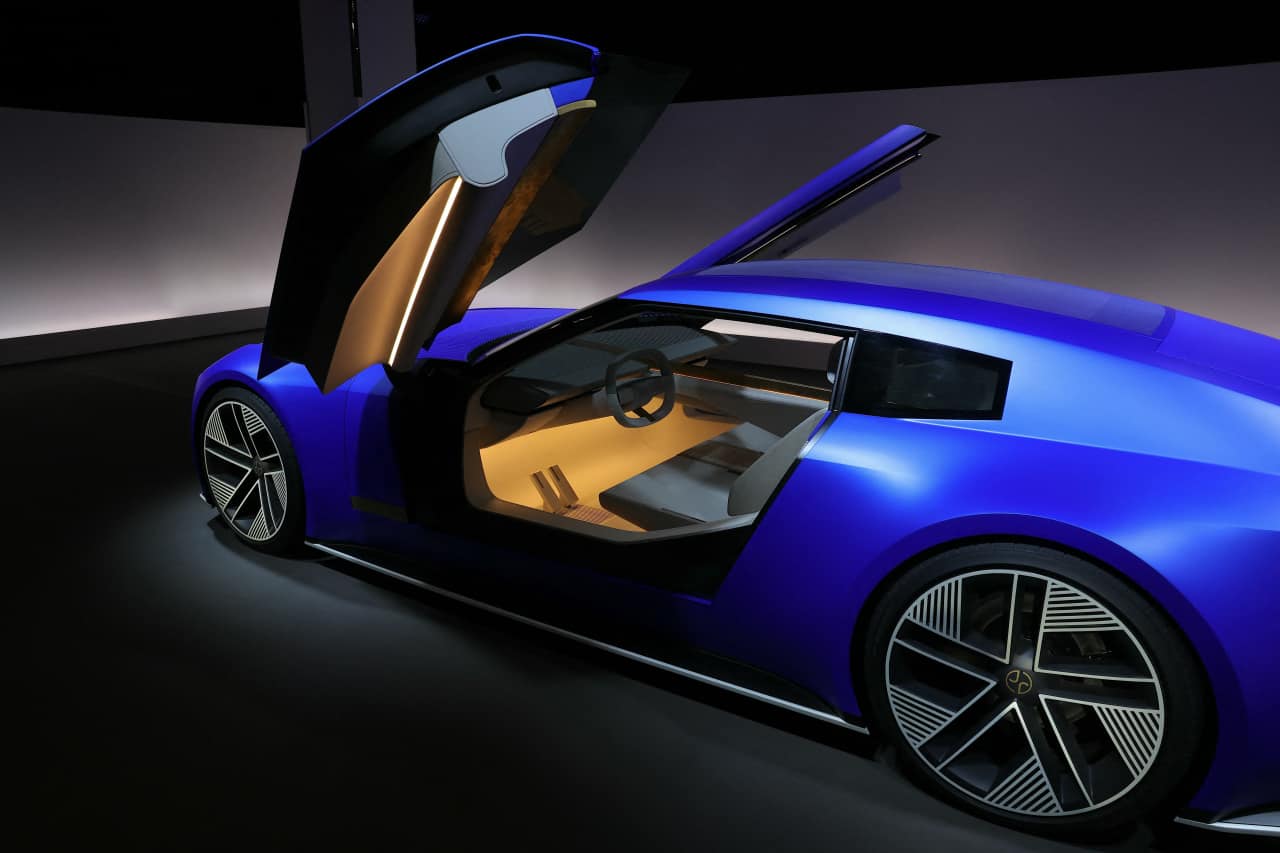

Is Lucid Stock a Millionaire-Maker?

Electric vehicle (EV) maker Lucid (NASDAQ: LCID) experienced a share price surge after the company went public in 2021. But since about mid-2022, the stock has been on a steady decline and is down 96% from its all-time high of about $58.The massive drop may have some investors hoping that if Lucid can just regain its momentum in the EV market, perhaps it can achieve its previous share price -- which would be more than a 2,500% increase from its current price.The right amount of money, paired with those gains, could mint millionaires. But Lucid looks far from being able to achieve returns of that magnitude. Here's what you should know if you're hoping for big returns from Lucid's stock.Continue reading

Electric vehicle (EV) maker Lucid (NASDAQ: LCID) experienced a share price surge after the company went public in 2021. But since about mid-2022, the stock has been on a steady decline and is down 96% from its all-time high of about $58.

The massive drop may have some investors hoping that if Lucid can just regain its momentum in the EV market, perhaps it can achieve its previous share price -- which would be more than a 2,500% increase from its current price.

The right amount of money, paired with those gains, could mint millionaires. But Lucid looks far from being able to achieve returns of that magnitude. Here's what you should know if you're hoping for big returns from Lucid's stock.