Is 27 Too Late to Start Saving for Retirement? My Journey to Financial Freedom

It’s best to get started with saving for retirement as soon as possible, but I believe it’s never too late to make up for lost time if one has a nest egg that’s skinnier for one’s age. For this 27-year-old Reddit user who’s making $55,000 per share, they’re starting to feel the pressure to start […] The post Is 27 Too Late to Start Saving for Retirement? My Journey to Financial Freedom appeared first on 24/7 Wall St..

It’s best to get started with saving for retirement as soon as possible, but I believe it’s never too late to make up for lost time if one has a nest egg that’s skinnier for one’s age. For this 27-year-old Reddit user who’s making $55,000 per share, they’re starting to feel the pressure to start adding to that nest egg. Though the sense of urgency may be warranted given their modest-sized nest egg, I’d argue that they’re not even close to being “too late.”

Indeed, many young people are still struggling with debt early on, as they attempt to climb out of student loan debt incurred during their early professional careers. Of course, it can feel like playing from behind once one graduates with a five- or even six-figure sum of debt. And while retirement feels like an unrealistic, even unreachable concept for such young individuals, I do think that it’s a mistake to underestimate the power of long-term compounding.

Indeed, all it takes is a decade or so to go from playing behind to sprinting ahead, perhaps by a wide margin.

Key Points

-

At 27, this Reddit user is definitely not too late to get started with saving (and investing) for retirement.

-

Investing (either actively or passively) in equities is the way for young individuals to get on the fast track to retirement.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

This 20-something-year-old Reddit user has many decades to save up for retirement.

The fact that this 27-year-old Reddit user is bringing up saving for retirement leads me to believe that they’re already ahead of the game, even if their nest egg isn’t in a spot that’d make something like early retirement a realistic possibility. Undoubtedly, it’s not all too hot of a topic for a recent graduate to be thinking four decades down the road. In any case, I do think our Reddit user is on the right track, with a realistic game plan to start building real wealth.

The first step for this Reddit user is to get serious about budgeting. Now, that doesn’t mean cutting out all but the most essential of costs, such that one has little to no fun money. But it does mean getting the right monthly amount such that there’s enough left over to stash in an investment fund.

Ideally, one should strive for a monthly savings amount that doesn’t entail a great deal of pain. The key to budgeting is finding a figure that’s sustainable and isn’t depriving one of enjoyment in the present. Perhaps setting a savings rate that’s too ambitious could turn one off from saving and investing altogether.

It’s getting harder to save for retirement. Cutting costs isn’t always the answer.

With the recent surge in the cost of living, I’d argue that it’s a better bet to focus a bit more on increasing one’s income, especially for someone starting out, than cutting one’s expenses to the bone. With soaring food and rent prices, it’s getting hard to set aside an extra dollar to be invested in the financial markets.

And for those who’ve already cut out unnecessary expenses and are still living paycheck to paycheck, cutting any further into the budget to hit a monthly savings goal may not be the optimal move. Of course, someone looking to get serious about saving up for retirement at a relatively young age should gain the services of a financial-planning pro.

Investing for the long haul is how new investors can pull ahead in the retirement race

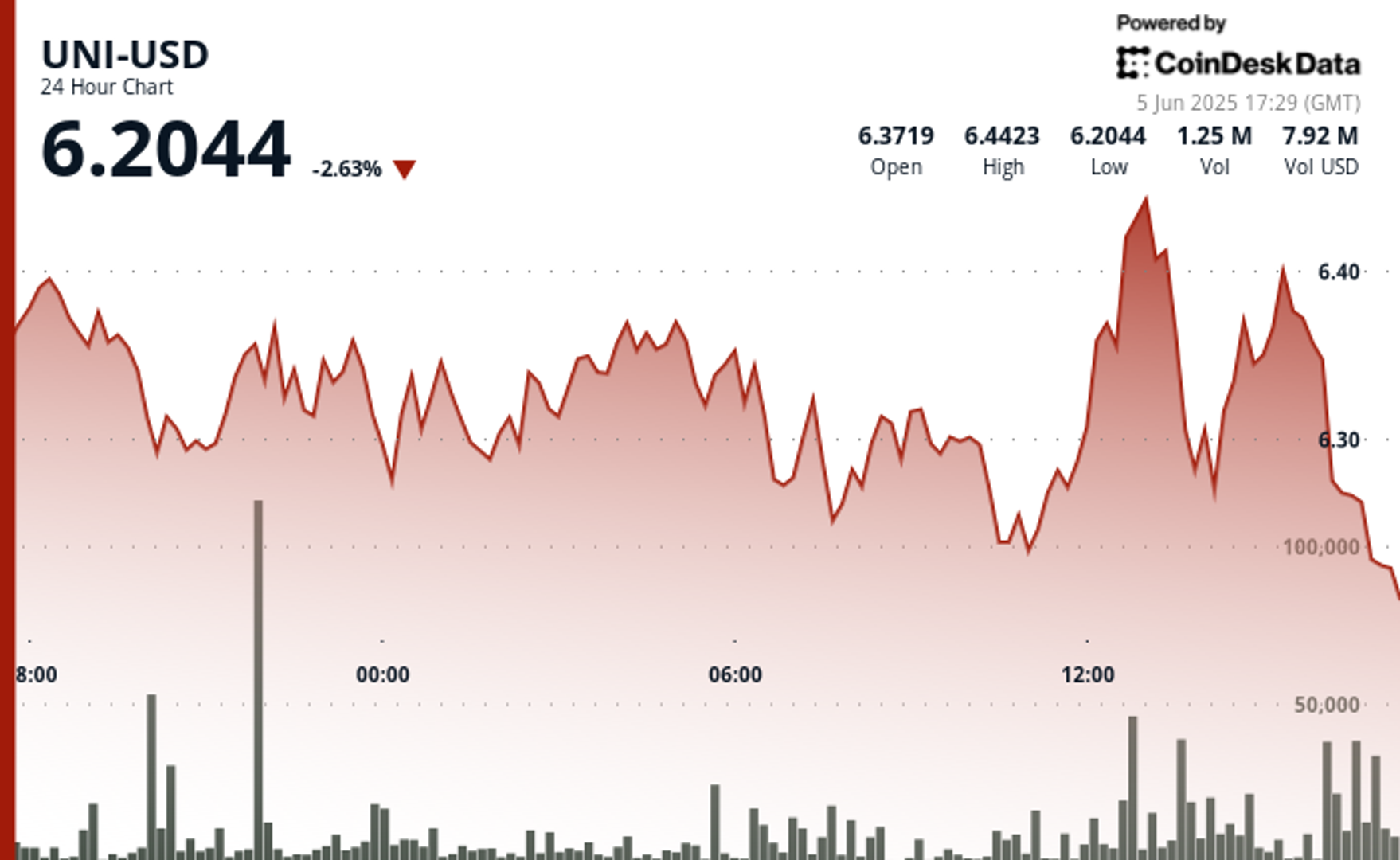

In any case, many passive investors or “Bogleheads” would be fine plowing savings into a low-cost total stock market index fund (preferably one from Vanguard). Picking individual stocks could make sense for some who seek greater engagement and a shot at the S&P 500 for some period of time.

Indeed, beating the market consistently over hard is no easy feat. But for a young person who can tolerate a bit more risk, a portfolio of high-quality growth stocks may be a great way to make saving and investing less of a boring feat.

Though young investors should be cautious, they should avoid making investing too exciting, so that they don’t chase gains from trading rather than investing steadily with a long-term horizon in mind. Indeed, too many young investors risk their shirt for a shot to get rich quickly. Instead, investors should shoot to build wealth slowly, over the span of multiple decades.

The post Is 27 Too Late to Start Saving for Retirement? My Journey to Financial Freedom appeared first on 24/7 Wall St..