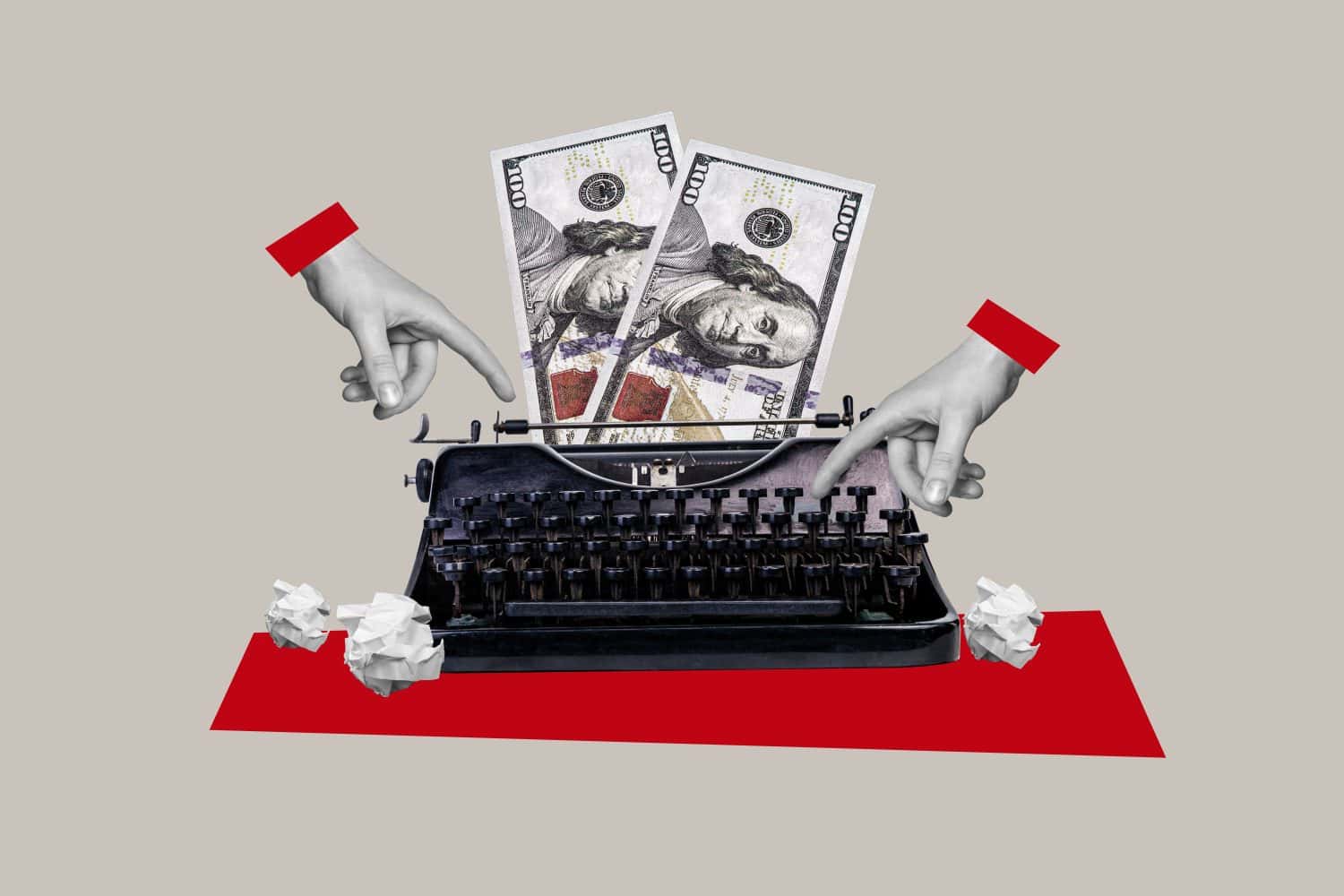

I retired today with $3 million invested and rental income – but why am I nervous about my financial future?

It takes many years to build up a sufficient nest egg that lets you retire, but even with a large portfolio, walking away can feel daunting. One Redditor finds himself in this position as he officially retired early as a 39-year-old. He is married to a 37-year-old wife who is mostly a stay-at-home mom for […] The post I retired today with $3 million invested and rental income – but why am I nervous about my financial future? appeared first on 24/7 Wall St..

It takes many years to build up a sufficient nest egg that lets you retire, but even with a large portfolio, walking away can feel daunting.

One Redditor finds himself in this position as he officially retired early as a 39-year-old. He is married to a 37-year-old wife who is mostly a stay-at-home mom for their child, who will be turning seven soon.

The husband admits to being normally anxious but feels like he made a good decision. He also acknowledged that his numbers are a bit tight for an expensive part of Canada. The couple has a $3 million portfolio and earns $40,000 each year from rental properties. Living expenses come to $130,000 per year before income taxes.

Redditors offered some encouraging advice to the recently retired husband.

Key Points

-

A 39-year-old husband retired with a $3 million portfolio and rental income.

-

He turned to Reddit for advice on making sure his money lasts and confirming if he made the right move.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

You Can Always Return To Work

One Redditor mentioned that the husband can always return to work in a consulting role or in some other capacity. Knowing that you have this option can help you enjoy retirement more since you know you have a way to replenish your money if necessary.

The husband is only 39 years old, so he still has time to rejoin the workforce if his needs change within the next decade. It’s harder for people in their 70s to rejoin the workforce after retiring, but it is possible for anyone who is physically able to work.

Retirement doesn’t always have to be final. The Redditor can always return to work if that means less stress with his finances. He also has rental income and dividends going into his bank account, so that may be enough to make his lifestyle more manageable.

Find Some Extra Income

One commenter suggested that the original poster still makes some income. While he no longer needs a corporate job that puts him through 80-hour workweeks, making extra money with a side hustle will make the retirement lifestyle easier.

Not only does a side hustle provide extra funds, but it will also keep the husband active. The husband agreed and thanked the commenter for the suggestion. He has a good record of working hard based on a white-collar career, freelance work, and having a second job teaching college part-time.

He may consider keeping the part-time job instead of retiring or doubling down on freelance work instead of working part-time.

Working For A Few More Years

One commenter suggested that the Redditor works for a few extra years to push their retirement age. For instance, retiring at 45 instead of 39 gives the Redditor six extra years to earn and invest his money. Then, he will have a bigger nest egg and fewer years where he has to stretch the money.

While this is an option for other people to consider in this scenario, the husband explained why this route wouldn’t have worked for him.

“My hand was forced. I could tell I was in the early phases of burnout — health suffering due to job stress, snapping at my family more often, more cavalier at work, etc.,” he explained.

If you don’t feel happy with your current work environment and have the nest egg, walking away early can be the right move. However, it’s not good to stop working completely, especially as a 39-year-old. The freelance work the husband does can serve as an additional opportunity to make money while giving him more control over his schedule.

The post I retired today with $3 million invested and rental income – but why am I nervous about my financial future? appeared first on 24/7 Wall St..