How Apple may solve its Google Search problem

The company is reportedly working on a deal that might kill two birds with one stone.

I hate my Dell laptop.

If I close the lid, the laptop will "suspend," but not really. Putting it in a bag in that state will make it hot, and the fans will choke. I have to watch out for this because if I don't, it will get damaged over time and die.

This should be enough for the product to be recalled. There are more issues with it, but that is a topic for another day. I know that other manufacturers have the same problem. This is what you get from a modern-ish PC.

Related: Analysts reset Qualcomm stock price target, send warning

Anyone with an Apple MacBook would be puzzled to hear this. They don't have this problem, and how the heck do PC users tolerate it? It seems that PC manufacturers can get away with anything today, and Apple can't; it is held to a higher standard.

With the release of the M1 chip in 2020, Apple left the PC competitors in the dust. It took them years to catch up. Even though I still wouldn't buy an Apple laptop for myself, this chip made me comfortable recommending them.

But I digress. The reality is that innovation takes time. After all, Apple needed thirteen years to make something really "life-changing" following the launch of the iPhone.

In fact, Apple generally takes its time, opting for others' so-called best-in-breed until it creates something better.

Perhaps that's why it relies so much on Google for search, rather than a homegrown solution. Apple's deal with Google has worked out well for it (and is profitable), but, unfortunately, that relationship may end soon. Shutterstock

Apple's Google search and AI problems

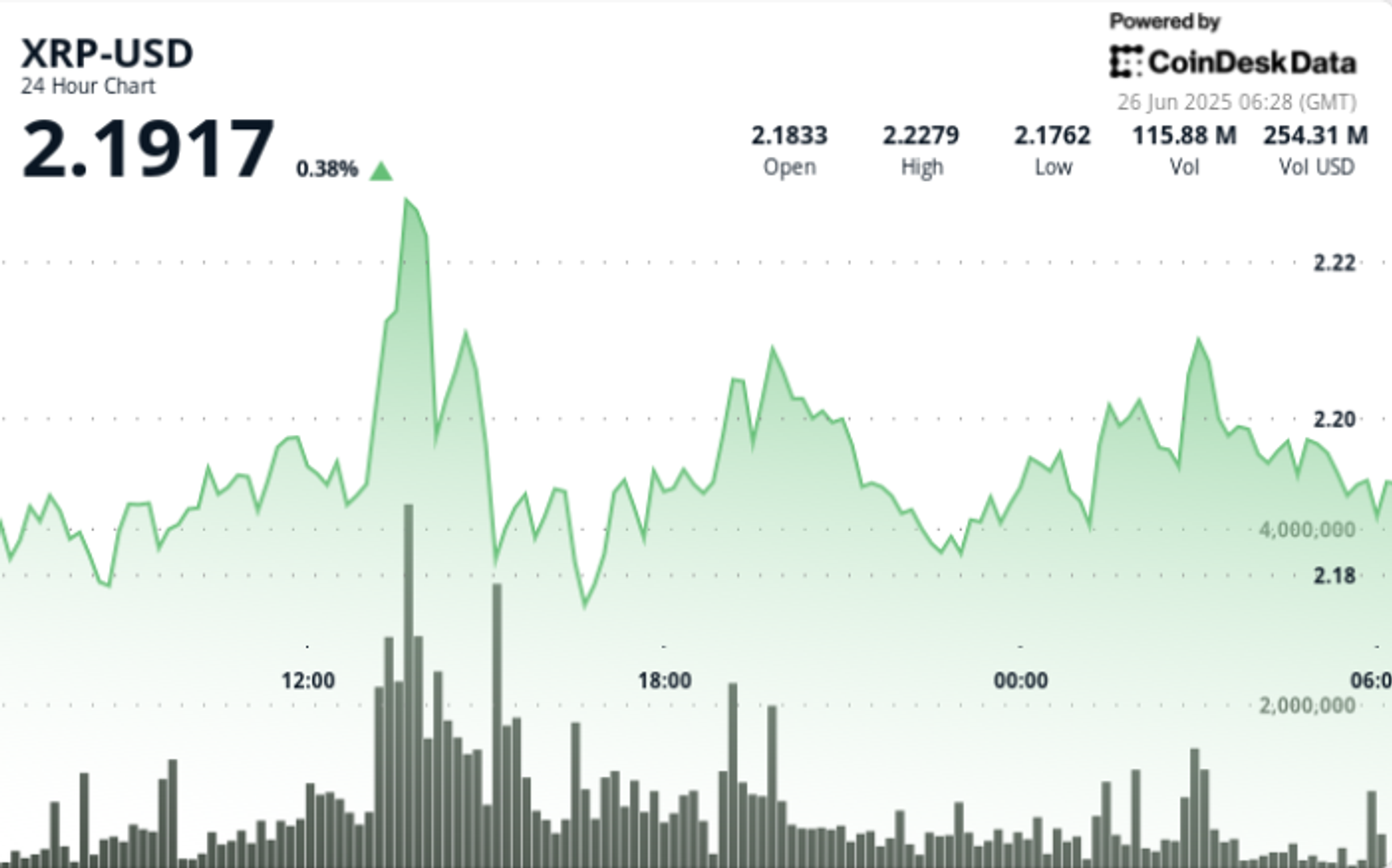

The Justice Department’s antitrust lawsuit against Google revealed that Apple (AAPL) was paid $20 billion by Google in 2022 to keep it the default search engine in the Safari browser, reported Bloomberg.

Google lost the lawsuit, and the DOJ wants the company to cease multibillion-dollar payments to Apple, among other things. Reuters reported that Google plans to appeal the decision.

Apple does not reveal revenue from this deal with Google in its earnings reports; however, it is part of its services revenue.

Related: Analysts revamp forecast for Nvidia-backed AI stock

In fiscal 2022, Apple's services revenue was about $78 billion. The calendar and fiscal year don't align, but making an estimate would mean Google's payment was about 25% of services revenue. Total revenue was $394 billion, so about 5% came from Google.

More Tech Stocks:

- Amazon tries to make AI great again (or maybe for the first time)

- Veteran portfolio manager raises eyebrows with latest Meta Platforms move

- Google plans major AI shift after Meta’s surprising $14 billion move

When you need to keep your revenue growing constantly, having 5% of it at risk is something you can't afford.

This is especially true given that Apple has been under fire lately for its apparent failure to launch some amazing artificial intelligence products.

I've already written about why the company is struggling on that front.

Apple might acquire or partner with Perplexity AI

Unconfirmed media reports suggest Apple wants to buy or partner with Perplexity AI to get its hands on its AI-powered search, which provides cited responses to search queries using third-party LLMs.

According to Bank of America analyst Wamsi Mohan, if this deal happens, it will quickly give Apple AI abilities that can be integrated into Siri. It will also provide access to the search advertising market and a high-quality team of AI workers.

Related: OpenAI makes shocking move amid fierce competition, Microsoft problems

It's not all roses, though. He pointed out four drawbacks:

- Technology integration might prove to be difficult.

- The company might face legal and regulatory risks.

- The deal would have an impact on existing Google relations.

- Some of Perplexity's offerings are dependent on rival LLMs.

Mohan has an Apple stock price target of $235 and rates the stock a buy, based on a favorable price-to-earnings ratio. He says Apple is trading at approximately 29 times his estimate for calendar year 2026 earnings per share of $8.07. The 5-year historical P/E range is 16 to 34.

"We believe a multiple at the higher end of the historical range is justified given a multi-year upgrade cycle, large cash balance and opportunity to diversify into new end markets, increasing mix and diversity of services," said Mohan.

Getting into the search advertising market and fixing Siri, with one acquisition, sounds like killing two birds with one stone, but I have my doubts.

Knowing that Meta tried to buy Perplexity AI and instead bought Scale AI, I hope that Apple is playing 4D chess. I think Apple would be better off buying a real search engine instead, because Google is getting worse and worse every day.