Goldman Sachs analyst revisits Rivian stock price target after Q4 earnings

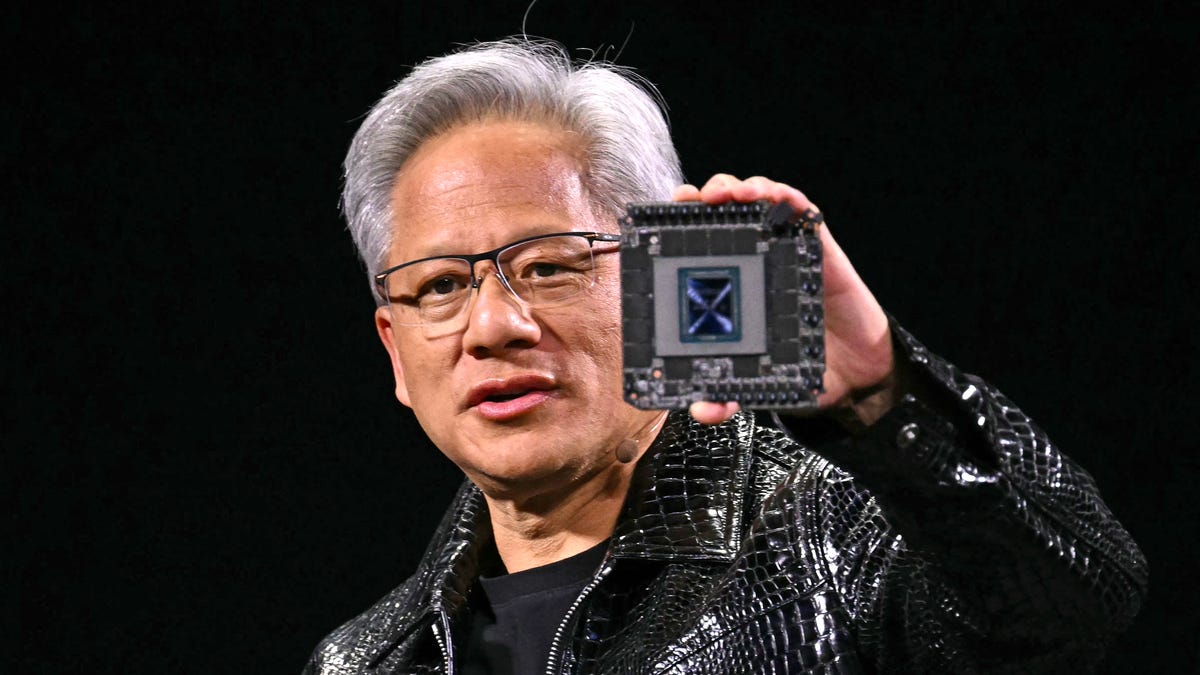

Rivian's R2 SUV, which is expected to challenge Tesla's Model Y, will launch early next year.

Rivian Automotive shares moved lower in early Friday trading following a disappointing sales outlook but a top Wall Street analyst remains bullish on the longer-term potential for the EV group and potential Tesla rival.

Rivian (RIVN) , which is backed by an early investment from Amazon AMZN and a recent $5.8 billion investment from Germany's Volkswagen Group, is looking to challenge Tesla's (TSLA) Model Y dominance in the SUV market with the launch of its R2 offering later next year.

It's also, like Tesla, aggressively cutting costs and streamlining its operations and supply chains as it grapples with fading EV demand, sticky inflation, the potential loss of U.S. tax credits and looming tariffs on parts from Canada and Mexico.

Against that backdrop, investors were disappointed by Rivian's early 2025 sales forecast, which predicts full-year deliveries of between 46,000 and 51,000 units, a likely decline from last year's 51,600 tally that also missed analysts' estimates of around 55,250 units. Rivian

"Our guidance represents management's current view on potential adjustments to incentives, regulations, and tariff structures," CEO Claire McDonough told investors on a conference call late Thursday.

Rivian cost-cutting focus

"Importantly, it's early in the year, and some of these factors could change," she added. "We expect to shut down both the consumer and commercial manufacturing lines in our Normal plant for approximately one month in the second half of 2025 to prepare for the launch of R2 in Normal in the first half of 2026."

For the three months ending in December, Rivian saw revenues rise nearly 32% from the prior-year period to $1.73 billion, while delivering 14,183 vehicles and posting its first-ever quarterly gross profit of $170 million.

Rivian still sees an adjusted loss of around $1.8 billion this year, but its cost-cutting and efficiency drives, which took around $31,000 out of its unit cost base, is setting it up for longer-term profitability once macro conditions improve, according to Goldman Sachs analyst Mark Delaney.

Related: Rivian's $80K electric van is up against intense competiton

Delaney, who reiterated his 'neutral' rating and $14 price target following last night's earnings, said the cost-cutting trend should lead to a 50% reduction in the bill of materials, the comprehensive list of car components, for next year's R2 launch.

"We believe there were positive signs with respect to the company’s underlying long-term profit potential," Delaney said.

Difficult macro backdrop for EV makers

While we see positive signs for the long-term, Rivian is operating in a difficult industry backdrop for EVs (including potential headwinds from a policy perspective for EV demand and credits) and guided for lower vehicle shipments in 2025," he added.

Delaney also noted Rivian's potential to grow its software and services business, which saw overall revenues more than double from a year ago to $214 million, thanks to its nascent partnership with Volkswagen.

Related: Rivian R1S showcases the best, and worst, of EVs

Rivian is "positioned to grow its software & services business, in part driven by its underlying electrical and electronic platform and the ability for the included vehicle hardware (e.g. sensors and compute) to scale to higher levels of (Advanced Driver Assistance System) over time," Delaney said.

"Rivian plans to support hands free driving soon, and situationally eyes off driving on highways in 2026 (with the scenarios it can operate under growing over time)," added.

EV credits risk

In terms of near-term challenges, Delaney noted the risk of losing support from government tax credits that provide buyers with up to $7,500 in purchasing power, which President Donald Trump has vowed to eliminate.

Rivian generated $299 million in fourth quarter tax credit revenue, a tally that helped it record a gross margin of 9.8% that topped Street forecasts.

More Automotive:

- General Motors silently distances itself from controversial policy

- Nissan can revive Honda merger talks on one condition

- Hertz absorbed a massive loss after electric vehicle fire sale

"We believe it will be important to monitor if there is a change in Rivian’s ability to capture regulatory credit revenue longer-term, which the company expects to be about flat (year-on-year) in 2025," Delaney said.

Rivian shares were last marked 3.6% lower in premarket trading to indicate an opening bell price of $13.12 each, a move that would still tip the stock into negative territory for the past six months.

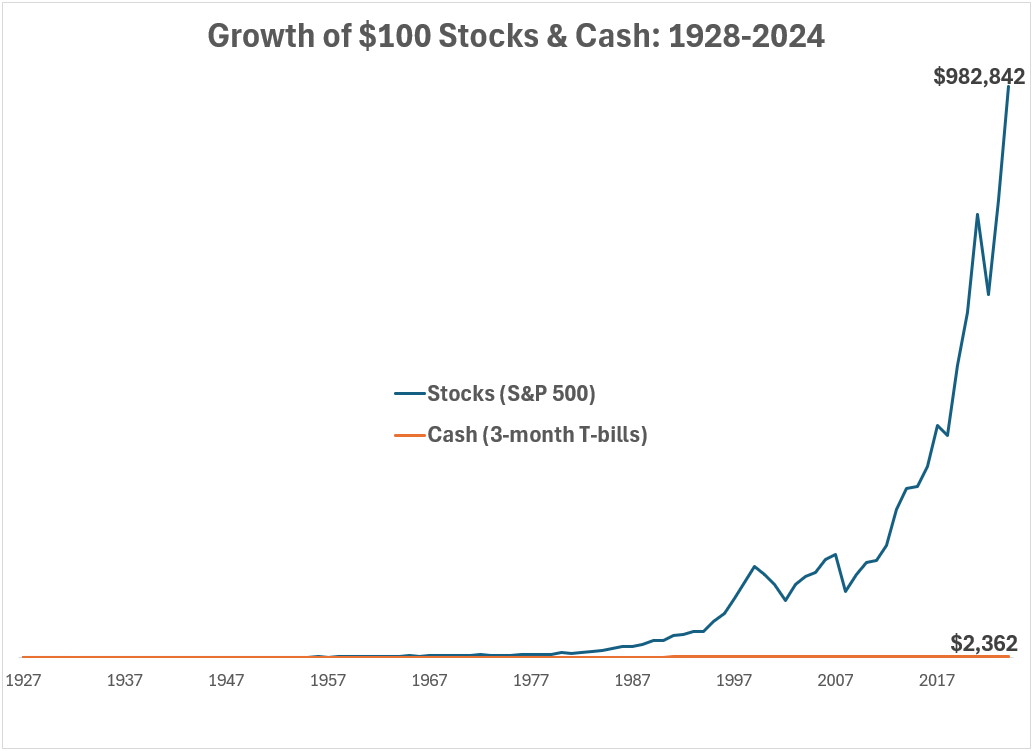

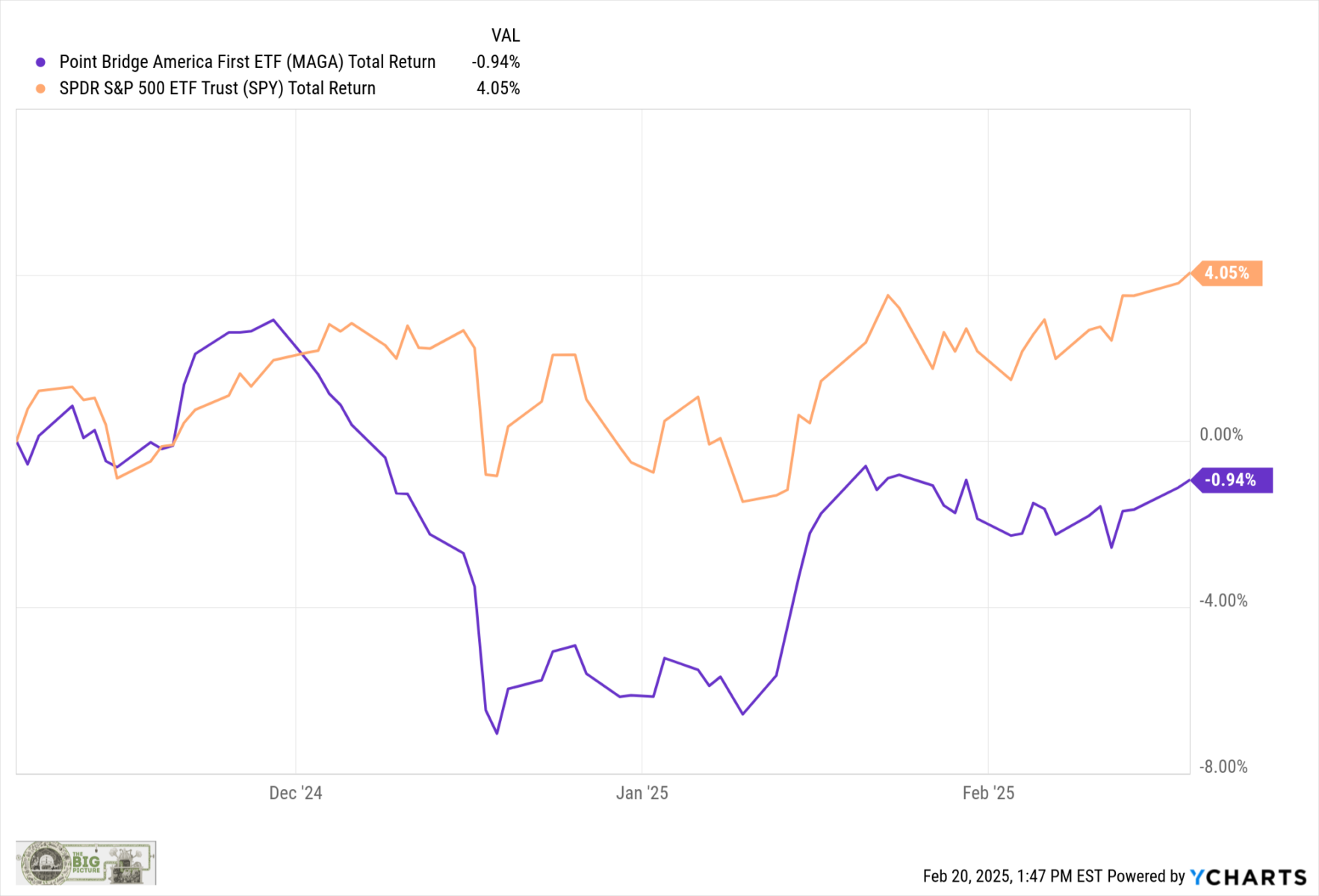

Related: Veteran fund manager issues dire S&P 500 warning for 2025