I have $300k in cash and want to turn it into $1 million – what are the most reliable ways to do it?

Comedian Steve Martin used to tell a joke about how to be a millionaire and not pay taxes. “First thing you do,” he said, “get a million dollars.” That’s the path many people want to take with their finances. They want to just jump to the end goal of being a millionaire without putting in […] The post I have $300k in cash and want to turn it into $1 million – what are the most reliable ways to do it? appeared first on 24/7 Wall St..

Comedian Steve Martin used to tell a joke about how to be a millionaire and not pay taxes. “First thing you do,” he said, “get a million dollars.”

That’s the path many people want to take with their finances. They want to just jump to the end goal of being a millionaire without putting in the work to get there. While it’s fun to think of what we can do with $1 million, it’s likely not going to happen overnight unless you hit the lottery.

This bit of levity came to mind after reading a Redditor’s post on the r/millionaire subreddit. He had $300,000 in cash that he wanted to turn into $1 million and wanted to know the best way to achieve it. Should he start a business or invest in the stock market?

24/7 Wall St. Insights:

-

There are many paths to millionaire status, each with its own potential pitfalls.

-

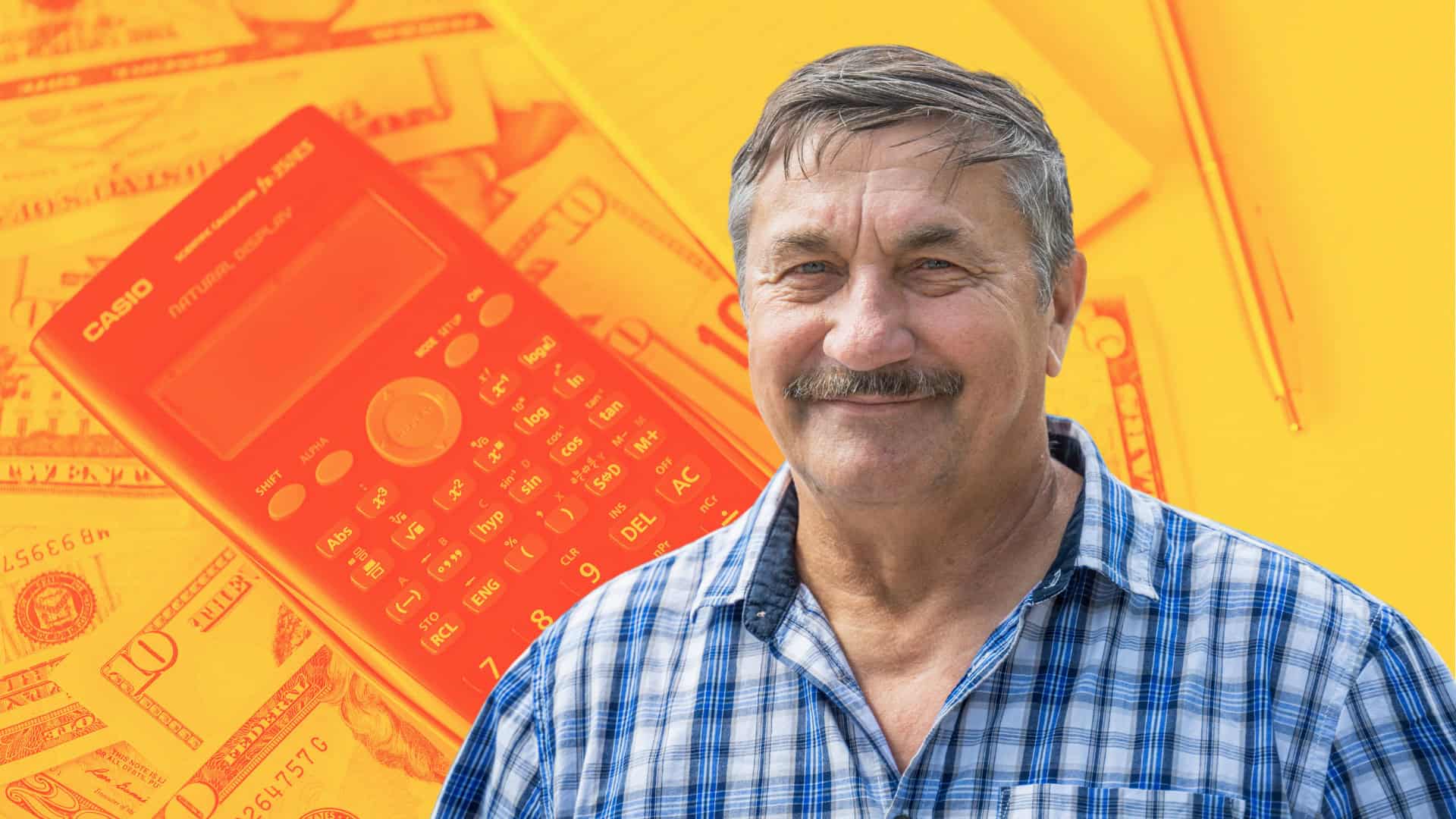

A lot depends upon the type of individual you are and whether you can stick to your guns through adversity or live under a mountain of debt. Speaking with a qualified fiancial professional is your best first step.

-

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

If becoming a millionaire was so easy, everyone would be one. And while it is achievable, it is not an overnight phenomenon.

While consulting with a qualified financial advisor is an essential step in your journey to becoming a millionaire, let’s look at a couple of scenarios that offer options for achieving that status.

The business of business

Obtaining $1 million is an ambitious but achievable goal, depending on your strategy, risk tolerance, and time horizon. Each path, however, has trade-offs in terms of effort, risk, and historical returns.

Starting a business offers the highest potential upside, but comes with significant risk and effort. According to the Small Business Administration, 20% of all new businesses fail in their first year. The Bureau of Labor Statistics says half of all new businesses survive five years before going under. Only a tiny fraction achieve massive returns.

If someone invests $300,000 into a business with a 20% annual profit margin and reinvests earnings, they could theoretically hit $1 million in less than a decade through compounding and revenue growth. For example, a $300,000 investment yielding $60,000 profit yearly (20%) could grow to $1 million in about 14 years with aggressive reinvestment and 10% annual revenue increases. It can occur faster if the business scales rapidly.

However, this assumes success in a competitive landscape, requiring entrepreneurial skill, market timing, and a good bit of luck. Failure, though, could wipe out the investment, making this the riskiest option..

The plain vanilla option

Investing in the stock market offers a more passive approach, but it has a solid historical track record. The S&P 500 index has delivered an average annual return of about 10% (or 7% after inflation) over the past century.

Starting with $300,000 and assuming a 7% compound annual growth rate (CAGR), it would take approximately 18 years to reach $1 million. This timeline shrinks to 11 years with a 12% return, plausible with growth stocks or ETFs like the Nasdaq 100, though volatility, such as the financial crisis crashing the market in 2008, could delay progress.

The advantage to investing, though, is liquidity and lower effort required compared to a business. But it requires discipline to weather downturns and avoid panic-selling. There could be fees, too, such as management fees for index or exchange-traded funds, and taxes that will slightly erode returns. Yett this remains a reliable, hands-off path for patient investors.

Diversification to reduce risk

A third avenue of obtaining $1 million is by diversifying across asset classes, such as stocks, bonds, real estate, and alternatives like gold, which balances risk and reward.

Historically, a 60/40 stock-bond portfolio averages 8% annually, according to Vanguard, while real estate offers 8% to 10% returns through appreciation and rental income. Allocating $150,000 to stocks (10% return), $100,000 to real estate (9% return, but also taking on debt), and $50,000 to bonds (4% return) might yield a blended 8.5% CAGR. At this rate, $300,000 grows to $1 million in about 15 years.

Real estate could accelerate this, using $100,000 as a 20% down payment on a $500,000 property could amplify returns if it appreciates 5% yearly while generating rent. However, diversification sacrifices some upside for stability, and managing multiple assets demands more oversight than pure stock investing.

Key takeaways

The best choice, of course, depends on the individual. Starting a business could work for risk-takers with expertise, but there is a high likelihood of failure. Stock market investing, particularly in low-cost index funds, is the simplest and most predictable, and is ideal for hands-off wealth-building. There is the middle ground of asset diversification, which balances safety and growth, but requires some knowledge of different asset types.

Historically, stocks edge out other options for consistency and the market’s reliability makes it the smartest play. Putting $300,000 into an S&P 500 fund today could turn into $1 million by 2038, assuming history holds true, but talking to a financial professional is the best first step you can take.

The post I have $300k in cash and want to turn it into $1 million – what are the most reliable ways to do it? appeared first on 24/7 Wall St..