Billionaire Bill Ackman Prioritizes Uber and Howard Hughes, Yet Restaurant Brands International Remains a Key Asset for Pershing Square

Billionaire Bill Ackman’s investment firm, Pershing Square Capital Management, filed its Q4 2024 13F holdings report on Feb. 14, one week after he revealed on X that he had accumulated a $2.3 billion stake in Uber Technologies (NYSE:UBER). Based on Pershing Square’s latest 13F, Uber would be the hedge fund’s largest holding. Larger than Brookfield […] The post Billionaire Bill Ackman Prioritizes Uber and Howard Hughes, Yet Restaurant Brands International Remains a Key Asset for Pershing Square appeared first on 24/7 Wall St..

Billionaire Bill Ackman’s investment firm, Pershing Square Capital Management, filed its Q4 2024 13F holdings report on Feb. 14, one week after he revealed on X that he had accumulated a $2.3 billion stake in Uber Technologies (NYSE:UBER).

Based on Pershing Square’s latest 13F, Uber would be the hedge fund’s largest holding. Larger than Brookfield Corp. (NYSE:BN), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and even Howard Hughes Holdings (NYSE:HHH), his attempt to create the next Berkshire Hathaway (NYSE:BRK.B).

However, what stands out from the six moves Ackman made in the fourth quarter is the one he didn’t make.

The billionaire has held Restaurant Brands International (NYSE:QSR) stock since Q4 2014. Despite making no changes to the restaurant conglomerate’s holdings in Q4, it went from 4th spot at the end of September to second position among 10 stocks at the end of December.

Despite all the grand plans for Uber and Howard Hughes, he continues to hold RBI.

Key Points About This Article:

- Although Bill Ackman has big plans for Howard Hughes Holdings (NYSE:HHH) and Uber Technologies (NYSE:UBER), Pershing Square Capital Management’s 7.3% stake in Restaurant Brands International (NYSE:QSR) remains its second-largest and second-longest.

- The owner of Burger King continues to trade at a significant discount to its peers.

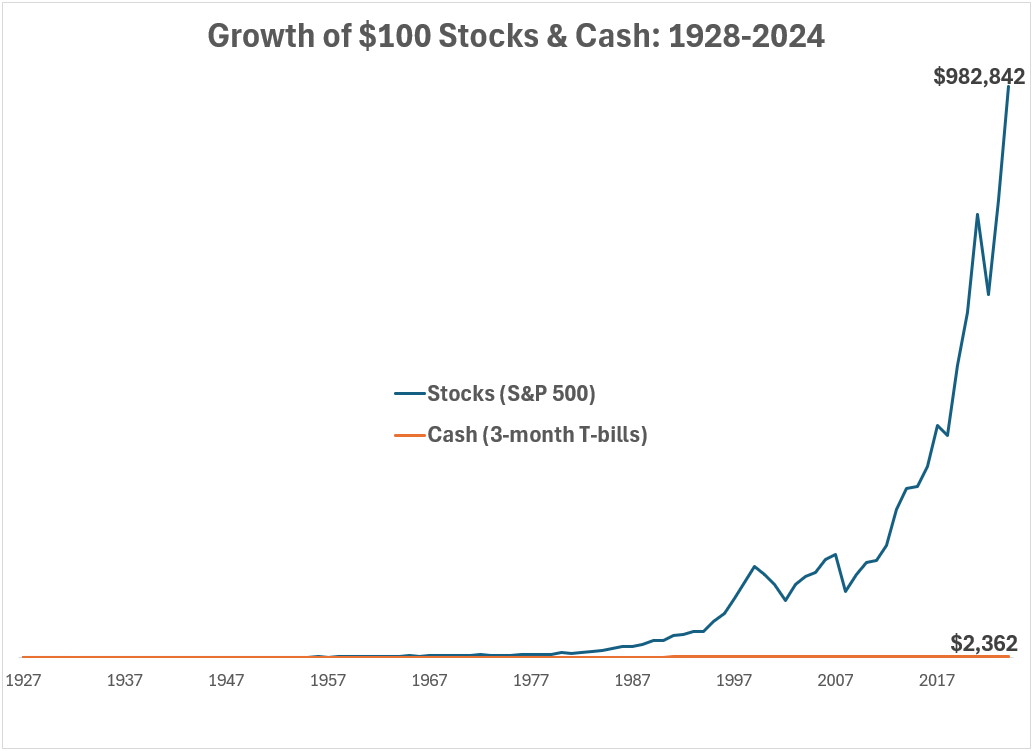

- Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks” now.

Pershing Square First Bought RBI Stock More Than a Decade Ago

Bill Ackman’s road to a 7.3% stake in the owner of Burger King, Tim Hortons, Popeyes, and Firehouse Subs started in Miami in April 2012 when Ackman-affiliated UK blank-check company, Justice Holdings, paid 3G Capital, the Brazilian private equity firm that owned the Whopper, $1.4 billion for a 29% stake in the company. Burger King was merged into the NYSE-listed Justice in June 2012, returning the burger business to the public markets.

Two years later, in August 2014, Burger King announced that it would buy Tim Hortons, the iconic Canadian coffee chain, in an $11.5 billion cash-and-stock deal. The merger created a business with $23 billion in worldwide annual sales. It was completed in December 2014.

As part of the combination, Burger King shareholders would receive 0.99 shares of newly issued common shares in what would become RBI and 0.o1 newly issued partnership exchangeable units for every share held. Burger King shareholders could elect to receive 1.0 partnership exchangeable units for every share held.

The 38.4 million shares of Burger King held by Pershing Square before the merger became 38.0 million at a value of $1.48 billion as of Dec. 31, 2014. Today, it owns 23.0 million shares valued at $1.5 billion.

At the end of 2014, RBI was Pershing Square’s fifth-largest holding out of seven stocks, accounting for 9.3% of its $16.0 billion in assets. At the end of December, it was the second-largest holding, accounting for 11.9% of $12.6 billion in assets.

Despite selling 12.7 million shares of RBI stock in Q3 2017 for approximately $760 million, it still owned 26.5 million shares. Over the next seven years, it bought and sold shares at various times, likely netting further gains for the hedge fund.

It’s has been a big success.

Why Does Ackman Like RBI?

As 24/7 Wall St. contributor Rich Duprey discussed in September, Ackman has a big portion of the hedge fund’s holdings (53%) in three stocks: RBI, Chipotle Mexican Grill (NYSE:CMG), and Hilton Hotels (NYSE:HLT). Due to a big reduction in Pershing Square’s Hilton holdings in the fourth quarter, the percentage has dropped to 34%, but still significant.

In the billionaire’s 2024 annual presentation, Ackman lists four reasons he likes RBI.

- Burger King and Tim Hortons are outperforming their peers.

- The acquisition of Carrols, Burger King’s largest U.S. franchisee, has accelerated the company’s turnaround of the segment’s franchisee profitability.

- Overall, it’s expected to grow its 2024 operating profit by 8%, and

- It trades at 18x the estimated earnings over the next 12 months, a discount of 30% to Yum Brands (NYSE:YUM), McDonald’s (NYSE:MCD), and Domino’s Pizza (NASDAQ:DPZ).

Here’s what he had to say in Pershing’s June 2024 shareholder letter:

“As the company returns to its historic mid-single-digit unit growth and delivers consistent performance at each of its brands, we believe the company’s share price will more accurately reflect its improving fundamentals.”

Since June 30, 2024, RBI stock has lost approximately 11% of its value. Except for selling 205,593 shares in Q2 2024, it made no other changes to its holdings. If it were to fall into the $50s–it hasn’t traded that low since June 2022–it would be interesting to see if Ackman adds to his position in RBI.

On Feb. 18, RBI announced that it had acquired the shares it didn’t already own in Burger King China for $158 million. Its partners in China helped the brand grow from 60 restaurants in 2012 to approximately 1,500 today. It will take some time to find a new local partner who will operate the business and own a controlling stake.

Although its local partners did help grow the number of locations in China, it hasn’t been very profitable for the company, which is likely why it opted to buy them out. A better partner in China would go a long way to improving Burger King’s international business.

I guess we’ll see if it happens in 2025.

The post Billionaire Bill Ackman Prioritizes Uber and Howard Hughes, Yet Restaurant Brands International Remains a Key Asset for Pershing Square appeared first on 24/7 Wall St..