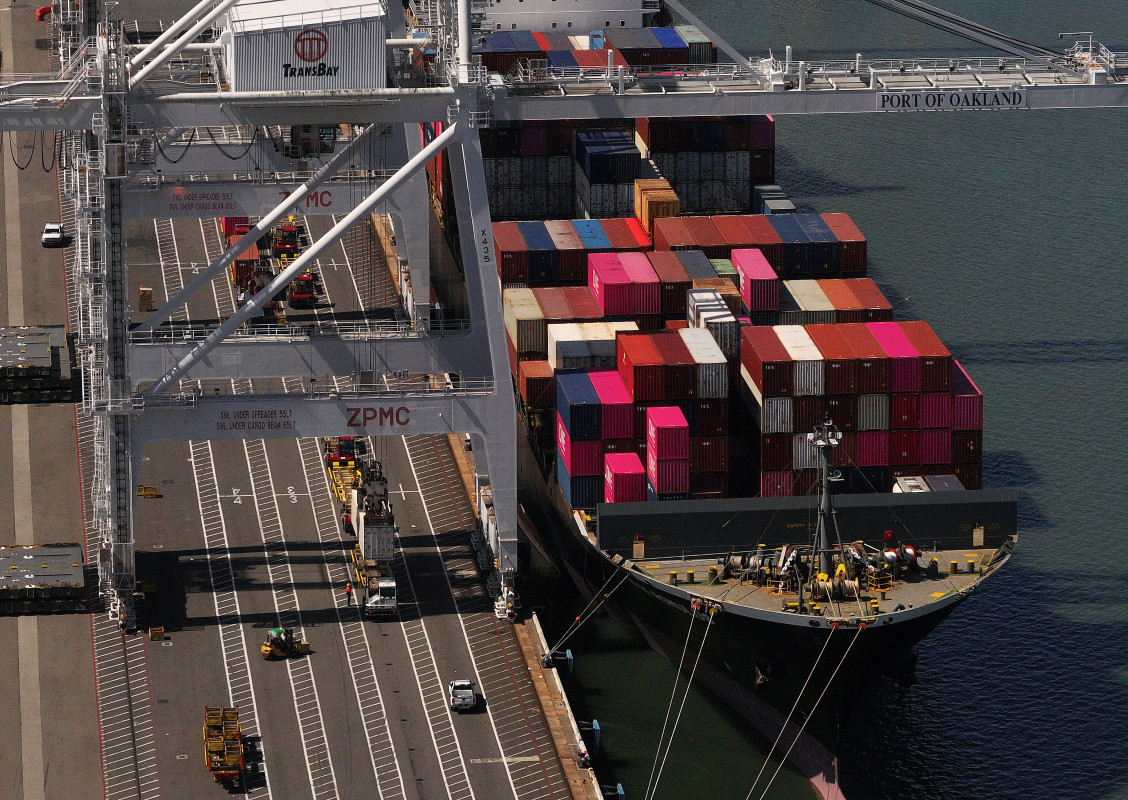

News on renewed China talks sparks global markets

Most tariffs imposed in the U.S.-China trade dispute will be suspended.

Updated: 5:10 a.m. ET

Early Monday, the United States and China announced the temporary suspension of most of the tariffs imposed on one another in April.

The suspension will be good for 90 days while the two countries negotiate a full tariff agreement.

Financial markets were rallying heavily in response.

The United States agreed to reduce its 125% tariff on all Chinese goods exported to the United States to 10%. Its 20% tariff that President Trump imposed in retaliation for China's alleged role in exporting fentanyl into the United State will remain.

So, the total tariff on imports to the United States from China would be 30%.

China, meanwhile, agreed to cut to 10% its tariff rate on goods imported from the United States. It had been 125%, imposed in retaliation to U.S. tariffs.

The negotiations for a full trade agreement would be led by Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer for the United States and by Vice Premier He Lifeng for China.

Asian and European stocks were surging on the news.

Futures trading in U.S. stocks suggested a huge open. The S&P 500 futures were up 158 points to 5,836. Futures based on the Dow Jones Industrial Average were up nearly 850 points.

Gold, meanwhile, was off more than $100 to $3,227 per troy ounce.

Crude oil was up $2 to $63.04.

Some good news for the economy

It looks like the U.S economy may have already received a very good piece of news to start the week. That was what the financial markets were saying late Sunday.

The good news: Reports the United States and China appear ready to negotiate a new trade deal that would bring tariffs on goods between the two countries down again.