Bitcoin Traders Eye New Highs by End of Summer; Ether Rises 3% on Treasury Optimism

With volatility elevated ahead of an upcoming Bitcoin conference, investors eye a summer breakout as ETH rises and BTC consolidates near $110,000.

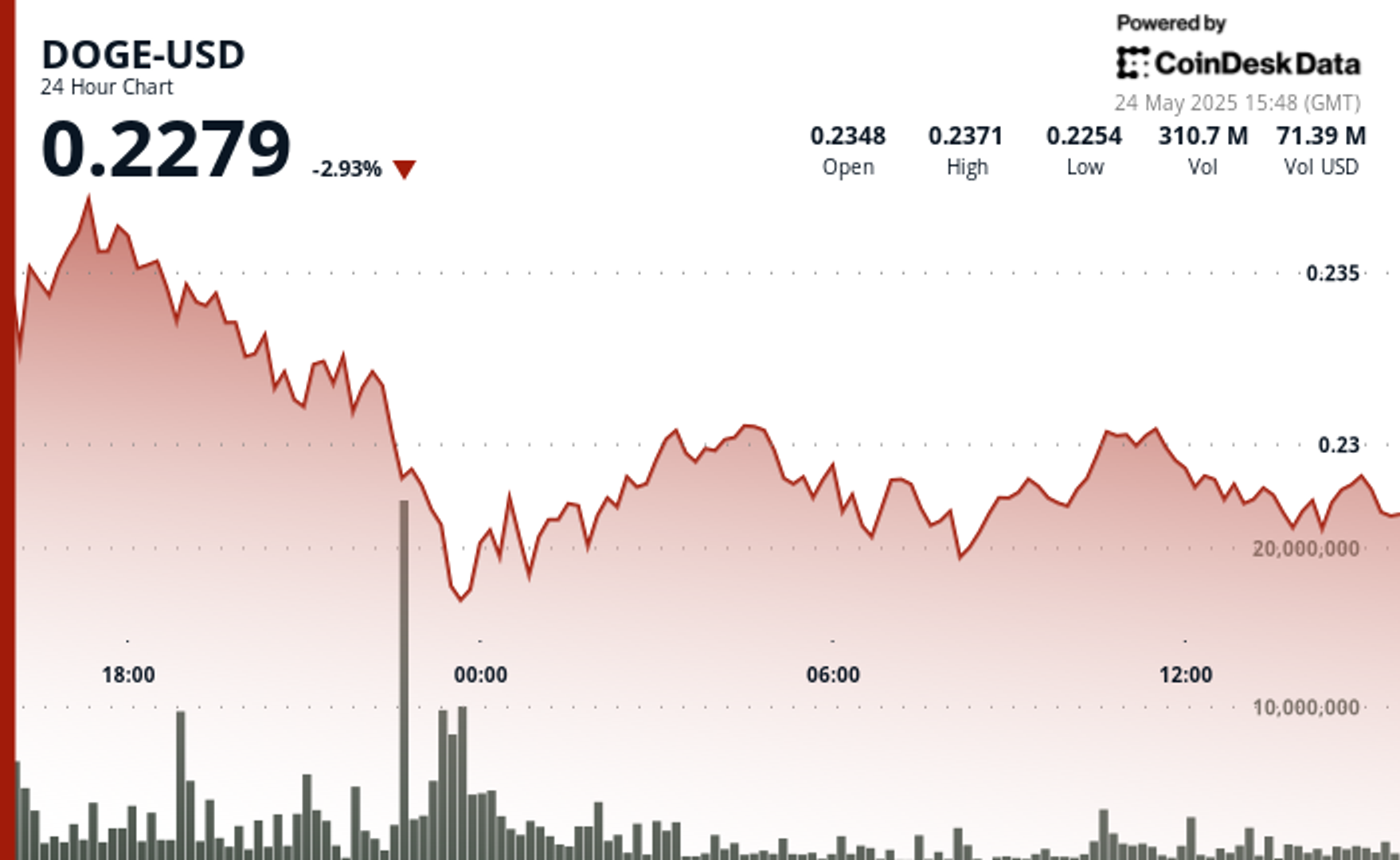

Bitcoin BTC held steady near $109,000 early Wednesday as traders bet on fresh highs in the coming months, with ether ETH rising over 3% after renewed confidence in Ethereum's long-term strategy and broader institutional activity.

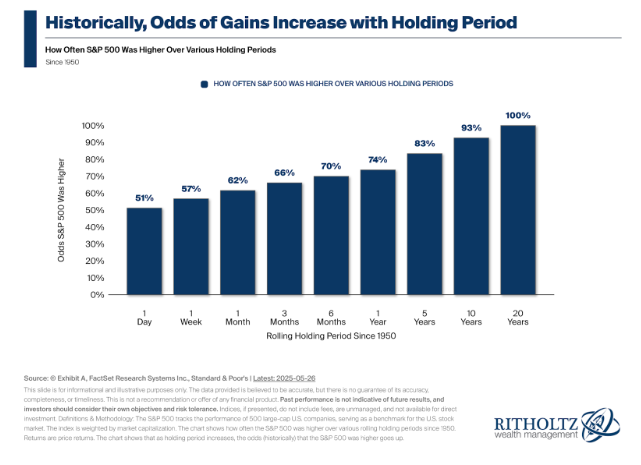

U.S. equities surged following the Memorial Day weekend, led by a 2% gain in the Nasdaq, as investors shrugged off labor market concerns and drew optimism from softening trade tensions.

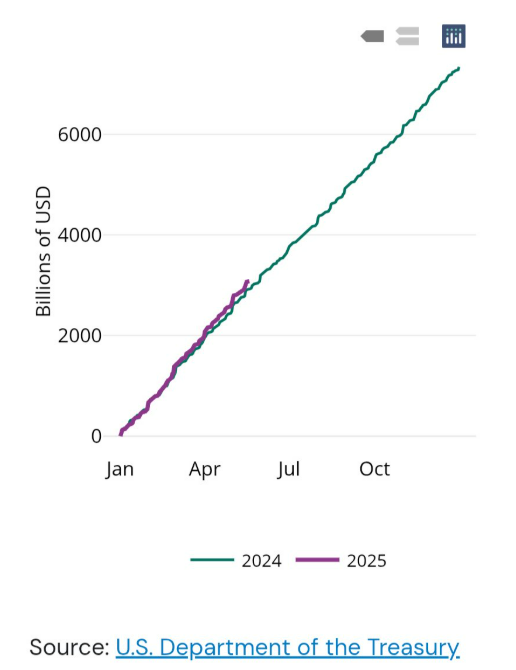

The rebound, aided by stabilizing Treasury yields and easing shipping disruptions between China and the U.S., has rekindled risk appetite across asset classes.

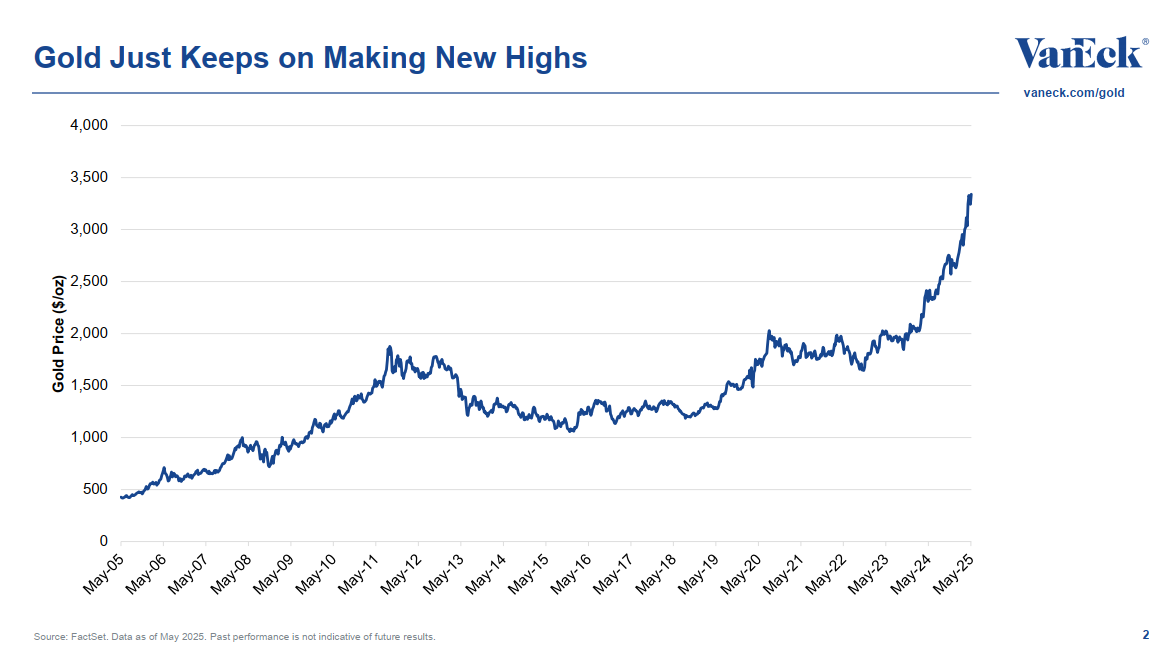

“Institutional investors are increasingly reallocating into crypto after volatility shook traditional safe havens,” said Kay Lu, CEO of HashKey Eco Labs. “Ethereum’s new treasury initiative—mirroring MicroStrategy’s BTC approach—shows that crypto is becoming a long-term reserve asset for the web3 ecosystem.”

Ethereum co-founder Joseph Lubin and development lab ConsenSys unveiled a $425 million ETH-based treasury reserve plan at publicly traded SharpLink, a move likened to Bitcoin-centric corporate strategies.

The company is raising roughly $425 million through a private investment in public equity (PIPE) offering. The proceeds will be used to buy ether, which will then serve as the primary treasury reserve asset.

The offering is expected to close on May 29th, according to the release. Lubin will become chairman of the board of directors upon the closing.

Meanwhile, bitcoin exchange-traded funds saw over $385 million in fresh inflows, signaling continued institutional demand.

Still, traders remain cautious ahead of the high-profile Bitcoin Conference, which kicks off in Las Vegas this week. Key speakers include JD Vance, Michael Saylor, and members of the Trump family, whose past appearances have stirred sharp market reactions.

“Front-end volatility remains elevated with BTC trading in a tight $107K to $110K range,” Singapore-based QCP Capital said in a market broadcast. “Last year’s Trump keynote in Nashville caused a spike in 1-day implied vol above 90, followed by a 30% BTC drop. That memory is still informing positioning.”

QCP added that perpetual futures open interest has eased, funding rates have normalized, and some prominent retail traders, including James Wynn, appear to be reducing exposure.

The defensive posturing suggests that, while new highs are expected this summer, traders are bracing for short-term volatility around political and macro headlines. Still, analysts remain broadly bullish.

“The structure underneath remains strong,” said Augustine Fan, head of insights at SignalPlus told CoinDesk in a Telegram message.

“Positive macro headwinds and better underlying structure paint an optimistic outlook with traders expecting prices to grind towards new highs by the summer,” Fan ended.