How Likely Are Social Security Cuts? Here’s What We Know Now

Many current and future retirees have pretty serious concerns about the future of Social Security. Some studies suggest close to three-quarters of all Americans fear that the retirement benefits program is going to run out in their lifetime. Since Social Security is a lifeline for seniors, providing a critical source of retirement funds, that would […] The post How Likely Are Social Security Cuts? Here’s What We Know Now appeared first on 24/7 Wall St..

Key Points

-

The most recent Social Security Trustees’ report has bad news about benefit cuts.

-

The trust fund is expected to run out in 2034, a year earlier than anticipated last year.

-

An automatic benefit cut could happen in less than a decade if lawmakers don’t make some changes soon.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Many current and future retirees have pretty serious concerns about the future of Social Security. Some studies suggest close to three-quarters of all Americans fear that the retirement benefits program is going to run out in their lifetime. Since Social Security is a lifeline for seniors, providing a critical source of retirement funds, that would be a huge problem.

So, is that likely to happen, or is that fear unfounded?

The Social Security Trustee’s report, which is released each year, sheds light on what’s likely to happen with benefits. The 2025 report was just recently released, and, unfortunately, the news that it contains is not good. In fact, the chances of Social Security benefit cuts are now higher than ever because of it.

Social Security benefit cuts could happen sooner than planned

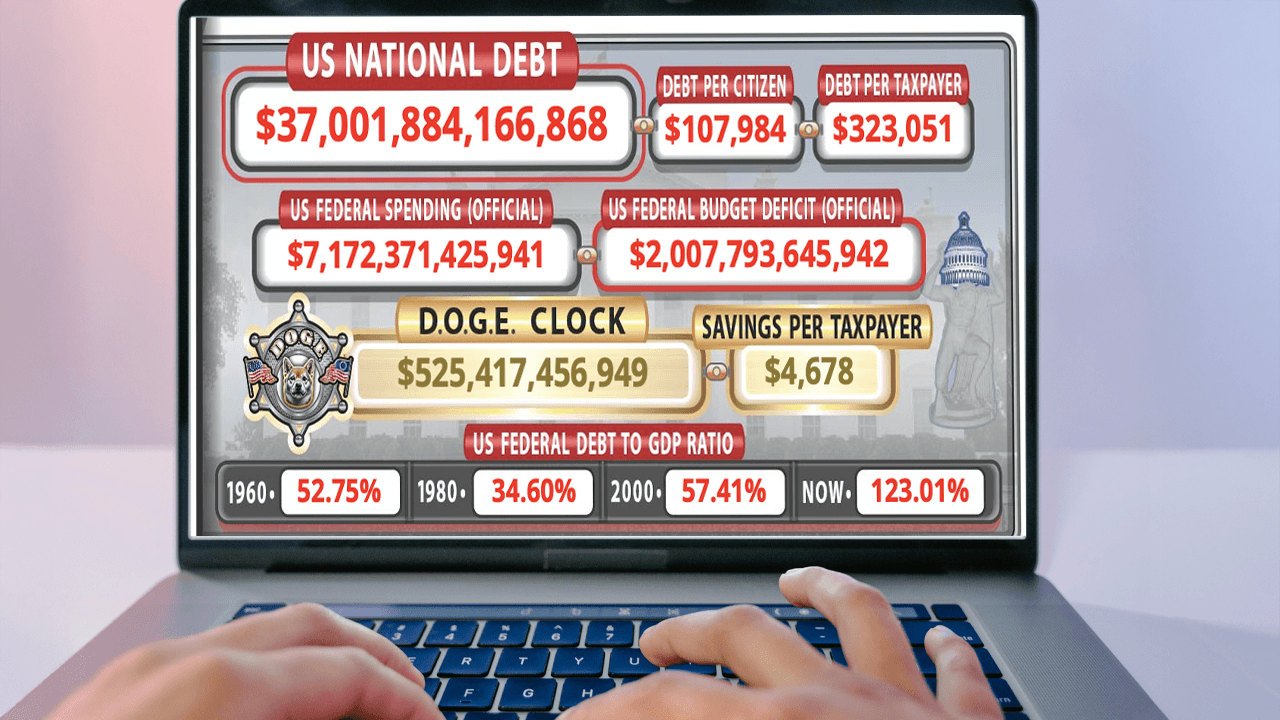

According to the 2025 trustee’s report, the Old-Age and Survivors Insurance (OASI) Trust Fund (the one that pays retirement benefits) will run out in 2033. At the time, Social Security will be able to pay only 77% of promised benefits. The Disability Insurance (DI) Trust Fund is expected to last through 2099, which is as far ahead as the report looks.

Those two trust funds are likely to be combined if the OASI fund runs out of money. If that happens, the combined OASDI fund would provide enough money to pay 100% of benefits only until 2034 before running out of money. The date the fund will run dry is one full year earlier than was predicted last year. If that happens, benefits could be paid only out of money currently coming in from workers paying Social Security tax. This would provide enough money to pay 81% of scheduled benefits.

Sadly, that means retirees are looking at around a 19% benefits cut in 2034 if something does not change. This cut is less than a decade out, and it would happen automatically because there simply would not be enough money to avoid it and Social Security isn’t authorized to take money from the general fund or anywhere else in the government.

Is a 19% benefit cut going to happen?

While the Trustee’s report makes clear that a huge cut to benefits is inevitable without action, it is equally inevitable that lawmakers will act. There is virtually no way that any politician is going to allow seniors to see such a huge cut on their watch, as it would be political suicide.

Rather than allowing a huge automatic benefits cut to happen, the most likely outcome is that Congress does something to fix the issue. The question, though, is what that something will be.

President Trump has promised no cuts to benefits, and lawmakers on the left have also said they don’t want to cut benefits, but something has to give, and some change does have to be made.

There have been proposals on the table to increase Social Security taxes only on high earners, as currently, people who make above $176,100 are not taxed on all their income in 2025. That’s because each year, there is a wage base limit. No worker who makes above that limit pays taxes on the rest of their income, and they also don’t get credit for excess income when benefits are calculated. This limit is put in place because benefits equal a percentage of taxable wages, and the government doesn’t want very high earners getting checks worth 10s of thousands.

Some lawmakers have suggested taxing income above this limit, but not providing a corresponding increase in benefits. In other words, top earners would pay more in taxes without taking more out in benefits. This idea isn’t likely to be popular with Republicans who are currently in office, though, and it would change the nature of Social Security, which has always been an earned benefit program where the amount you take out is based on what you pay in.

Other proposals to shore up Social Security, such as a change to full retirement age, are also possible, but would be a de facto benefits cut because if you have to wait longer to get your full benefit, you either collect fewer checks or accept early filing penalties and collect smaller checks. Both options ultimately mean you get less money.

Still, while these proposals have issues, lawmakers are going to have to come up with some kind of compromise — and since there simply isn’t enough money, that compromise will mean at least someone sees some kind of cut. It just remains to be seen if it is only top earners who lose out, or if Americans are asked to accept less across the board to preserve Social Security for the future.

The post How Likely Are Social Security Cuts? Here’s What We Know Now appeared first on 24/7 Wall St..