Here's Why Nike's Unexpected Ace in the Hole Makes the Dividend Stock a Buy Now

After surging to an all-time high of over $170 per share in 2021, Nike (NYSE: NKE) stock has given up all of its post-pandemic gains and is hovering around multiyear lows.Leadership changes and a new corporate strategy centered around product innovation and key markets in China and North America could help the business turn around. But trade tensions, weak consumer spending, and high interest rates are throwing a wrench into Nike's recovery and testing investor patience. Younger brands like Hoka -- owned by Deckers Outdoor -- and On from On Holding have eroded Nike's pricing power and some of its competitive advantages.There are a few reasons to be optimistic about Nike in the near term. But Nike does have an ace in the hole that could make the dividend stock worth buying now.Continue reading

After surging to an all-time high of over $170 per share in 2021, Nike (NYSE: NKE) stock has given up all of its post-pandemic gains and is hovering around multiyear lows.

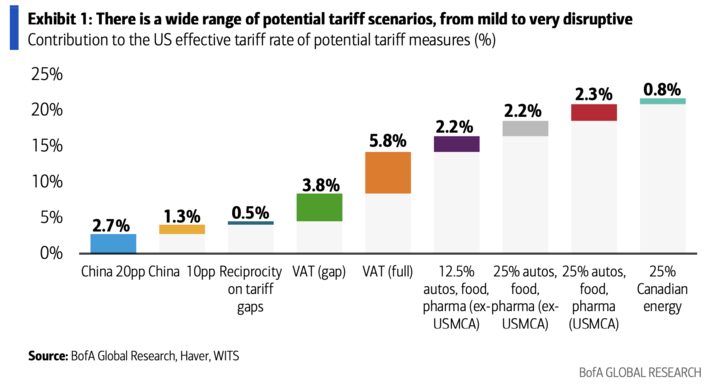

Leadership changes and a new corporate strategy centered around product innovation and key markets in China and North America could help the business turn around. But trade tensions, weak consumer spending, and high interest rates are throwing a wrench into Nike's recovery and testing investor patience. Younger brands like Hoka -- owned by Deckers Outdoor -- and On from On Holding have eroded Nike's pricing power and some of its competitive advantages.

There are a few reasons to be optimistic about Nike in the near term. But Nike does have an ace in the hole that could make the dividend stock worth buying now.