CoreWeave CEO Michael Intrator on capital markets vs the media

Also: Markets tumble as tariff “Liberation Day” approaches, China’s AI edge.

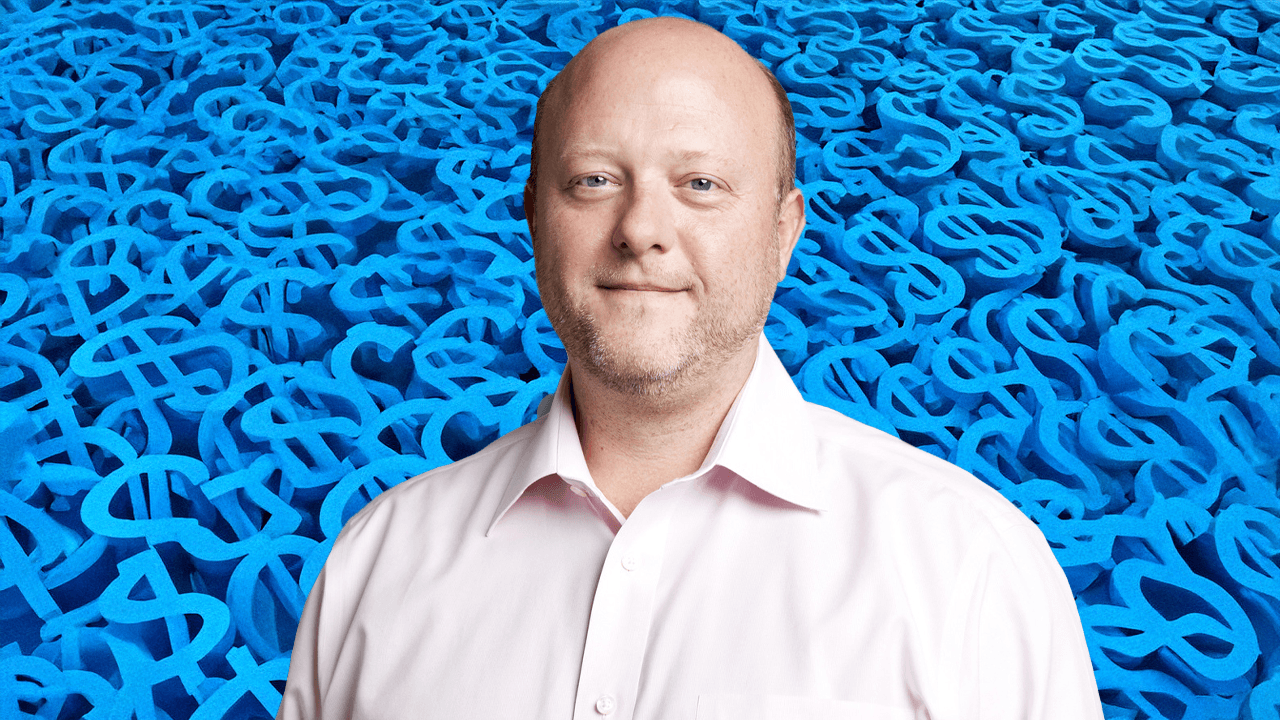

- In today’s CEO Daily: Diane Brady talks to CoreWeave CEO Michael Intrator.

- The big story: Markets fall worldwide as tariff “Liberation Day” approaches.

- The markets: It’s grim out there.

- Analyst notes from UBS, Bank of America, EY, and Apollo on tariffs and the economy.

- Plus: All the news and watercooler chat from Fortune.

Good morning. The performance of an IPO can reflect broad market sentiment or narrow investor enthusiasm for the company being listed—or a bit of both. There were a lot of eyes on CoreWeave’s Nasdaq debut on Friday, which closed flat at its scaled-back IPO price of $40 a share. Some saw the underwhelming performance of the Nvidia-backed AI cloud-computing provider as a bad sign for tech IPOs and AI, while others, including my colleague Jeremy Kahn, believe the reaction to CoreWeave reflects the challenges of being CoreWeave.

I spoke with CoreWeave CEO Michael Intrator on Friday about the New Jersey-based company’s much-scrutinized debut. He said they had scaled back the price and size of the stock offer because of “broader market headwinds,” describing the IPO as “a means to an end” for the company to grow.

“It puts us on the path towards what we need to accomplish as a business,” he said. “A little bigger, a little smaller, a little higher, a little lower. That’s not going to matter. What’s going to matter is: how do we execute on our business?”

That is a topic of much debate. Being a public company could drive down the cost of accessing debt markets, but CoreWeave’s capital-intensive model and existing debt burden unnerves some investors. The company has borrowed $8 billion to build out data centers that run graphics processing units (GPUs) provided by Nvidia. Servicing that debt is likely to cost at least $1 billion this year, which puts the $1.5 billion it raised through Friday’s IPO in perspective.

CoreWeave also relies heavily on one customer—Microsoft, which accounted for 62% of its revenue last year. Besides that, the company is betting heavily on a class of Nvidia chips that could be disrupted by newer models. And then there’s the question of whether we’re in a data center bubble, which Intrator dismisses.

“There’s a divergence between what the capital markets and what the media is thinking, and what I am feeling down in the trenches. What I am feeling is relentless demand,” he says. “I know what my clients want. I know the type of infrastructure they need. I know the type of scale that they’re requesting, and I build for them. Over time, I will be able to generate enormous value for my investors. I don’t really care where it is today or tomorrow or the day after.”

You can read my full interview with Intrator here.

More news below.

Contact CEO Daily via Diane Brady at diane.brady@fortune.com

This story was originally featured on Fortune.com