Bitcoin 'bullish cross' with 50%-plus average returns flashes again

Bitcoin’s (BTC) stochastic RSI has printed a bullish cross with a history of preceding sharp price rebounds. Stochastic RSI tracks momentum based on price movements relative to their range over a given period. This classic indicator operates between 0 and 100, with values above 80 considered overbought and below 20 deemed oversold. BTC/USDT weekly price chart. Source: TradingView/Merjin The TraderA crossover of the blue %K line above the orange %D line from an oversold region technically suggests growing upward momentum. Another $120,000 BTC price target emergesHistorical fractals show that each time the weekly stochastic RSI made the bullish cross, Bitcoin underwent sharp price recoveries within three to five months. Its gains have averaged at around 56% during such rebounds, ̛including rallies that extended beyond the 90%-return mark.BTC/USD weekly price chart. Source: TradingViewThat includes a roughly 90% rally from November 2022 lows, 92% gains in late 2023, and a staggering 98% move into Bitcoin’s recent all-time high of around $110,000 in January 2025.If history repeats, Bitcoin could see another parabolic rise by July or August, aligning with previous stochastic RSI bullish crosses that delivered outsized returns. Market analyst Merjin the Trader says Bitcoin’s price can reach at least $120,000 if the Stochastic RSI fractal plays out as intended.Source: Merjin The TraderMeanwhile, Bitcoin’s bullish reversal outlook receives further cues from its 50-week exponential moving average (50-week EMA; the red wave in the chart above) at around $77,230. The 50-week EMA wave has served as a strong accumulation zone for traders since October 2023.In case BTC’s price breaks decisively below the 50-week EMA, it could head toward the next support target at around the 200-week EMA (the blue wave), near $50,480, down approximately 40% from current prices.Bitcoin hedge funds are buying the dipAnother bullish sign comes from hedge fund accumulation during the ongoing price correction.Global crypto hedge funds are increasing their Bitcoin exposure, as seen in the latest rolling 20-day beta to BTC, which has surged to a four-month high. This suggests that institutional investors are buying into the dip, positioning themselves for potential upside.Global crypto hedge funds rolling 1-month beta to Bitcoin. Source: Glassnode/BloombergBeta measures how closely hedge fund returns track Bitcoin’s movements. When beta rises above 1.0, it indicates that the fund rises more than BTC’s price. Conversely, when the beta drops below 1.0, the fund moves less than Bitcoin. Related: Peak 'FUD' hints at $70K floor — 5 Things to know in Bitcoin this weekThe beta is now at a 4-month high, meaning hedge funds believe the recent Bitcoin dip is a buying opportunity and expect higher prices ahead, reinforcing the $120,000 price outlook as discussed above.As Cointelegraph reported, the $120,000+ is becoming a popular target for summer 2025.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

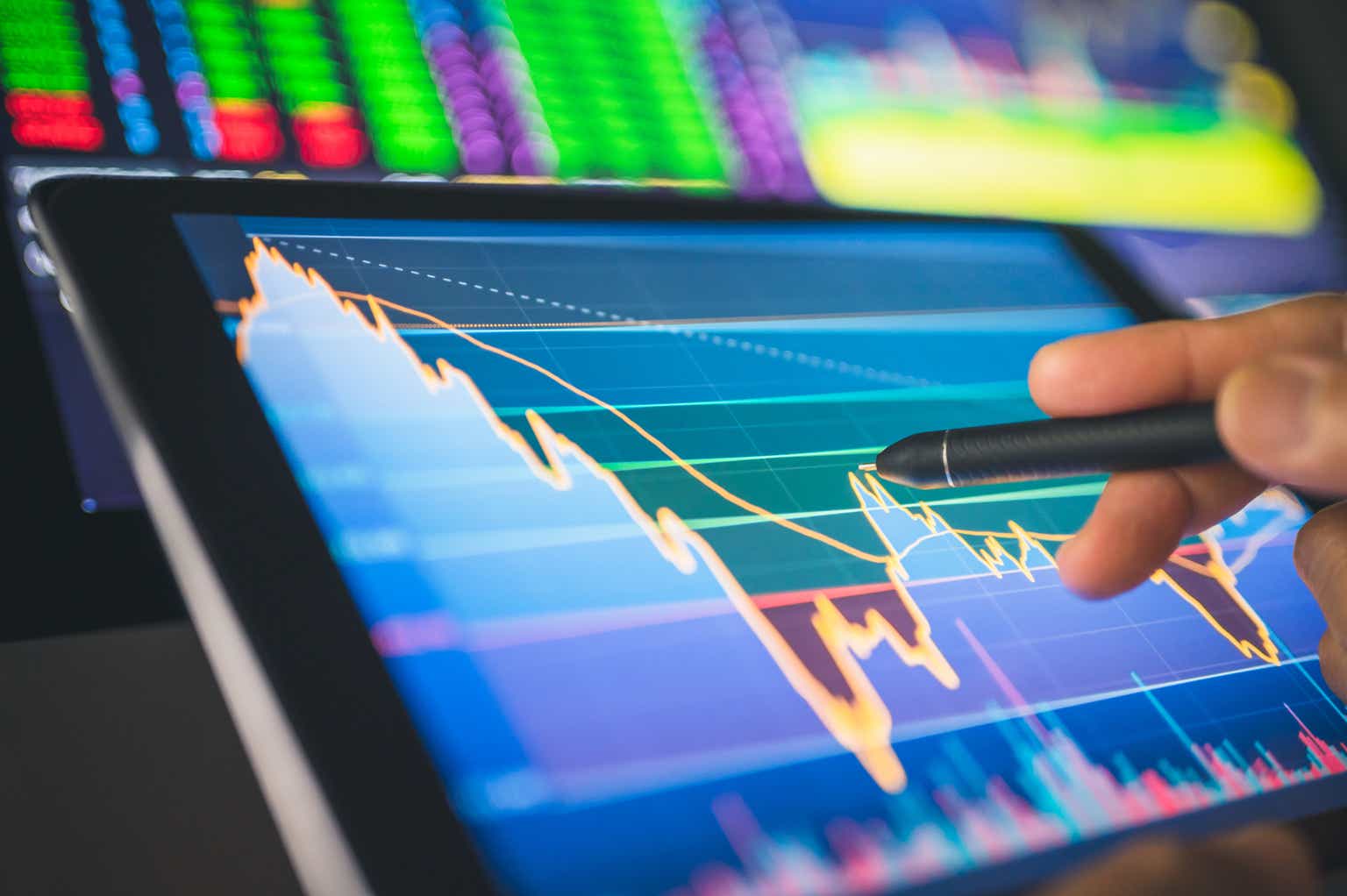

Bitcoin’s (BTC) stochastic RSI has printed a bullish cross with a history of preceding sharp price rebounds.

Stochastic RSI tracks momentum based on price movements relative to their range over a given period. This classic indicator operates between 0 and 100, with values above 80 considered overbought and below 20 deemed oversold. BTC/USDT weekly price chart. Source: TradingView/Merjin The Trader

A crossover of the blue %K line above the orange %D line from an oversold region technically suggests growing upward momentum.

Another $120,000 BTC price target emerges

Historical fractals show that each time the weekly stochastic RSI made the bullish cross, Bitcoin underwent sharp price recoveries within three to five months. Its gains have averaged at around 56% during such rebounds, ̛including rallies that extended beyond the 90%-return mark. BTC/USD weekly price chart. Source: TradingView

That includes a roughly 90% rally from November 2022 lows, 92% gains in late 2023, and a staggering 98% move into Bitcoin’s recent all-time high of around $110,000 in January 2025.

If history repeats, Bitcoin could see another parabolic rise by July or August, aligning with previous stochastic RSI bullish crosses that delivered outsized returns.

Market analyst Merjin the Trader says Bitcoin’s price can reach at least $120,000 if the Stochastic RSI fractal plays out as intended. Source: Merjin The Trader

Meanwhile, Bitcoin’s bullish reversal outlook receives further cues from its 50-week exponential moving average (50-week EMA; the red wave in the chart above) at around $77,230.

The 50-week EMA wave has served as a strong accumulation zone for traders since October 2023.

In case BTC’s price breaks decisively below the 50-week EMA, it could head toward the next support target at around the 200-week EMA (the blue wave), near $50,480, down approximately 40% from current prices.

Bitcoin hedge funds are buying the dip

Another bullish sign comes from hedge fund accumulation during the ongoing price correction.

Global crypto hedge funds are increasing their Bitcoin exposure, as seen in the latest rolling 20-day beta to BTC, which has surged to a four-month high. This suggests that institutional investors are buying into the dip, positioning themselves for potential upside. Global crypto hedge funds rolling 1-month beta to Bitcoin. Source: Glassnode/Bloomberg

Beta measures how closely hedge fund returns track Bitcoin’s movements. When beta rises above 1.0, it indicates that the fund rises more than BTC’s price. Conversely, when the beta drops below 1.0, the fund moves less than Bitcoin.

Related: Peak 'FUD' hints at $70K floor — 5 Things to know in Bitcoin this week

The beta is now at a 4-month high, meaning hedge funds believe the recent Bitcoin dip is a buying opportunity and expect higher prices ahead, reinforcing the $120,000 price outlook as discussed above.

As Cointelegraph reported, the $120,000+ is becoming a popular target for summer 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.