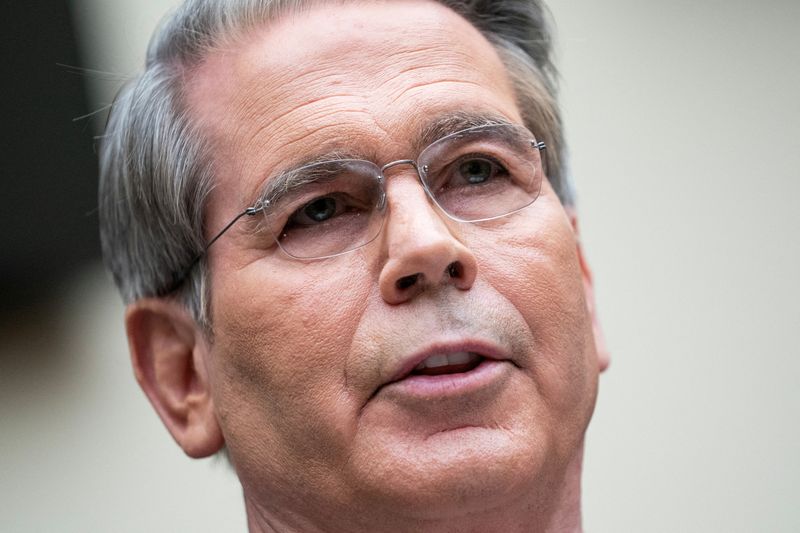

Billionaire Bill Ackman Ditches Nike and Pours 19% of His Fund Into This Stock

Bill Ackman, billionaire investment legend and top boss over at Pershing Square Holdings, made some notable moves in the first quarter. Just last week, 13-F filings unveiled that Ackman had sold out of his position in footwear giant Nike (NYSE:NKE) while pouring nearly 19% of his fund’s capital into ride-hailing firm Uber Technologies (NASDAQ:UBER). Undoubtedly, […] The post Billionaire Bill Ackman Ditches Nike and Pours 19% of His Fund Into This Stock appeared first on 24/7 Wall St..

Key Points

-

Bill Ackman dumped Nike and initiated a new position in Uber. It’s a smart move that could hail bigger gains for Pershing Square.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Bill Ackman, billionaire investment legend and top boss over at Pershing Square Holdings, made some notable moves in the first quarter. Just last week, 13-F filings unveiled that Ackman had sold out of his position in footwear giant Nike (NYSE:NKE) while pouring nearly 19% of his fund’s capital into ride-hailing firm Uber Technologies (NASDAQ:UBER). Undoubtedly, Ackman’s new bet on Uber was no mystery, as he had unveiled the significant investment earlier this year on X (formerly Twitter).

Undoubtedly, NKE stock has been in a serious slump in recent years. And the pain hasn’t really subsided, with shares nosediving in the face of Donald Trump’s Liberation Day tariffs. Though shares of NKE have regained much of the ground it had lost in the Liberation Day fallout, Nike’s hefty exposure to trade risk does make it a riskier play than it was before Trump won the election.

Timelier opportunities than Nike are out there as Trump tariff risks linger

I think it’s safe to say that there were better and timelier opportunities for Ackman. And while I wouldn’t be so quick to follow Ackman out of NKE stock and into UBER stock if you still believe there’s immense value to be had in the sneaker top dog, I do think Ackman’s latest moves are worth meditating over. After all, Ackman isn’t one to stay invested in a name he no longer believes in should the circumstances or slate of risks suddenly shift for the worse.

Throughout his career, we’ve seen him cut his losses on soured positions and move on to better things. He’s not one to dwell on the past.

In the case of Nike, a firm that Ackman is quite fond of, perhaps there’s really no making too much of the matter, especially since Nike CEO Elliott noted that ample patience will be required on the part of the investor as he does his best to turn the ship around. Indeed, there may be a sound game plan in place, but Nike’s comeback story could take a number of years to play out.

Are Nike’s tariff risks too much to handle?

Meanwhile, there’s the added unknown of tariffs to ponder as the firm may consider a pricy move in production. Though Nike hasn’t yet committed to anything, such as supply chain shifts or lofty price hikes, I think it’s safe to say that tariffs represent yet another hurdle for Nike to leap over before it can get a better view of the finish line.

Of course, there are tariff risks to factor into your investment thesis as Ackman likely already has. But at today’s depths, one has to think a lot of such trade risks are baked in. Furthermore, the cheap stock has gotten much cheaper in the past year, sagging more than 31%. In short, Nike’s a blue chip that’s suffered a devastating and historic crash. Although the name isn’t for the faint of heart, I do think 20.8 times trailing price-to-earnings (P/E) isn’t all too high a price to pay for one of America’s most iconic brands, even if tariffs throw a wrench into Nike’s comeback plans.

Catching a smoother ride with Uber

Thus far, Ackman’s decision to ditch Nike for Uber has been a smart one. The stock has gained more than 23% in the past month and is sitting at a fresh, new all-time high just north of $91 per share. The company’s GO-GET event pulled the curtain on features (like Route Share) that could make it cheaper to hail a ride. Indeed, affordability is at the top of American consumers’ minds as the weight of tariffs is added to monthly budgets.

Additionally, Uber pulled the curtain on a new autonomous vehicle deployment plan for Los Angeles, which is currently booked for early 2026. Indeed, Uber may very well be one of the earlier winners of the gear shift towards self-driving vehicles. In any case, I think Ackman’s wise to place such a big bet (around $2.2 billion, which works out to close to 19% of assets) on Uber.

Despite the latest upside surge, shares still look far cheaper than Nike at 15.8 times trailing P/E. With timelier catalysts that could pave the way for even higher highs and less, if anything, to worry about on the tariff front, I certainly view Uber as a less stressful stock to own in this environment. Either way, I expect Ackman will enjoy his ride from here as UBER stock looks to add to its strength while doubling down on affordability while bracing for the margin-enhancing shift towards autonomy.

The bottom line

Despite the tariff uncertainty, Nike is still a cheap stock as it attempts to stage a comeback. Still, I think Ackman is right on the money to go with Uber over Nike. Unlike Nike, which is on weak footing, Uber is in a position of strength, with needle-moving catalysts that could beget more strength.

The post Billionaire Bill Ackman Ditches Nike and Pours 19% of His Fund Into This Stock appeared first on 24/7 Wall St..