Dave Ramsey sounds the alarm on major mortgage risks for homeowners

Taking this approach can help buyers tap into their equity, but it will cost more in the long run.

With inflation driving up the cost of living, Americans feel stretched to cover competing financial obligations, such as student loan debt, credit card debt, and housing payments.

Consumers are increasingly looking for other options to help bridge the gap and help make ends meet, fueling higher levels of U.S. household debt and credit card debt.

Homeowners have the benefit of accessing home equity, which renters don't have. However, borrowing against your home's value has significant pros and cons.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

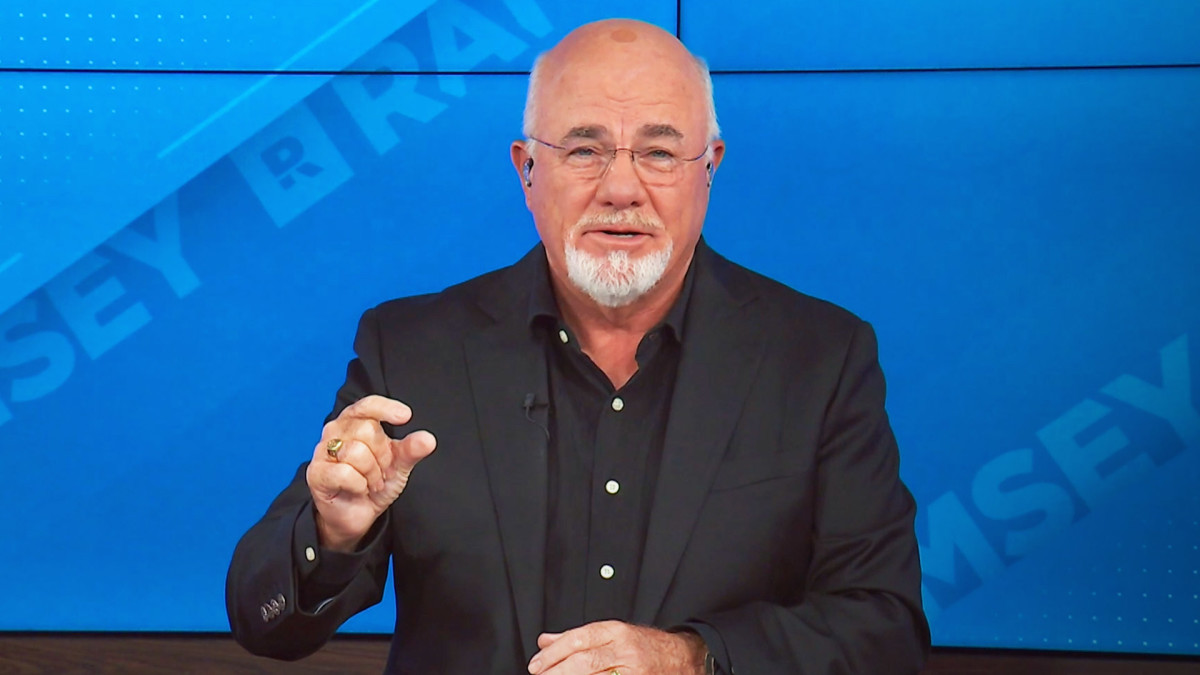

Personal finance expert Dave Ramsey explains how HELOCs work and whether the benefits outweigh the potential risks.

While it may be tempting to take out a home equity line or home equity line of credit (HELOC), homeowners may be committing to long-term loan payments in addition to their monthly mortgage. Shutterstock

Dave Ramsey explains how HELOCs work for homeowners

Rising housing costs and surging consumer prices have made it difficult for households to cover expenses on the same salary, driving many to take on debt to get by in the moment.

The New York Fed found that elevated mortgage rates have increased demand for HELOCs over the past few years. After thirteen years of consistent declines, HELOC balances have grown 20% since 2021.

HELOCs are home equity loans that homeowners can use for any purchase, not just housing costs. It operates similarly to a credit card: there's a revolving door of credit, so once borrowers make a payment, they can borrow the amount that has been repaid again.

The principal that homeowners can borrow is dependent on their home equity level, meaning the value of their home minus the amount that they owe. But unlike home equity loans, HELOCs carry a variable interest rate, meaning that monthly payments will vary based on interest rates and market movements.

Ramsey explains why a HELOC can be a slippery slope for borrowers struggling to make ends meet or living paycheck to paycheck.

More on homebuying:

- Dave Ramsey warns Americans on a homebuying mistake to avoid

- Housing expert reveals surprising ways to reduce your mortgage rate

- Americans buying homes may see major housing cost changes in 2025

- Finance veteran has a warning for Americans purchasing a home now

"A HELOC may sound like a good idea, but it’s actually one of the biggest financial traps you can fall into," Ramsey wrote, "It uses the part of your home that you own as collateral. That means if you can’t pay back the HELOC, the lender can foreclose on your house. Yikes!"

Since borrowers must tie their home to the loan, they risk losing their biggest asset if they have a financial emergency and cannot make payments for an extended period.

"Now you can see why we don’t recommend HELOCs—because if you get one of these monsters, you’re risking the roof over your head!"

Dave Ramsey highlights the downsides of tapping into your home equity

The good news is that HELOCs have the lowest delinquency growth rates out of all major loans, but unfortunately, some homeowners get caught in the repayment trap, which can end in foreclosure.

Ramsey explains that HELOC repayment can be tricky, and most offer a 30-year term, similar to a mortgage. However, once your credit term expires or you sell your home, you must repay the balance in full.

Related: Dave Ramsey warns retired Americans to avoid one mortgage mistake

"Lenders set up HELOC repayment plans so they can make money, not make it easy for you," Ramsey continued.

While it may be suitable for some homeowners, HELOCs can quickly become another monthly payment that is difficult and costly in the long run.

"Trying to pay back your HELOC in minimum monthly payments—like most people who use credit cards or credit lines—will not fill your account back up very quickly, and you’ll end up paying even more ridiculous interest charges!"

Related: Veteran fund manager unveils eye-popping S&P 500 forecast