I just inherited a $700k IRA – How should I handle the mandatory RMDs over the next decade?

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. Once you reach the age of 73, you’re legally required to take your Required Minimum Distributions (RMDs). That way the government can collect taxes on your money. About This Article To calculate […] The post I just inherited a $700k IRA – How should I handle the mandatory RMDs over the next decade? appeared first on 24/7 Wall St..

Once you reach the age of 73, you’re legally required to take your Required Minimum Distributions (RMDs). That way the government can collect taxes on your money.

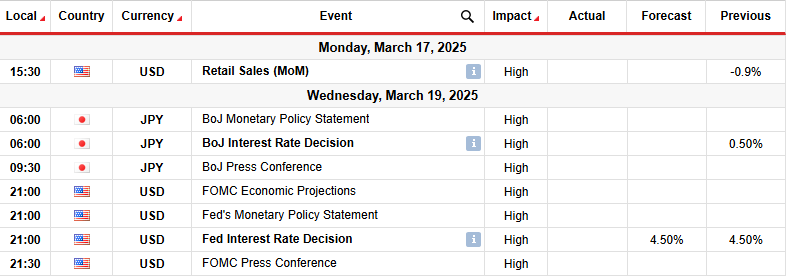

Key Points About This Article

- To calculate your RMD, the IRS will use a formula that includes your total account balances, your age, your life expectancy, and your beneficiary life expectancies.

- If you inherit an IRA for someone who passed in 2024, and you’re a non-spouse beneficiary, you must start taking RMDs by December 31, 2025.

- If you inherit it as a spousal beneficiary, you can treat the IRA as your own, delay RMDs until the age of 73, or take the RMDs based on your own life expectancy numbers.

- Also: Take this quiz to see if you’re on track to retire (Sponsored)

If you’re already above 73 or are nearing that age, it’s important to know how to calculate your required minimum distribution.

To calculate your RMD, the IRS will use a formula that includes your total account balances, your age, your life expectancy, and your beneficiary life expectancies. The IRS then divides the total balance by your life expectancy factor. That’s the age at which you’re expected to live.

But what if you inherit a $700,000 IRA, for example?

Let’s say you inherit an IRA for someone who passed in 2024, and you’re a non-spouse beneficiary. You must start taking RMDs by December 31, 2025. You then have 10 years to empty the IRA.

If you inherit it as a spousal beneficiary, you can treat the IRA as your own, delay RMDs until the age of 73, or take the RMDs based on your life expectancy numbers, starting at the end of the year after the person’s death.

There are exceptions to the 10-year rule.

According to the Internal Revenue Service includes a child who has not reached the age of majority, a disabled or chronically ill person, or a person not more than ten years younger than the employee or IRA account owner.

The IRS added that “Treasury and IRS reviewed comments suggesting that a beneficiary of an individual who has started required annual distributions should not be required to continue those annual distributions if the remaining account balance is fully distributed within 10 years of the individual’s death as required by the SECURE Act. However, Treasury and IRS determined that the final regulations should retain the provision in the proposed regulations requiring such a beneficiary to continue receiving annual payments.”

It’s also best to check in with your financial advisor to get all your ducks in a row.

With that advisor, you want to determine if the 10-year rule applies to the inherited money. You want to determine if the original owner of the IRA started to take RMDs. You need to calculate RMDs for each year, take the RMDs by required deadlines. And if necessary, empty the retirement account by the end of the tenth year.

Here’s How to Calculate Your RMD with Your Financial Advisor

To calculate your RMD, the IRS will use a formula that includes your total account balances, your age, your life expectancy, and your beneficiary life expectancies.

The IRS then divides the total balance by your life expectancy factor. That’s the age to which you’re expected to live until. For an example of how that works, here’s a link to the IRS Uniform Lifetime Table.

Let’s say you’re 73 years old. You would have a Life Expectancy Factor of 26.5.

If you have an account balance of $250,000 as of December 31 of last year, you would divide $250,000 by 26.5, which would give you an RMD distribution amount of $9,433.96.

We should also note that if you have a spouse who is 10 years younger than you and is listed as a 100% beneficiary of your RMD, you need to calculate your RMD using a Joint Life Expectancy Table. The calculation includes your age and your spouse’s age, which can result in longer life expectancy, which can also reduce your required RMD.

It’s another way for the IRS to make your life even more fun.

Be Sure to Avoid RMD Errors

Make sure you don’t get caught up in an RMD pitfall. For example, make sure you’re using the correct account balance. The wrong balance can lead to an RMD that’s too low. You also want to make sure you’re using the correct life expectancy factor, as we noted a moment ago. And you want to make sure that you’re accounting for all retirement accounts.

In addition, before you start with an RMD, visit with your financial advisor.

The last thing you want to do is calculate the RMD incorrectly. That can lead to unnecessary calls from the IRS.

The post I just inherited a $700k IRA – How should I handle the mandatory RMDs over the next decade? appeared first on 24/7 Wall St..