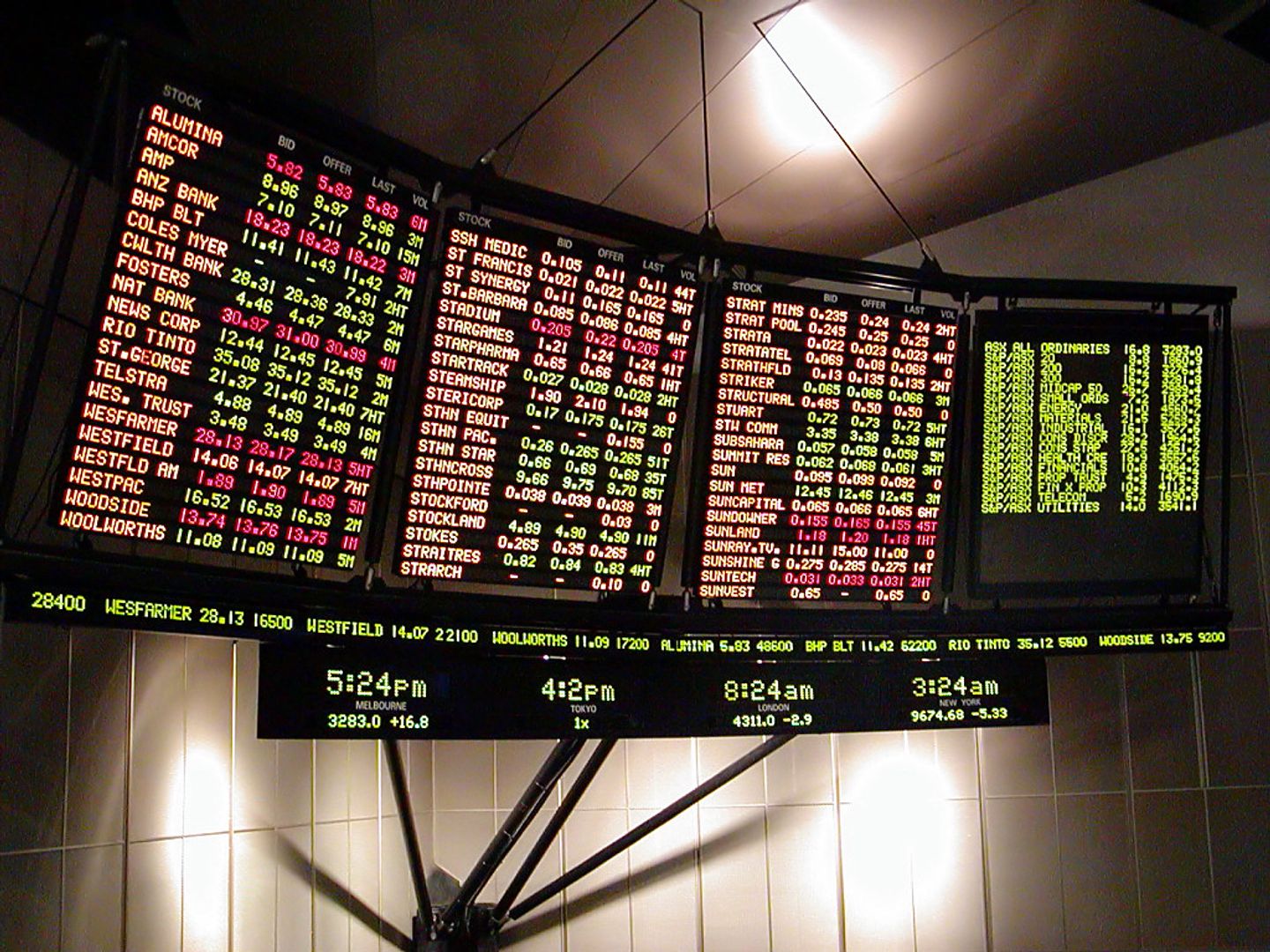

Bayer’s stock is charting a 40% rebound after years of losses

Bayer surged almost 40% in 2025, ranking among the DAX’s top performers. The rally has pushed its share price close to surpassing the average 12-month analyst target.

For years, Bayer AG was one of Germany’s worst stocks. Now, it’s turning out to be among the best.

The pharma and chemical conglomerate soared some 40% in 2025, ranking among the top stocks in the DAX. It has risen so rapidly that the price is on the cusp of surpassing the average 12-month analyst target.

Traders are betting on a possible breakthrough in Bayer’s long-running legal battle over Roundup weedkiller and that its experimental Asundexian drug might be a blockbuster treatment for preventing strokes. Some analysts have said the worst-case scenario is already priced in and there have been no sell ratings on the stock since September, according to data compiled by Bloomberg.

“The entire situation for Bayer is definitely better than last year,” said Markus Manns, a portfolio manager at Union Investment in Frankfurt. “The first successes of the turnaround are visible.”

Chief Executive Officer Bill Anderson has sought to streamline the sprawling organization and step up legal and lobbying efforts in the US since taking over in 2023.

Still even after this year’s recovery, Bayer shares are a fraction of what they once were. The company already paid out about $10 billion of the $16 billion set aside to handle Roundup claims, and its acquisition of Monsanto in 2018 is now seen as a textbook case of an ill-fated blockbuster deal. Last year, the stock plunged some 42%, a bigger loss than any other company in the DAX.

More investors are seeing the beginnings of a turnaround, especially as the US Supreme Court could review Bayer’s litigation as soon as June and ultimately decide in favor of the company.

There’s probably a 40% chance that the Supreme Court will carry out the review of the Roundup litigation, and should that happen, there’s a 75% probability it will ultimately side with Bayer, according to Tom Claps, a litigation analyst at Gordon Haskett.

Bayer spokesperson said the company shares the view that there could be a Supreme Court review by the end of June, adding that the firm is looking at all available options to deal with the litigation.

Goldman Sachs Group Inc. analyst James Quigley says if the high court reviews Bayer’s case, it may trigger a 10% to 25% jump in the stock price. Earlier this month, he upgraded the stock to a buy recommendation, one of three analysts to do so.

Of course, if the Supreme Court rejects Bayer’s appeal, the company will have to rely on other approaches, for example separating its glyphosate business. The firm could have to shell out another $8 billion to get beyond the 67,000 or so outstanding claims, according to Holly Froum, a Bloomberg Intelligence analyst.

A Bayer spokesperson declined to comment on estimates of the amount of the settlement of outstanding claims.

Bayer also has a high debt burden, and prominent German investor, Deka Investment’s Ingo Speich has voiced exasperation over the company’s ongoing struggles. Besides, the firm is facing increased competition for blockbuster eye medicine Eylea and blood-thinner Xarelto.

The stock is still cheap relative to peers and some investors are optimistic that there could be positive results from a trial testing an experimental stroke medicine. Bayer trades at around six times forward earnings, compared with average multiple of 15 for companies in the Stoxx 600.

The firm’s pharma unit could get a boost if the stroke drug Asundexian produces good late-stage trial data later this year, according to Union Investment’s Manns. He estimates the treatment may generate as much as €2 billion ($2.3 billion) in annual sales.

“Once the litigation overhang is cleared, the company may be better able to present a strategy to shareholders to de-gear the balance sheet, which could enable it to invest in its pharma pipeline,” Rajesh Kumar, an analyst at HSBC Holdings Plc, wrote in a note.

This story was originally featured on Fortune.com