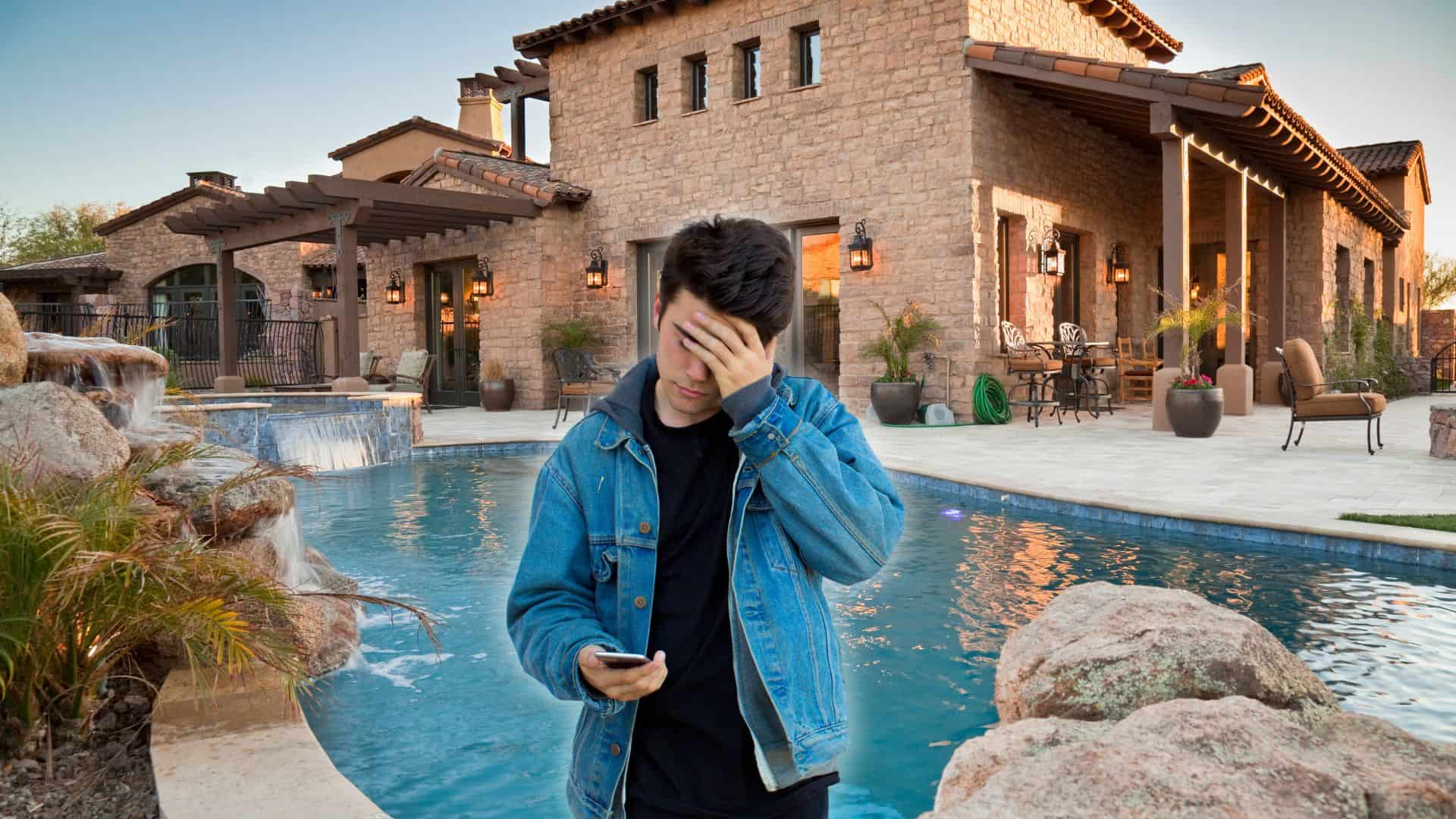

I want to retire at 55, but my husband will be 67 – how do age-gap couples handle retirement planning?

It can be a bit of a tricky tightrope walk to retire alongside one’s partner if there’s a significant age gap. In this piece, we’ll examine the case involving a 12-year age gap. The individual, 55, could realistically retire early (joining the FIRE movement) as they leave the labor force at the same time as […] The post I want to retire at 55, but my husband will be 67 – how do age-gap couples handle retirement planning? appeared first on 24/7 Wall St..

It can be a bit of a tricky tightrope walk to retire alongside one’s partner if there’s a significant age gap. In this piece, we’ll examine the case involving a 12-year age gap. The individual, 55, could realistically retire early (joining the FIRE movement) as they leave the labor force at the same time as their husband, 67, who’s at a more traditional (maybe a tad older than the average American retirement age). Of course, it’s far easier to pull off the feat playing as a team. And in this piece, we’ll look into potential strategies that can help those with huge age gaps (let’s say 10 years or more) sync up their retirements and the potential pitfalls to be mindful of.

Key Points

-

Retiring in sync when there’s an age gap can be tricky if the combined nest egg isn’t large enough.

-

Delaying retirement by a bit could make sense for both folks as they aim to retire together.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

How to sync up retirements with an age gap? It’s not that much more complicated than “retiring together” at similar ages.

Retiring together is a dream of many, and it’s totally worth pursuing, even for couples with age gaps. And while circumstances may differ if there’s a wider difference in age, it all comes down to whether there’s enough of a nest egg in the bank to support both individuals. Indeed, there are added nuances of retiring a decade (or more) earlier than the typical retirement age. Notably, one will need their money to last an extra decade longer and do without Social Security benefits for a number of years or more than a decade. However, for the most part, I do think retiring early is more than worth the price of admission for someone who wants to spend more time with their older spouse.

Indeed, the 55-year-old prospective retiree won’t be getting Social Security benefits anytime soon. But their 67-year-old partner will get a nice check cut at the end of each month. With a heftier nest egg, perhaps a portion of that check could go the way of their partner if the older spouse has more than they’ll need to fund their monthly costs of living.

Additionally, combining the nest egg and splitting the income generated (or sums withdrawn from the account) could make sense, especially if the younger individual isn’t quite ready to get FIRE’d.

Health insurance could be a wild card.

If the 55-year-old has a somewhat limited nest egg or finds they need to tap into the partner’s retirement accounts, perhaps it’s best to stay in the workforce for just a while longer, perhaps on a part-time basis, for the included health insurance benefits. Indeed, health insurance can really add up. And if our 55-year-old doesn’t have as large of a nest egg as they would have liked, perhaps stepping back from work makes more sense than stepping away.

Though I have no deep insights into the individual’s personal finance situation, I would recommend hiring a financial advisor to double-check the math. Some things can be moved around, but if the nest egg isn’t large enough, syncing up retirement dates may not make all too much sense.

Embracing frugality and retiring a bit later could make sense if the nest egg isn’t fat enough.

In such a case, I wouldn’t lose hope, though, as the 67-year-old may wish to retire with a more frugal lifestyle. Any additional savings could go towards their younger spouse’s retirement fund. Indeed, working as a team could help get the 55-year-old on the fast track to an earlier retirement.

In short, it’s best to play like a team and get that nest egg to where it needs to be before committing to anything. If the 67-year-old is ready and willing, perhaps they could stay at work for a bit longer until there’s enough to retire themselves and their partner. Personally, I think that’d be the best move if the combined accounts and income aren’t enough to support both individuals in retirement.

The post I want to retire at 55, but my husband will be 67 – how do age-gap couples handle retirement planning? appeared first on 24/7 Wall St..