Markets take a pause as investors stop ‘TACO’ trade after one day bounce

The cycle of depression and joy investors seem to experience each time Trump announces and then removes a tariff threat may be losing its intensity.

Investors on Tuesday celebrated President Donald Trump’s walkback of his threat of 50% tariffs on EU goods by sending U.S. stocks skyward.

The S&P 500 rose 2.1%, putting it within 3.7% of its all-time high. The Dow gained 1.8%, and the Nasdaq rose 2.4%. Stocks also got a boost from May consumer confidence numbers, with the Conference Board reporting on Tuesday that consumer confidence surged after five months of decline. It rose 12.3 points, to 98—near its pre–”Liberation Day” levels.

But investor excitement over Trump’s climbdown from another tariff threat—what one Financial Times columnist dubbed the ‘TACO,’ or Trump Always Chickens Out, trade—had the lifespan of a morning glory flower (that is, one day).

On Wednesday, markets wobbled again.

In Asia, indexes were flat to down: Shanghai and Japan’s Nikkei were flat, Hong Kong’s Hang Seng lost 0.5%, and India’s Nifty 50 slipped 0.3%. In Europe, the Stoxx Europe 600 was off 0.2% in midday trading, and the U.S. premarket was little better.

S&P, Dow and Nasdaq futures all were trading from flat to up 0.2% before the markets opened.

As we noted yesterday, the cycle of depression and joy investors seem to experience each time Trump announces and then removes a tariff threat may be losing its intensity. “Investors know this act by heart,” Stephen Innes of SPI Asset Management wrote in a note seen by AP. “The volatility is still there, but like a horror franchise on its fifth sequel, the jump scares are losing their bite.”

The bigger question for investors is whether the jump scares are doing long-term damage. Paul Donovan, chief economist of UBS Global Wealth Management, seems to think so.

“Equity markets seemingly rallied on optimistic comments from U.S. President Trump around trade. So much focus on the words of one individual is unusual,” he wrote in a Wednesday note seen by Fortune. “Trump has the power to limit future economic damage from new trade taxes, but cannot undo the damage of past policy swings. For example, comments in yesterday’s sentiment data highlighted that companies are delaying decisions in the face of policy uncertainty, even as Trump retreated from some tariffs.”

Here’s a snapshot of today’s action prior to the opening bell in New York:

- The S&P 500 rose 2.1% Tuesday. The index is up 0.7% YTD.

- S&P futures were trading up 0.1% this morning.

- The Stoxx Europe 600 was down 0.2% in early trading.

- Asia was flat to down: Japan and Shanghai were flat, Hong Kong fell 0.5%, and India’s Nifty 50 lost 0.3%.

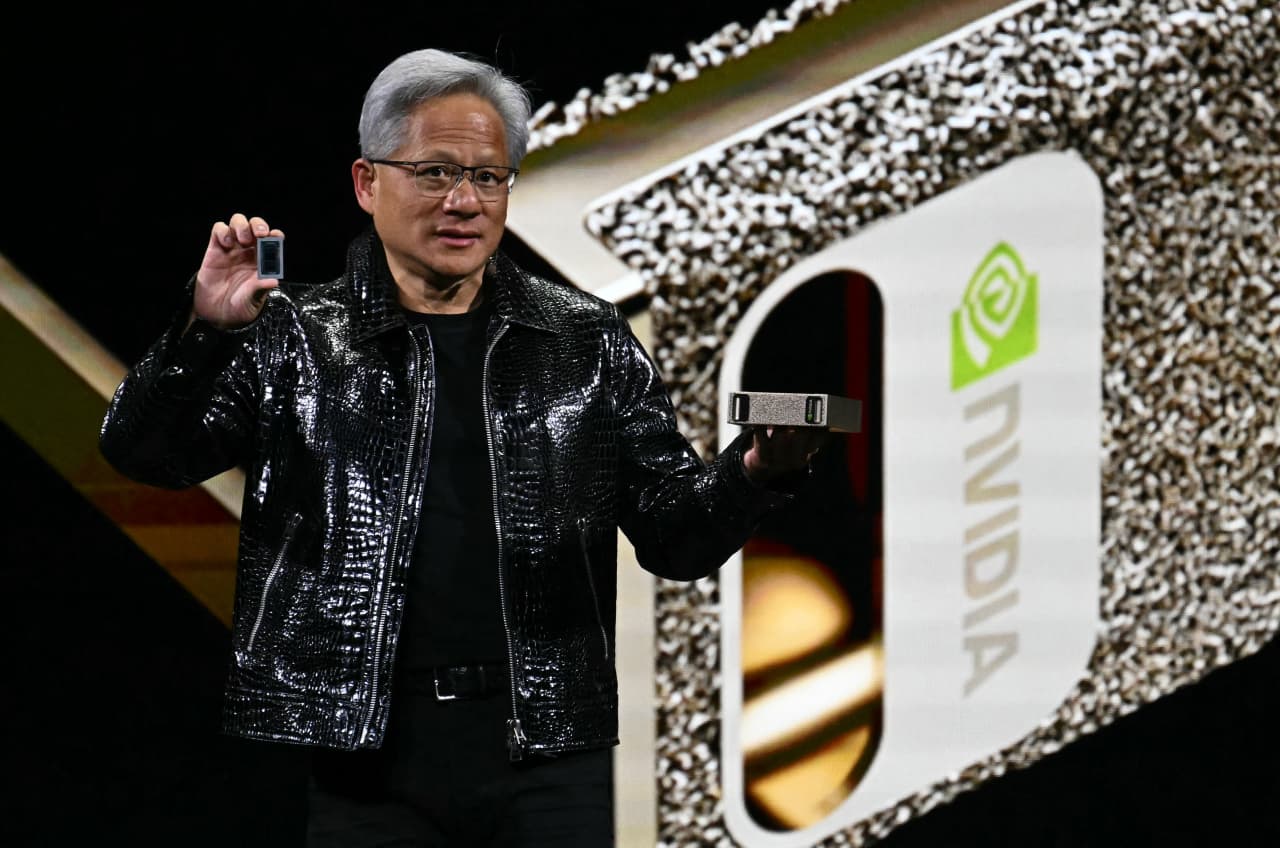

- All eyes are on Nvidia, which reports earnings after the closing bell. It’s the last of the Magnificent Seven technology stocks to report earnings, which so far have exceeded investors’ expectations. Yesterday, Nvidia shares gained 3%.

- Bitcoin was sitting up at $108,900 this morning.

This story was originally featured on Fortune.com