results.

Astounding, NVIDIA grew its revenue by 69% year over year to $44.062 billion in Q1 FY2026. The company also managed to increase its net income by 26% to $18.775 billion.

Not surprisingly, NVIDIA the revenue-generating machine has plenty of available capital. As of April 27, 2025, the company had $15.234 billion worth of cash and cash equivalents. That’s roughly double the $7.587 billion in cash and cash equivalents that NVIDIA had as of April 28, 2024.

Clearly, NVIDIA is a cash cow that’s perfectly capable of paying bigger cash distributions to its shareholders. Notably, NVIDIA’s dividend payout ratio (the portion of earnings paid out as dividends) is only 1.3%. The company could increase its payout ratio to 20%, 30%, or even 40% without raising sustainability concerns.

Balancing Growth With Shareholder Rewards

For the most part, NVIDIA has focused on growth instead of rewarding its shareholders with big dividends. Just look at this NVDA stock chart, and I’m sure you’ll agree that the company’s investors have benefited from NVIDIA’s relentless growth.

Moreover, recent developments indicate that NVIDIA continues to prioritize growth opportunities. For instance, NVIDIA plans to build a massive AI cloud factory in Germany. Plus, the company is teaming up with Siemens (OTCMKTS:SIEGY) to advance industrial AI capabilities for manufacturers.

Yet, NVIDIA could mature from a red-hot market darling to an established part of the technology-sector landscape. Over time, this happened with dot-com hyper-growth businesses like Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

Today, Microsoft and Apple actually pay decent dividends when compared to some other large-cap Big Tech names. Soon, and maybe even in 2025, NVIDIA’s maturation process could accelerate. The company’s management might prioritize shareholder rewards, and NVIDIA may ease up on its relentless drive for growth.

NVIDIA Shareholders: Make Your Voice Heard!

Ultimately, Big Tech executives tend to respond to the demands of the shareholders. If you want NVIDIA to enact more dividend hikes like the 150% increase from 2024, then you can let the company know how you feel.

I suspect that more and more of NVIDIA’s passive-income-seeking stockholders will make their voices heard in the coming quarters. It might just be a matter of time before NVIDIA’s management establishes a more balanced mix of growth and shareholder rewards. With that, NVIDIA could transform from a dividend punch line to a bona fide yield superstar.

The post NVIDIA’s Tiny Dividend Is a Joke — But That Could Change Fast appeared first on 24/7 Wall St..