I’m 53 with $3.7 million in a single stock gain – should I sell now and face an $800k tax bill or spread out the sales?

Most Americans don’t have $3.7 million, period. But this Reddit poster has $3.7 million in a single stock gain. On the one hand, that’s impressive. On the other hand, it makes me very nervous, even though it’s not my portfolio. It’s rarely a good idea to have a $3.7 million position in a single […] The post I’m 53 with $3.7 million in a single stock gain – should I sell now and face an $800k tax bill or spread out the sales? appeared first on 24/7 Wall St..

Key Points

-

It’s not a good idea to have too much money in a single stock.

-

If you need to unload shares, you may want to do so over time to minimize your tax hit.

-

You may want to time your gains to when your income is lower.

-

Over 4 Million Americans set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started. (Sponsored)

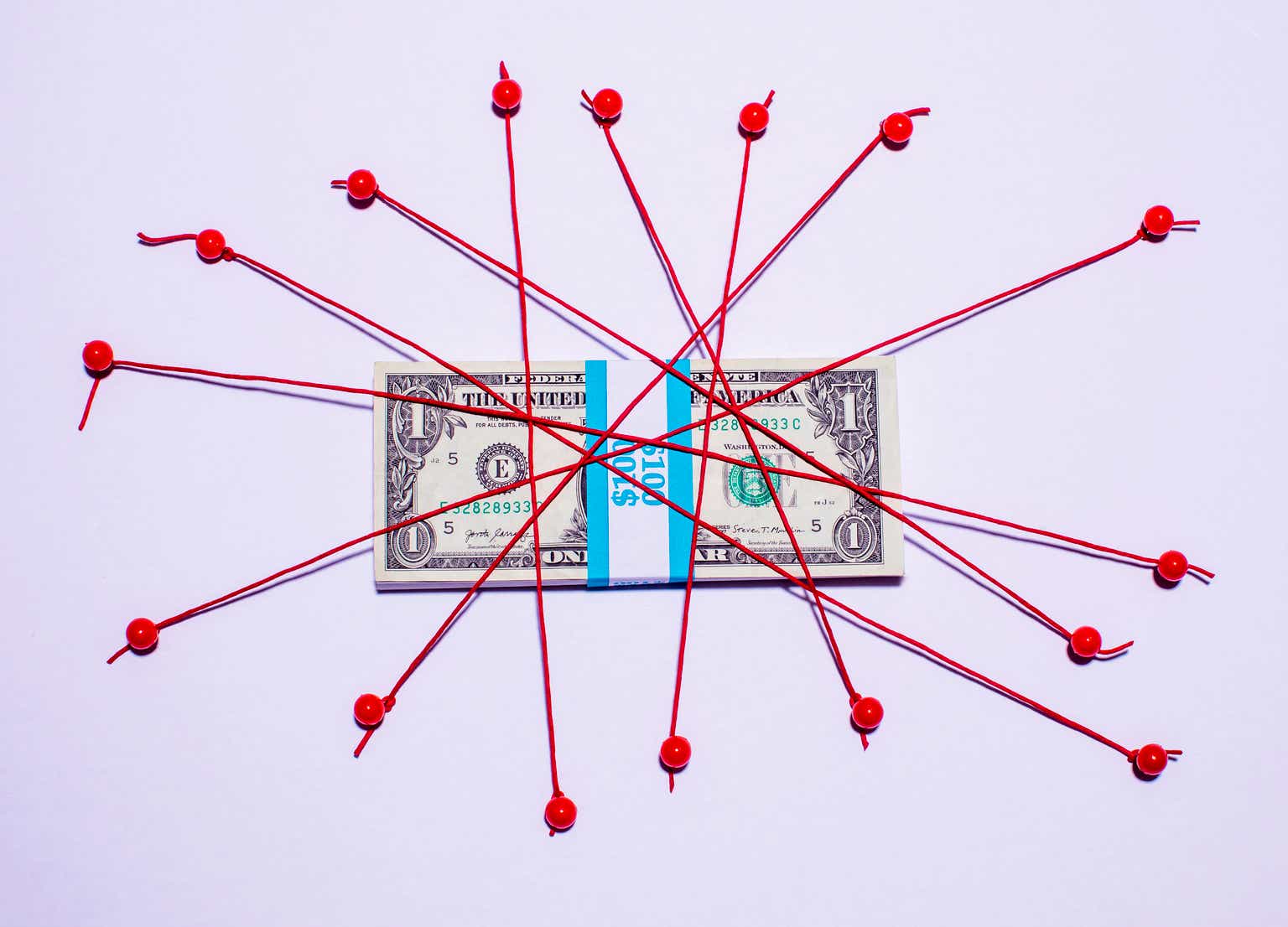

Most Americans don’t have $3.7 million, period. But this Reddit poster has $3.7 million in a single stock gain.

On the one hand, that’s impressive. On the other hand, it makes me very nervous, even though it’s not my portfolio.

It’s rarely a good idea to have a $3.7 million position in a single stock. The only way I’d say this is okay is if the poster had a $100 million dollar portfolio, and this single stock was actually a fairly small percentage of it.

If things go south, that $3.7 million stock could lose 40% or 50% of its value, thereby slashing the poster’s wealth substantially. So I’d encourage them to try to unload that stock to a large degree.

But they’re going to have to go about that strategically. The reason? They may be looking at an $800,000 tax bill if they cash out their gains. So this situation is definitely going to require some careful planning.

Getting out of a large stock position

It’s easy to see why you might end up with a single large stock position in your portfolio. Your stocks aren’t guaranteed to gain value at the same pace. If one company outperforms the rest of the companies you’re invested in, it could easily lead to a situation where you have most of your wealth tied up in a single stock.

Or, it could be that you work for a public company and are compensated in stock as well as salary. If you keep getting shares of the same company, you’re apt to grow a large position in that one stock, even if you aren’t buying it yourself.

But it’s important to be well diversified. So I’d tell this poster they need a plan for unloading some of their shares.

They could take a massive tax hit all at once. But a better bet may be to spread their gain out over time so it’s less impactful.

Another thing they could do is time the sale of the stock to when their income is lower to potentially minimize the tax hit. If they’re planning to spend a few years working part-time and transitioning into retirement, that’s a potentially good opportunity to unload some of those shares. At that point, with a lower income, they may fall into a lower tax bracket.

A financial advisor can help

The situation above is definitely a tricky one. It can be argued that the poster’s problem is a good one to have, but they still need a solution.

So to that end, I’d suggest that they talk to a qualified financial advisor. A financial advisor can help them time the sale of their stock accordingly so it causes less damage. They can also potentially work with the poster to take losses in their portfolio strategically to offset some of that gain.

A financial advisor might also suggest that the poster keep some of that stock rather than sell all or even most of it. So it’s a good idea to consult with someone who deals with situations like these on a regular basis and who can offer unbiased financial advice.

The post I’m 53 with $3.7 million in a single stock gain – should I sell now and face an $800k tax bill or spread out the sales? appeared first on 24/7 Wall St..