Is This Your Last Chance to Buy Disney Under $100?

The clouds may be stormy, but the media titan hasn't been this cheap in a long time.

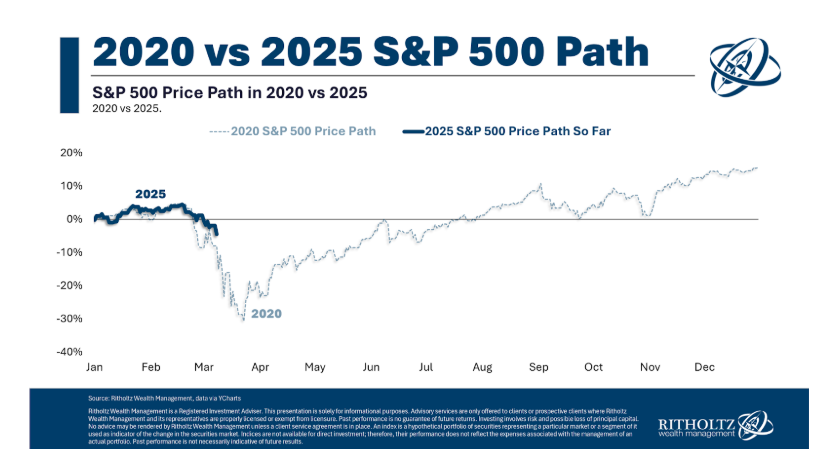

The House of Mouse has buckled below the triple-digit mark. Shares of Walt Disney (NYSE: DIS) tumbled 5% to $97.90 on Tuesday, its first close below $100 in more than four months. The headwinds are swirling beyond the general market pullback. A trip to one of Disney's theme park attractions isn't cheap, and concerns of a potentially softening economy would slow the turnstile clicks. The trade war is heating up, and that could also send shockwaves through most of the diversified media conglomerate's subsidiaries.

It's not just a global recession that can be triggered by the risk of stagflation both here and abroad. The battle itself can deteriorate the appeal of American brands in international markets, and this can hit Disney harder than you may think. Mickey Mouse collects passport stamps everywhere you look. Half of Disney's dozen theme parks are located overseas. A surprising 54% of Disney+ subscribers are streaming outside the U.S. and Canada. Disney had the world's three highest-grossing theatrical releases last year, and foreign ticket sales accounted for 62%, 52%, and 57% of the total box office receipts.

Disney becomes a risky investment when it's a smaller world after all. With that bleak backdrop out of the way, let's dive into why the media stock bellwether could be a great candidate to bounce back into the triple digits -- sooner than you probably think.