Ethereum critics say it has failed—but boosters say cryptocurrency has become ‘digital oil’

The second largest cryptocurrency has lagged behind Bitcoin in price and is still about 50% below all-time highs in 2021.

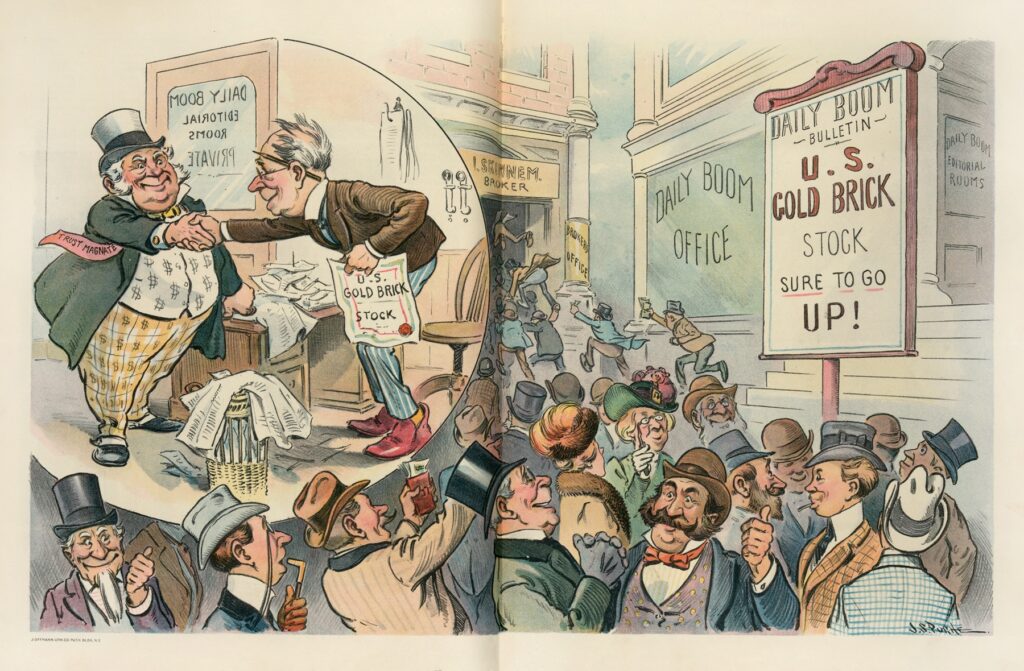

Ethereum is dead. Ethereum will be fine. The social media takes are flying on the state of the world’s second most valuable blockchain. Conceived in 2013, Ethereum has experienced a series of dramatic ups and downs, including an existential hack in 2016 and a remarkable technological upgrade in 2022. But this year has brought unprecedented scrutiny of the current and future direction of the project.

A big part of this is due to the price of Ethereum, which is badly lagging Bitcoin. The world’s most valuable cryptocurrency has notched a series of all-time highs and a flurry of interest from Wall Street investors. Meanwhile, as of Tuesday, Ethereum was trading around $2,500, about 50% lower than its all-time high, according to data from crypto exchange Binance.

Ether’s lackluster price movement has prompted some to proclaim Ethereum’s end. “Ethereum died,” wrote Max Keiser, a prominent Bitcoin booster, on X. “It just hasn’t been buried yet.”

This is an overstatement. But questions remain on whether Ethereum’s price slump reflects a temporary stumble, or whether the blockchain—long hailed by boosters as the computer of the future—will never grow into its promise.

Congestion fees and scaling

“Bitcoin has died many times… Ethereum has died several times,” Joseph Lubin, CEO of the blockchain technology firm Consensys and cofounder of Ethereum told Fortune. “When there are challenges, we learn from them.”

Those challenges have been present since 2013, when a wiry 19-year-old from Canada named Vitalik Buterin had an idea for a new type of computer. Fearing that Big Tech firms have an unhealthy monopoly over cloud computing that could stifle developers, Buterin looked to blockchains instead. He and others came up with Ethereum—a decentralized blockchain-based computing platform where programmers’ code was immune to the whims of corporate behemoths.

Developers soon flocked to Ethereum, but the increase in activity brought a rise in “gas fees.” Every time users send each other assets on Ethereum, they need to pay with cryptocurrency—in the same way Amazon requires users to pay dollars to use its cloud computing network. The only difference is that Ethereum’s gas fees are distributed to the decentralized cohort of computers supporting the blockchain, instead of one corporate entity. In 2021, sending a few dollars of cryptocurrency to other users on Ethereum resulted in charges of sometimes hundreds of dollars, and developers looked for a solution.

That solution is what Ethereum’s critics say has sapped the network of some of its financial value. Instead of immediately working to speed up Ethereum’s core network, developers fostered a system of layer-2 blockchains, or L2s, built on top of Ethereum. These L2s—including Arbitrum, Optmism and Polygon— package user data into one bundle and post that onto Ethereum, rather than ask the blockchain to process each transaction individually.

If gas fees are any indication, that strategy has worked. Since a peak in mid-2020, transaction costs have plummeted more than 99% on Ethereum, according to data from Glassnode.

But Kyle Samani, managing partner at crypto investment firm Multicoin Capital, believes this approach has made the core network of Ethereum less valuable. “It’s my fundamental view that a network is not sustainable or valuable without direct user activity,” he told Fortune.

Users have moved to L2s and drained Ethereum of some of the activity that propped up its cryptocurrency’s price, Samani, a noted supporter of the competing Solana blockchain, argued.

However, Paul Brody, chairman of the Enterprise Ethereum Alliance, an advocacy group for the blockchain, said fixation on the price of Ether in the short term is missing the point. “Ethereum is the amazing world computer,” he told Fortune. “I don’t think it can or should try to be all things, all people, and, especially, I don’t think Ethereum should also try to be the best, most deflationary cryptocurrency.”

Back to layer one

Ethereum’s upgrades, not any explicit work to buoy Ether’s price, should prompt a rise in demand for the cryptocurrency, said Brody. And that’s what developers are working on, said Danny Ryan and Vivek Raman, cofounders of the Ethereum advocacy group Ethrealize—one of many wings of a robust technical and cultural community based around the blockchain that convenes at large annual get-togethers like ETHDenver in Colorado.

Programmers are now optimizing the speed of the layer-1 network, not just its ecosystem of layer-2 chains, say Ryan and Raman. Plus, the duo believe that the flood of Wall Street and Big Tech firms exploring blockchain technology will spur a rush to buy the cryptocurrency. “I don’t think that we should pretend like the asset doesn’t need to be valuable,” added Danny Ryan. His cofounder Raman even equated Ethereum to “digital oil.”

“When you ask institutions, when we go have our meetings and say, ‘Which is a civilizational infrastructure, which is the global, neutral infrastructure that you can actually deploy real assets with real trust?’” Raman added. “Ethereum is the obvious choice.”

But whether Wall Street titans decide to go with Ethereum, rather than competitors like Solana, remains to be seen. Still, proponents are hopeful. “If we do our job, and we become the first place for everybody to do business,” said Brody, “then the asset price is just something that takes care of itself.”

This story was originally featured on Fortune.com