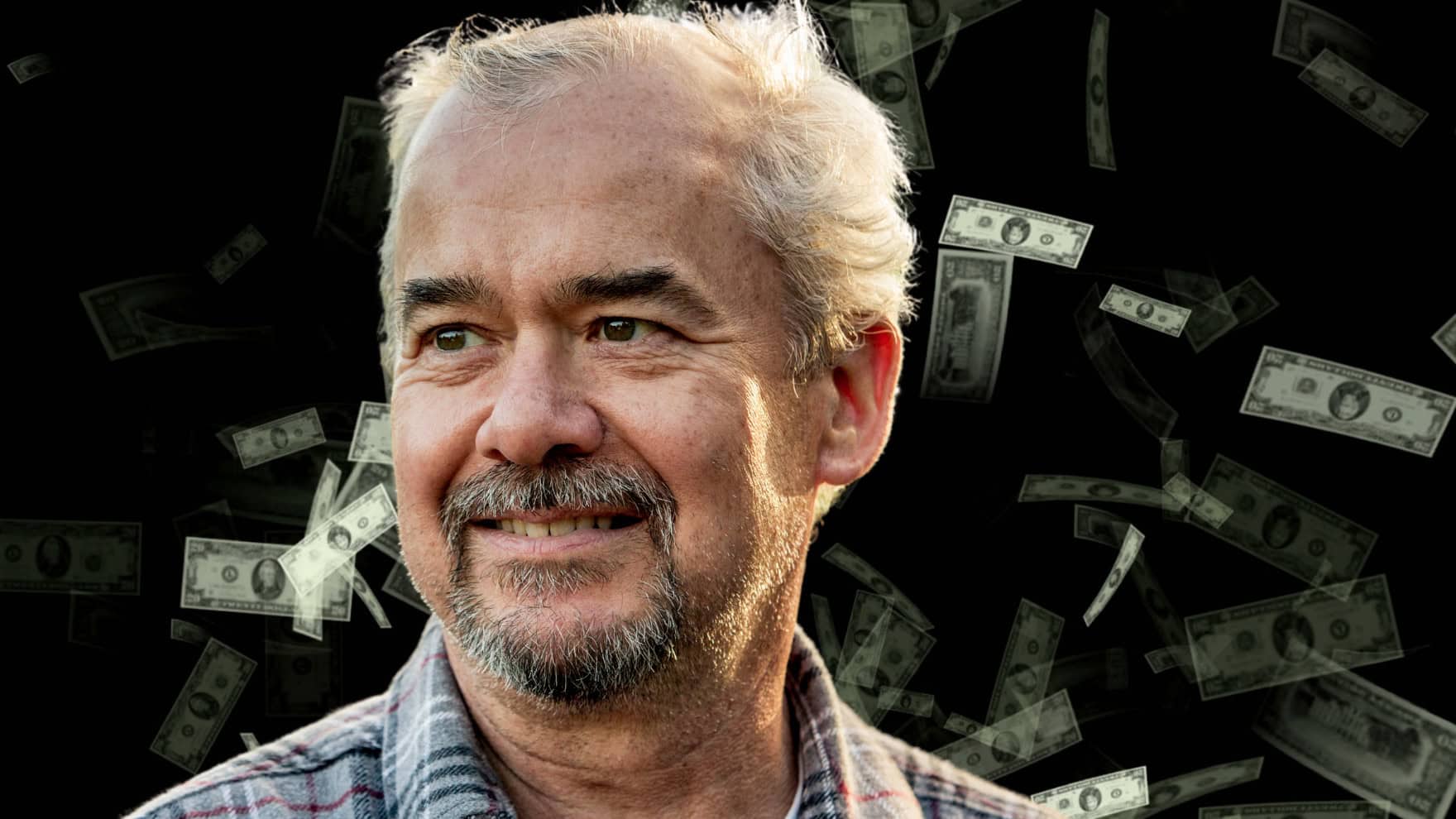

I’m Ready To Retire Early, but Does That Mean Leaving My 401(k) Untouched For Another 5 Years?

A lot of people have no choice but to work until their late 60s or even beyond due to a lack of savings. But if you’ve saved well enough, retiring early may be possible. That said, if you have all of your long-term savings in a 401(k), early retirement could become more difficult to […] The post I’m Ready To Retire Early, but Does That Mean Leaving My 401(k) Untouched For Another 5 Years? appeared first on 24/7 Wall St..

Key Points

-

There are some situations when you can tap a 401(k) early.

-

Make sure you know the rules to avoid penalties.

-

Talk to a financial advisor before ending your career at a relatively young age.

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started.

A lot of people have no choice but to work until their late 60s or even beyond due to a lack of savings. But if you’ve saved well enough, retiring early may be possible.

That said, if you have all of your long-term savings in a 401(k), early retirement could become more difficult to pull off. That’s because 401(k)s require you to wait until age 59 and 1/2 to take withdrawals. If you remove funds ahead of that age, you could face a 10% early withdrawal penalty.

That’s what this Reddit poster is worried about. They’re looking to retire at 55 but don’t want to be penalized for tapping their 401(k) too soon. But there’s actually good news for this poster and people in a similar boat.

Introducing the rule of 55

It’s true that normally, you have to wait until age 59 and 1/2 to take penalty-free withdrawals from a 401(k). But there’s an exception you might qualify for called the rule of 55.

The rule says that if you leave your job during the calendar year in which you turn 55 or later, you can take a withdrawal from your 401(k) without a penalty — provided it’s the 401(k) being sponsored by the company you’re leaving. This rule does not apply to any old 401(k)s you have from previous jobs. It also does not apply to money you have in an IRA.

So in this case, the poster above may be perfectly fine to tap their 401(k) and not wait another five years. That means early retirement may be feasible for them.

Talk to a financial advisor before retiring early

The poster above does not say how much money they have or what their living costs look like. Because of this, it’s hard to know whether an early retirement is appropriate for them.

If they have a $5 million portfolio and expect to need $100,000 a year to cover their expenses, then I’d say sure, go ahead and retire at 55. But if they’re sitting on $1.5 million with the same annual spending needs, then I’d have a different answer.

That’s why it’s important to speak to a financial advisor if you’re thinking about retiring early.

Leaving your career at a relatively young age could mean having to stretch your savings longer than the typical retiree. So it’s important to make sure you have enough cash reserves to pull that off. And it’s also a good idea to get a professional involved in your portfolio to ensure that your asset mix is optimal for your financial situation.

There are also a number of pitfalls to know about if you’re retiring early. You may be losing health insurance by leaving your job, and Medicare doesn’t kick in until age 65. You also can’t claim Social Security until age 62 at the earliest.

A financial advisor can discuss these factors with you and help you arrive at solutions. They can also explain the rules of 401(k) withdrawals, including the rule of 55, so you know what funds you have access to.

The post I’m Ready To Retire Early, but Does That Mean Leaving My 401(k) Untouched For Another 5 Years? appeared first on 24/7 Wall St..