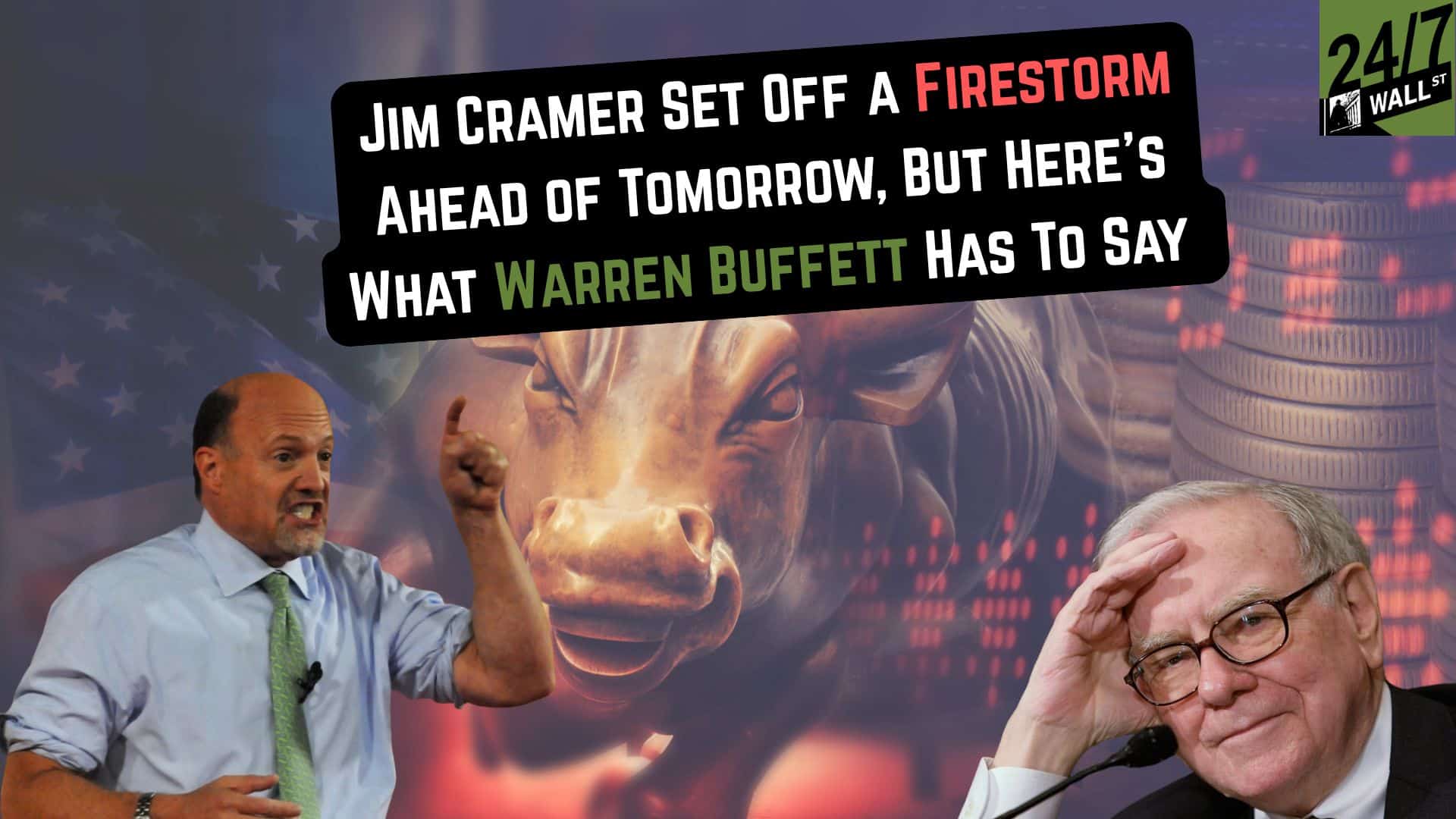

Jim Cramer Set Off a Firestorm Ahead of Tomorrow, But Here’s What Warren Buffett Has To Say

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. Jim Cramer suggested tomorrow could be a second Black Monday No one will know until the markets close, but Warren Buffett has plenty of wisdom to share With the markets in collapse, […] The post Jim Cramer Set Off a Firestorm Ahead of Tomorrow, But Here’s What Warren Buffett Has To Say appeared first on 24/7 Wall St..

compensation for actions taken through them.

Key Points

- Jim Cramer suggested tomorrow could be a second Black Monday

- No one will know until the markets close, but Warren Buffett has plenty of wisdom to share

- With the markets in collapse, it’s time to check with a financial advisor and see if your portfolio is positioned to weather the storm. Click here to speak with one now. Don’t worry, it’s free.

Jim Cramer Summoned The Demon

When investing, one must be certain to never summon the demon of Black Monday. Yesterday, the CNBC host said:

“If the president doesn’t try to reach out and reward these countries and companies that play by the rules, then the 1987 scenario… the one where we went down three days and then down 22% on Monday, has the most cogency,” and “We will not have to wait too long to know. We will know it by Monday,”

We should all hope he is wrong, but unfortunately many shares are down big pre-market, including the Mag7 stocks like Tesla (Nasdaq: TSLA) and Nvidia (Nasdaq: NVDA).

But Buffett Has Words For Moments Like This

While both Jim and Buffett have seen a lot in the markets, I generally turn to The Oracle of Omaha for a calming word about how to handle volatility. Here is some of his best advice that rings truer today than ever. Perhaps his most famous quip is the most well suited, that we should

“Be fearful when others are greedy, and greedy when others are fearful.”

and

“The best chance to deploy capital is when things are going down.”

Both of these are quite true at the moment, with the S&P down 13.7% YTD, and many growth stocks selling off further pre-market. Buffett is well positioned to take his own advice, too. Berkshire Hathaway has over $330b in cash on the balance sheet right now, roughly 30% of the market cap of the company.

If you’re planning on following suit, there are 3 dividend stocks that are already turning green ahead of the open tomorrow. But before you buy any of them, remember what Buffett has to say on the matter:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

Good luck tomorrow.

The post Jim Cramer Set Off a Firestorm Ahead of Tomorrow, But Here’s What Warren Buffett Has To Say appeared first on 24/7 Wall St..