Forget tariffs, automakers face an even bigger threat from China

China may have the trump card in the auto tariff war.

President Donald Trump has been clear about his affinity for tariffs.

While he's repeatedly said he even loves the word itself, tariffs also serve a wider purpose for the president.

Trump has promised to use tariffs to do everything from paying down the deficit to balancing the budget. On more than one occasion, Trump has suggested the U.S. abolish income taxes in favor of tariffs to fund the government.

Related: White House responds to the latest Elon Musk jab

However, one of the biggest ways Trump has been able to sell the idea of paying more taxes on everyday goods is by promising that the tariffs will bring jobs back to the U.S.

After decades of offshoring manufacturing jobs, America is a husk of its factory-driven past.

However, bringing factory jobs back to the U.S. could potentially take years to accomplish.

In the meantime, U.S. economic rivals are making their own moves to keep international manufacturing within their borders.

Thanks to its lower wages and more lax regulations, China is often seen as the poster child for cheap international labor. And it doesn't want to lose manufacturing like Western countries did post industrialization.

China is one of the world's leaders in manufacturing auto parts, and the country has a trick up its sleeve that will not only keep jobs in the country, but could also entice more foreign companies to move operations there.

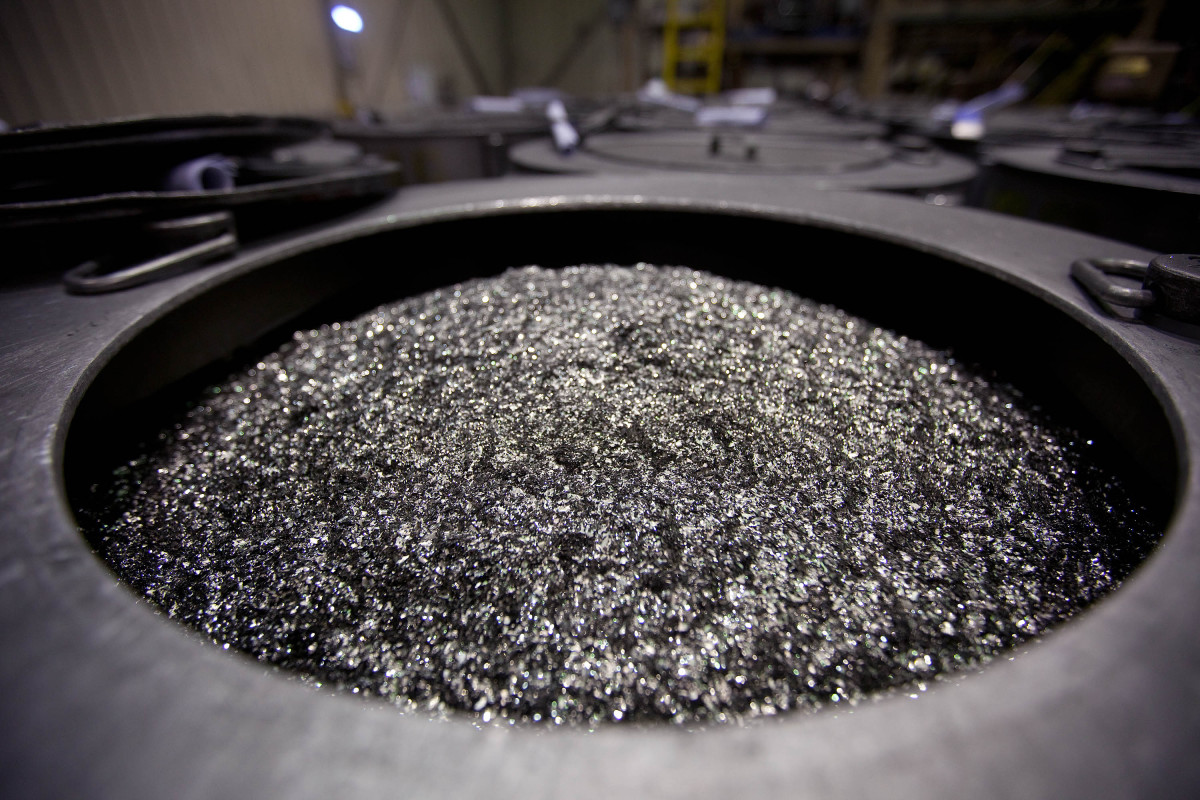

China plays hardball with rare earth magnets

Multiple foreign manufacturers are considering moving at least some production to China, according to a Wall Street Journal report, to gain access to the rare earth materials on which China is placing increased controls.

Some manufacturers are considering producing electric motors in Chinese factories or shipping made-in-America motors to China to have the rare earth magnets they need installed after the fact.

At least four major automakers are scrambling to find a solution after China raised controls on the valuable material in response to the 25% tariffs on autos and auto parts that went into effect recently.

More automotive:

- Here's why Tesla's robotaxi launch is destined to fail

- Tesla faces big threat from rivals in key market

- The 'anti-Tesla' gives American buyers more good news

“If you want to export a magnet [from China], they won’t let you do that. If you can demonstrate that the magnet is in a motor in China, you can do that,” a supply-chain manager at a carmaker told the Journal.

China began tightening controls in April when it started requiring companies to apply for permission to export magnets made with rare earth metals like dysprosium and terbium.

For the auto industry, rare earth metals are essential for electric vehicle motors to function at high speeds.

China was supposed to reduce the controls on the materials as part of the 90-day pause in the tariff war between the two countries. However, China has been slow-walking its approval process, according to the Journal. The president has accused China of violating the deal, while China has said that the U.S.'s own “discriminatory and restrictive measures” have forced its hand.

China EV industry has shifted into overdrive

China is serious about EVs being the vehicle of the 21st century and laying the groundwork to dominate EV manufacturing.

There are already multiple players in the space.

Tesla is the biggest EV maker in the U.S. It sold 1.8 million vehicles worldwide last year. BYD, the largest Chinese EV maker, sold more than 4 million vehicles last year.

And BYD looks to sell a lot more this year.

In late May, BYD, Tesla's biggest rival in China, launched a new round of price cuts of up to 53,000 yuan (about $7,300) across 22 models.

The move sent shockwaves throughout the industry, as smaller rivals will have trouble keeping up wth the discounts the much-larger BYD can offer. The move was so drastic that the China Association of Automobile Manufacturers (CAAM) and the Ministry of Industry and Information Technology had to issue public warnings about “disorderly price wars.”

Related: Elon Musk, Tesla finally get some good news out of China