Bitcoin Threatens $100K, Crypto Losses Grow as Musk/Trump Feud Goes Nuclear

What began as a spat over the GOP tax and spending bill moving through Congress morphed into uncharted levels on Thursday.

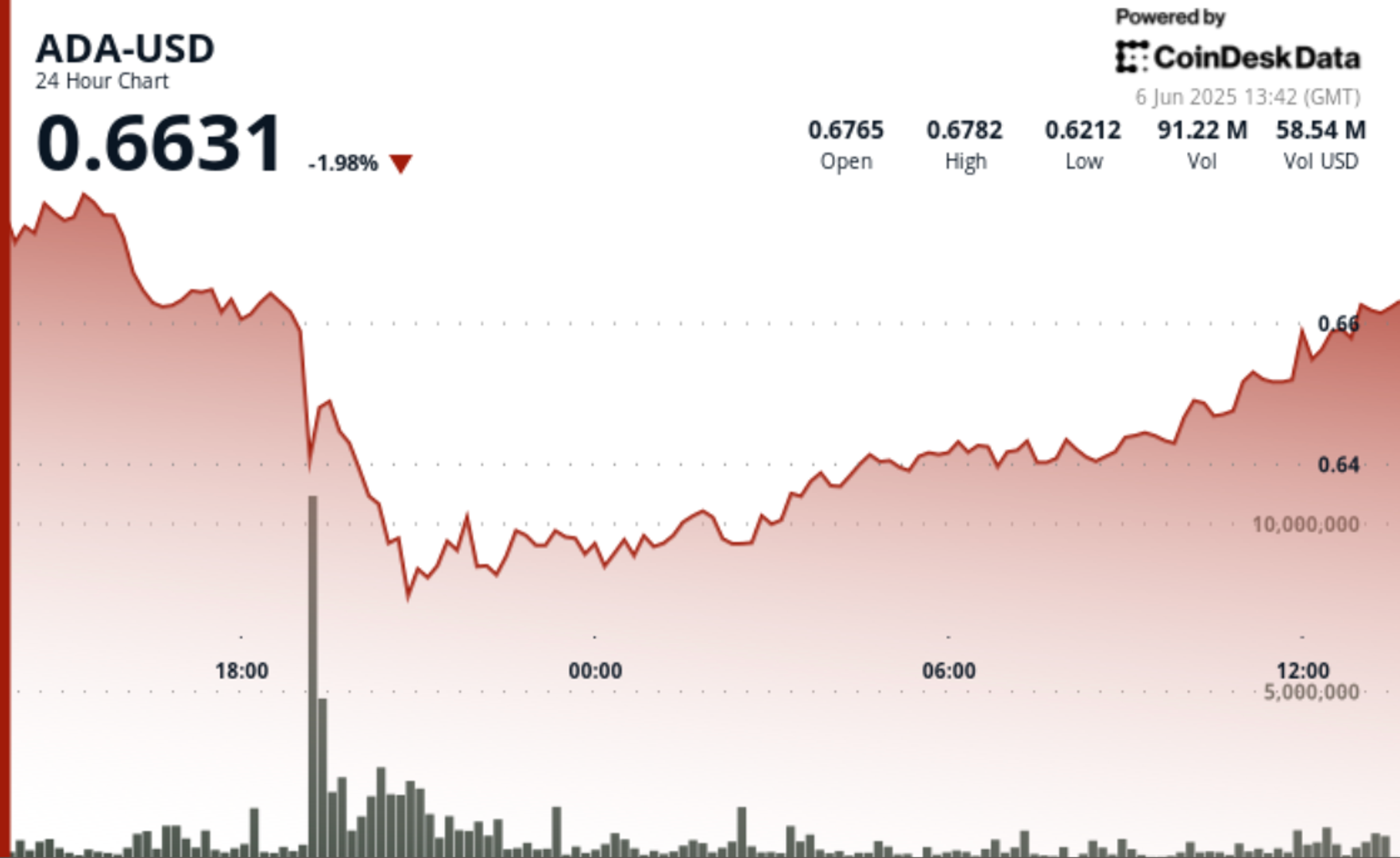

The crypto market is getting redder by the minute as the spat between U.S. President Donald Trump and Tesla CEO Elon Musk intensifies.

Late in the U.S. day, bitcoin BTC was down more than 4% to $100,500, threatening to dip back into five digits for the first time in a month.

The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, except for exchange coins, memecoins and stablecoins — is down more than 5% in the same period of time. SOL and SUI are notable underperformers, printing losses of more than 7%.

Coinbase (COIN) lost 4.6%, Strategy (MSTR) slid 2.4% on Thursday, while a few miners including MARA Holdings (MARA), Riot Platforms (RIOT) and Core Scientific (CORZ) suffered 5% losses.

Musk and Trump’s argument, initially triggered by the potential effects of the “Big, Beautiful Bill” on U.S. national debt, quickly escalated on Thursday afternoon, with the President saying that the SpaceX founder had gone “crazy” and threatening to terminate government contracts for all Musk-led companies.

The world’s richest man, for his part, wrote that Trump was implicated in the Jeffrey Epstein files, stated that SpaceX would decommission its Dragon aircraft, and agreed with a social media post calling on Trump to be impeached and replaced by Vice President J.D. Vance. Tesla (TSLA) stock fell more than 14% on Thursday.

Circle IPO day

Crypto prices were already under pressure on Thursday amid the euphoria surrounding the IPO of stablecoin issuer Circle (CRCL). Those with memories were recalling similar excitement surrounding Coinbase's (COIN) 2021 IPO, which at the time marked an historic top for crypto markets.

Circle, which went public at $31, soared to above $100 at one point Thursday before closing at $83.