Analysts revisit Broadcom stock price targets after Q1 earnings surprise

An unexpected addition to Broadcom's earnings has the AI chipmaker soaring in early Friday trading.

Broadcom shares soared in early Friday trading after the chipmaker posted stronger-than-expected quarterly earnings, as well as robust near-term outlook, that soothed investors concerns over the pace of global AI demand.

Broadcom (AVGO) is the clear market leader in application-Specific Integrated Circuit, or ASIC chips, which help hyperscalers move large amounts of data through integrated circuits and ultimately accelerate the speed and reliability with which they process information.

Broadcom also makes specialized networking gear that determines the speed at which information collected in one network is passed along to the next.

Collectively, the group sees the serviceable size of those markets rising to between $60 billion and $90 billon over the next two years.

For the three months ending on Feb. 2, the group's fiscal first quarter, Broadcom saw overall revenues rise 6.2% to $14.92 billion, with AI-related sales soaring 77% to $4.1 billion.

Looking into the current quarter, the group expects AI revenues of around $4.4 billion, with overall sales of $14.9 billion and an operating margin of around 66%.

Marvell outlook reset expectations

That outlook was crucial to the stock's overnight reaction after its custom-chip rival Marvell Technology (MRVL) suffered its biggest single-day decline since 2001 following a muted sales forecast earlier in the week.

"We're encouraged by these strong results, as Broadcom strengthens its position as a leading custom AI ASIC provider," said KeyBanc Capital Markets analyst John Vinh, who lifted his price target by $15 to $275 per share.

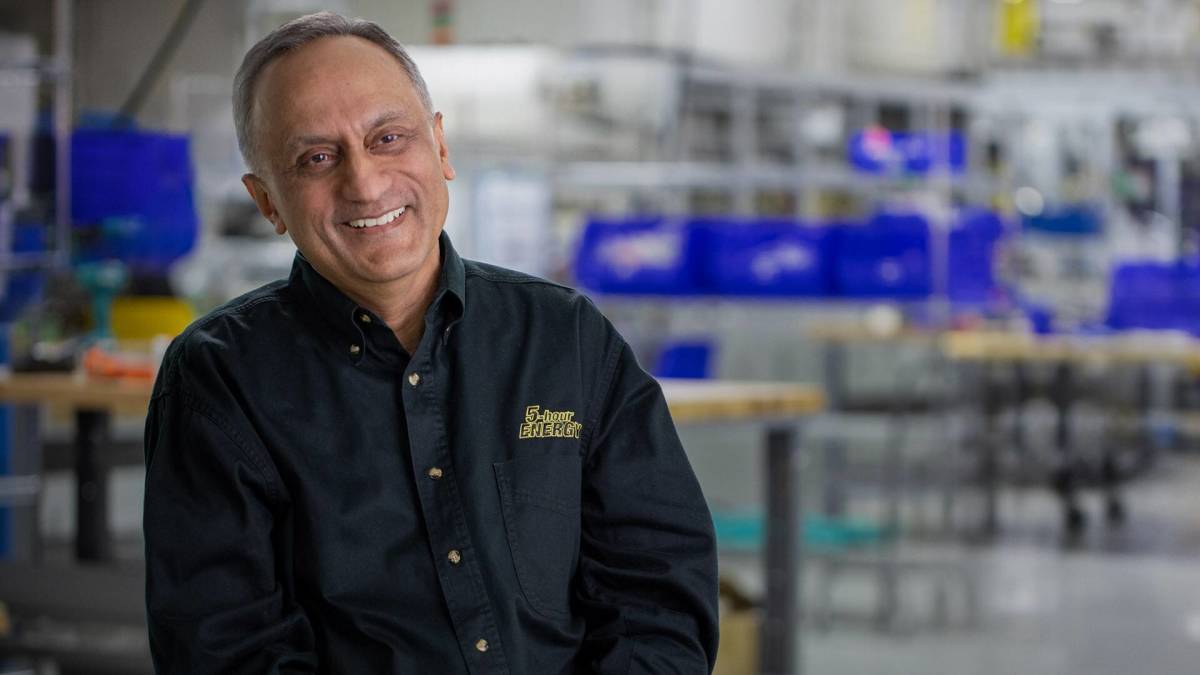

Adding fuel to the earnings beat, however, was a statement from CEO Hock Tan that Broadcom is close to adding four new hyperscaler customers for its ASCI chips as companies look to source alternatives from Nvidia NVDA while enhancing their computing power for increasingly complex tasks.

Related: Analysts overhaul Marvell stock price targets after Q4 earnings

"We are deeply engaged with two other hyperscalers in enabling them to create their own customized AI accelerator," Tan told investors on a conference call late Thursday, adding that "two additional hyperscalers have selected Broadcom to develop custom accelerators to train their next-generation frontier models."

"And to be clear, of course, these four are not included in our estimated SAM of $60 billion to $90 billion in 2027. So, we do see an exciting trend here," he added.

Broadcom adding major new clients

Cantor Fitzgerald analyst C.J. Muse, who kept his 'overweight' rating and $300 price target unchanged following last night's update, said the new clients, which were not named, "should dramatically increase the company’s SAM" once included.

Muse said the clients are likely ARM Holdings (ARM) , Amazon (AMZN) and OpenAI, as well as one of either Oracle (ORCL) , Microsoft (MSFT) or Elon Musk's xAI.

"Supported by this backdrop, Broadcom is stepping up its research and development to support investment in the next generation of accelerators with a keen focus on large-scale clusters for 3 primary customers," like Google, Meta and TikTok owner ByteDance, said Muse.

Related: Intel stocks leaps on report tied to Nvidia and Broadcom

Piper Sandler analyst Harsh Kumar also praised the group's core AI business, alongside gains in enterprise software and the integration of cloud computing group VMWare, which it purchased in late 2023.

"Broadcom reported a strong quarter, nicely beating January quarter estimates as well as expectations for the April quarter guide, and the big driver continues to be XPU and AI-related networking," said Kumar, who kept his 'overweight' rating and $250 price target in place.

"All in all, we continue to be impressed with Broadcom's execution," he added.

Broadcom well-placed for AI growth

Benchmark analyst Cody Acree was also bullish, but also kept his $250 price target and 'buy' rating in place following a 27% surge for the stock over the past six months into last night's earnings.

"With expected continue growth in its AI business, we believe Broadcom is extremely well-positioned to capitalize on what we expect to be improving industry fundamentals over the intermediate term and is uniquely situated to reap the benefits of the macro industry-wide adoption of AI," Acree said.

More AI Stocks:

- Nvidia-backed startup could be hottest tech IPO of the year

- Apple blames name-calling glitch on its new AI feature

- Several AI leaders are considering a deal that could save Intel

"We are particularly encouraged by the company’s increasing AI visibility, which now looks to extend for at least the next few years," he added.

Broadcom shares were marked 11.4% higher in premarket trading to indicate an opening bell price of $199.94 each.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast