Earnings Live: Can C3.ai Shares Get Back on Track

C3.ai (NYSE: AI) enters fiscal Q4 2025 earnings with high short interest (~16% of float) and high expectations for a growth inflection. Shares trade at $23.25, down 32.5% year-to-date, as bulls and bears continue to debate whether contract wins and federal AI momentum can convert into sustainable revenue. Consensus calls for $107.8 million in revenue […] The post Earnings Live: Can C3.ai Shares Get Back on Track appeared first on 24/7 Wall St..

C3.ai (NYSE: AI) enters fiscal Q4 2025 earnings with high short interest (~16% of float) and high expectations for a growth inflection. Shares trade at $23.25, down 32.5% year-to-date, as bulls and bears continue to debate whether contract wins and federal AI momentum can convert into sustainable revenue.

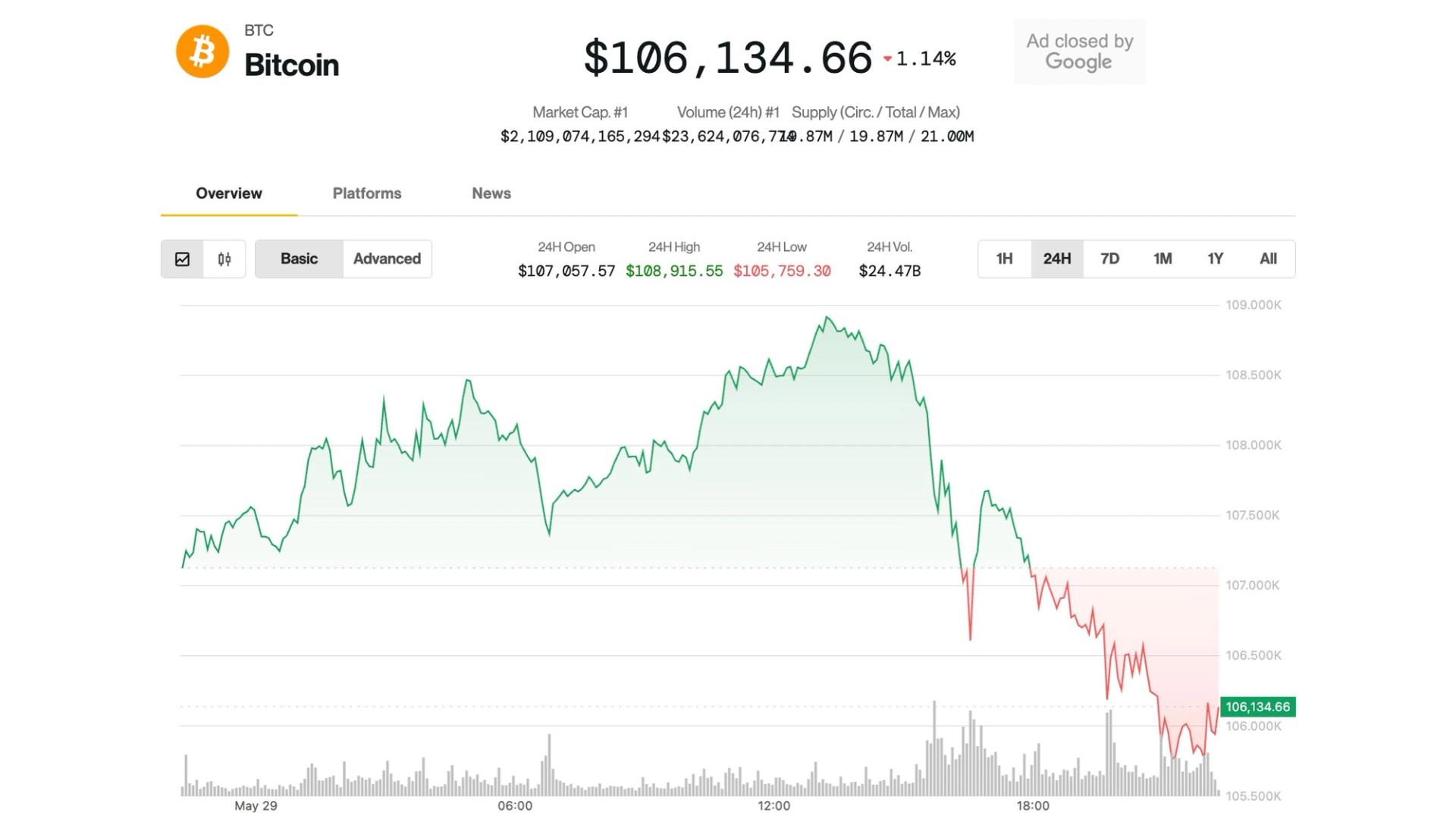

Consensus calls for $107.8 million in revenue (+24% YoY) and an adjusted EPS loss of –$0.20. Management previously guided to a range of $103.6M–$113.6M, but the company has historically posted wide gaps between bookings and GAAP revenue. The key question is whether its pivot to usage-based pricing and AI partnerships (notably with Microsoft and AWS) are beginning to drive real ARR growth.

While the stock remains a retail favorite, recent quarters have seen tempered enthusiasm. Investors are watching closely for signs that product-market fit is improving, especially in the government and energy verticals. Without concrete evidence of improving unit economics, skepticism is likely to remain elevated.

The post Earnings Live: Can C3.ai Shares Get Back on Track appeared first on 24/7 Wall St..