Costco destroys Walmart in a surprising way

Costco has an edge over its larger rival.

Struggling cash-strapped consumers have become increasingly cost-conscious, and as a result, they've shifted more of their weekly spending toward large retailers with the buying power necessary to keep prices low.

The shift in consumer behavior has been a boon to the largest big-box retail chains and wholesale clubs.

Related: Best Buy CEO has stern warning for customers

Unsurprisingly, that means good times for Walmart, the largest retailer in America, and Costco (COST) , the biggest warehouse chain.

The two rivals are battling for market share, but Costco's latest earnings results show that it outperforms its larger peer in one crucial area.

A struggling economy drives shoppers toward bargains

Inflation isn't as high as in 2022, when it topped 8%, but it's still pinching wallets. In January, the Consumer Price Index showed prices increased by 3% nationwide, up from 2.4% in September.

Related: Target sounds alarm on unexpected customer behavior

We're also seeing signs of a struggling jobs market. Unemployment remains low at 4%, but that's up from 3.5% in 2023. Recently, there's been a steady cadence of high-profile layoffs, particularly in the high-paying technology sector.

Over 407,000 technology workers have lost jobs since 2022, according to Challenger, Gray, & Christmas. Across all industries, 172,000 Americans were laid off in February, the most let go in the month since 2009.

The U.S. economy is also creating fewer new jobs. Payroll processor ADP reported just 77,000 new jobs in February, the worst showing since July and down from 186,000 in January.

Given that backdrop, it's little wonder shoppers are turning to retailers like Walmart (WMT) and Costco for bargains.

Costco outperforms Walmart in a crucial way

The two companies are retail giants, but they operate somewhat differently.

Walmart boasts over 4,600 stores in the U.S. and operates another 600 Sam's Club warehouse stores. You'll need a Sam's Club membership to access those stores, but anyone can shop at the local Walmart.

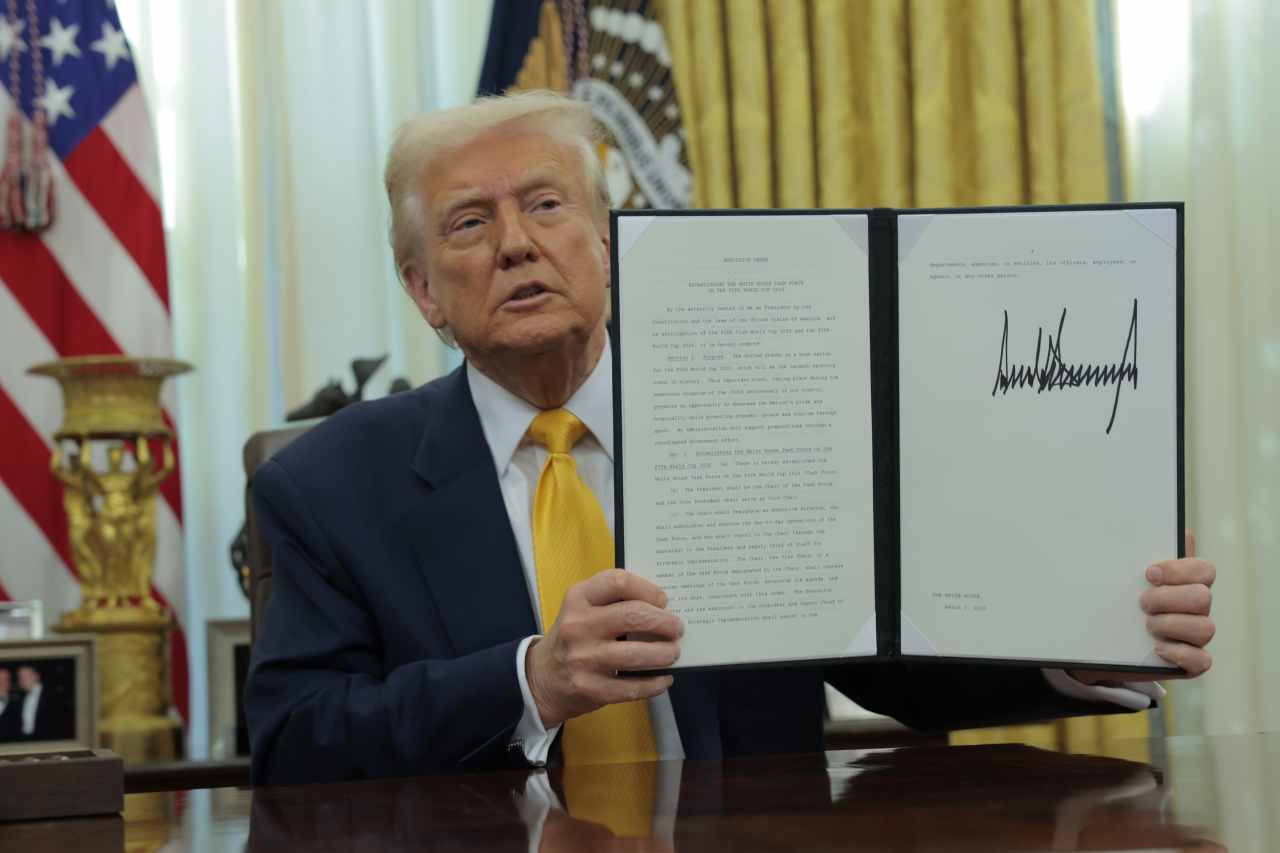

Related: Popular retailers may get smacked hard by tariffs

On the other hand, Costco is a warehouse club that charges a membership fee to access its 897 U.S. locations. No membership? No joy unless a friend takes you, you have a gift card, shop online, or you pick up a prescription.

Costco's membership fee increased last year, so it will charge new members more in 2025. Its Gold Star membership currently costs $65 a year. For comparison, Sam's Club charges $50 a year for its Club membership.

The membership fee requirement at Costco may make you think that Walmart is growing faster, but Costco's latest sales results show the opposite.

On March 6, management reported that total revenue rose 9% year over year last quarter to $63.7 billion.

Importantly, comparable store sales at locations open at least one year increased by 6.8% worldwide and 8.3% in the United States.

More Retail Stocks:

- Discount retailer closing more stores after Chapter 11 bankruptcy

- Popular discount grocery chain dumps store leases, fires workers

- Retail chain has retail theft answer Walmart, Target could copy

If you remove the impact of gasoline sales and the ups and downs of global currencies, U.S. comparable sales were up 8.6% in the quarter. That was the fastest growth since late 2022. It was $640 million above Wall Street analyst's projections and much higher than Walmart's growth.

In its most recent quarter, Walmart's revenue rose about 5%, and comparable sales only increased by 4.6%.

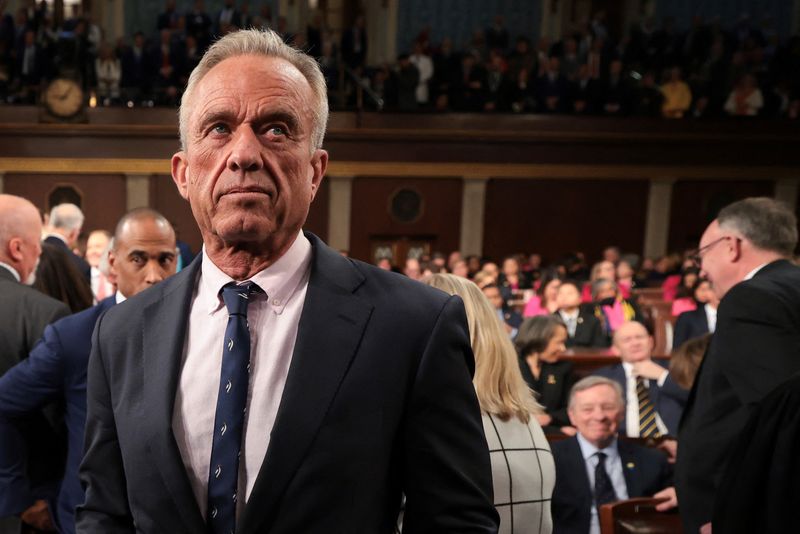

Foot traffic at both retail store chains could increase if inflation continues to climb and the jobs market weakens, particularly if tariffs on imports from Canada, Mexico, and China raise retail prices.

While that should be good news for both companies, Costco's performance suggests it may be the bigger beneficiary.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast