Bitcoin sags below $108K as rate-cut bets evaporate before Fed minutes

Key points:Markets increasingly see fewer Fed rate cuts this year, with the first only coming in September.Despite potential labor market weakness to come, crypto and risk assets lack an overall bullish catalyst, analysis says.BTC/USD continues to drop toward new multiday lows.Bitcoin (BTC) sold off at the May 28 Wall Street open as markets continued to price out US interest rate cuts.BTC/USD 1-hour chart. Source: Cointelegraph/TradingViewBTC price retreats with Fed rate cut betsData from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping below $108,000 to challenge multiday lows.Ahead of the minutes of the Federal Reserve’s May meeting, the mood among risk assets was cautious.CME Group’s FedWatch Tool showed decreasing odds of a rate cut — a key tailwind for crypto, stocks and more — before September.Fed target rate probabilities for September FOMC meeting. Source: CME GroupInformal sentiment likewise continued to deteriorate on the day, with prediction service Kalshi seeing just two cuts in 2025, down from four in early April.

Key points:

Markets increasingly see fewer Fed rate cuts this year, with the first only coming in September.

Despite potential labor market weakness to come, crypto and risk assets lack an overall bullish catalyst, analysis says.

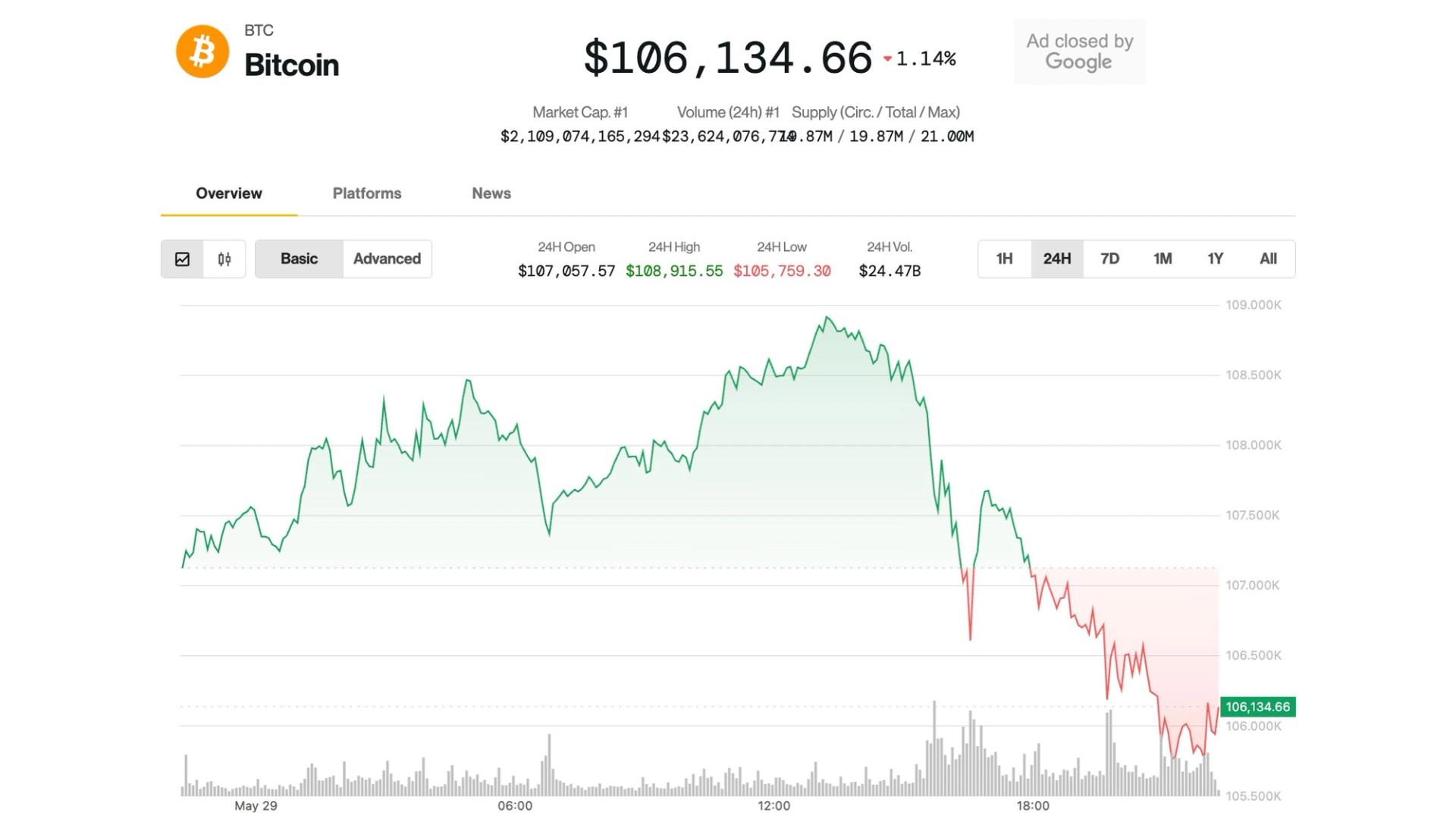

BTC/USD continues to drop toward new multiday lows.

Bitcoin (BTC) sold off at the May 28 Wall Street open as markets continued to price out US interest rate cuts.

BTC price retreats with Fed rate cut bets

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping below $108,000 to challenge multiday lows.

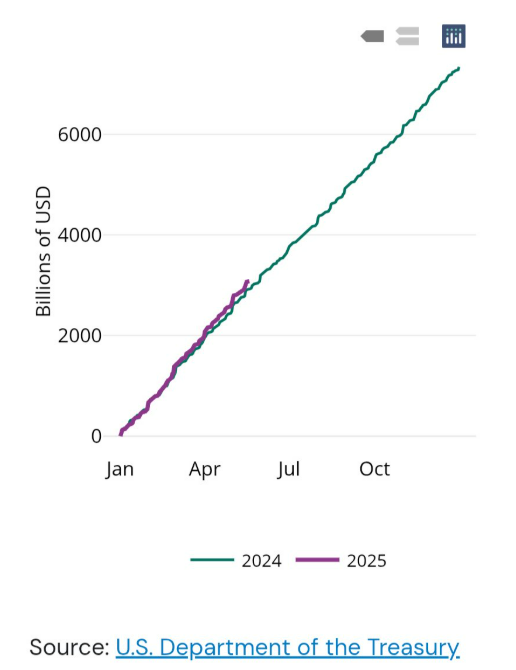

Ahead of the minutes of the Federal Reserve’s May meeting, the mood among risk assets was cautious.

CME Group’s FedWatch Tool showed decreasing odds of a rate cut — a key tailwind for crypto, stocks and more — before September.

Informal sentiment likewise continued to deteriorate on the day, with prediction service Kalshi seeing just two cuts in 2025, down from four in early April.