After Hitting $10M In Assets, What Can I Do To Make Sure It Lasts?

As you build wealth and get closer to retirement, priorities shift. Many people strive to accumulate wealth when they are young and look for ways to preserve their nest eggs as they get older. This trend came up in a Fat FIRE Reddit post. A Redditor has $10 million in liquid assets and anticipates spending $15k/mo. […] The post After Hitting $10M In Assets, What Can I Do To Make Sure It Lasts? appeared first on 24/7 Wall St..

As you build wealth and get closer to retirement, priorities shift. Many people strive to accumulate wealth when they are young and look for ways to preserve their nest eggs as they get older. This trend came up in a Fat FIRE Reddit post. A Redditor has $10 million in liquid assets and anticipates spending $15k/mo. He has a 90/10 allocation in stocks and bonds.

I will share my thoughts on making the money last, but it is good to speak with a financial advisor if you can.

Key Points

-

A Redditor has a $10 million portfolio and is looking for guidance.

-

He can live off dividends and interest. As he gets older, he may want to shift some stocks into fixed-income assets.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Living off Dividends and Interest

The Redditor currently has approximately $1 million in Treasuries and a little more than $9 million in stocks. Assuming a 4% APY on Treasuries, the Redditor is making about $40,000 per year ($3,333.33/mo). We don’t know the Redditor’s stock portfolio, so it’s harder to gauge how much of its dividends are and what the average yield looks like.

Treasury income brings the $15k/mo commitment to about $12k/mo. The Redditor only needs a 1.6% yield across his $9 million portfolio to cover the remaining $12k/mo. The great thing about dividend investing is that most companies raise their dividends each year, so the Redditor’s dividend income may outperform inflation.

The 4% Withdrawal Rule Offers Additional Security

The 4% withdrawal rule is a common framework that lets retirees withdraw 4% of their portfolio each year to cover various expenses. The idea behind the 4% rule is that you withdraw money, and then your portfolio grows at more than 4% each year, essentially resulting in a net gain.

With a $10.8 million portfolio, the Redditor can withdraw $432k each year. Naturally, the Redditor doesn’t need to withdraw that much money. The Redditor can get away with withdrawing less than 2% of their portfolio each year.

However, it gets even better. Since the Redditor is earning income from Treasury bonds and dividends, it’s possible thatthe Redditor may only need to withdraw 1% of their portfolio each year or possibly less.

The Redditor Has No Children

It will be even easier for the Redditor to keep up with monthly expenses in the long run since he has no children. He has a girlfriend, and it’s good for the Redditor to assess if he plans on leading a family.

Having children will increase his living expenses, but it won’t impact his ability to preserve his $10 million. It’s also possible that he and the girlfriend separate or get married without having children, so there are some variables.

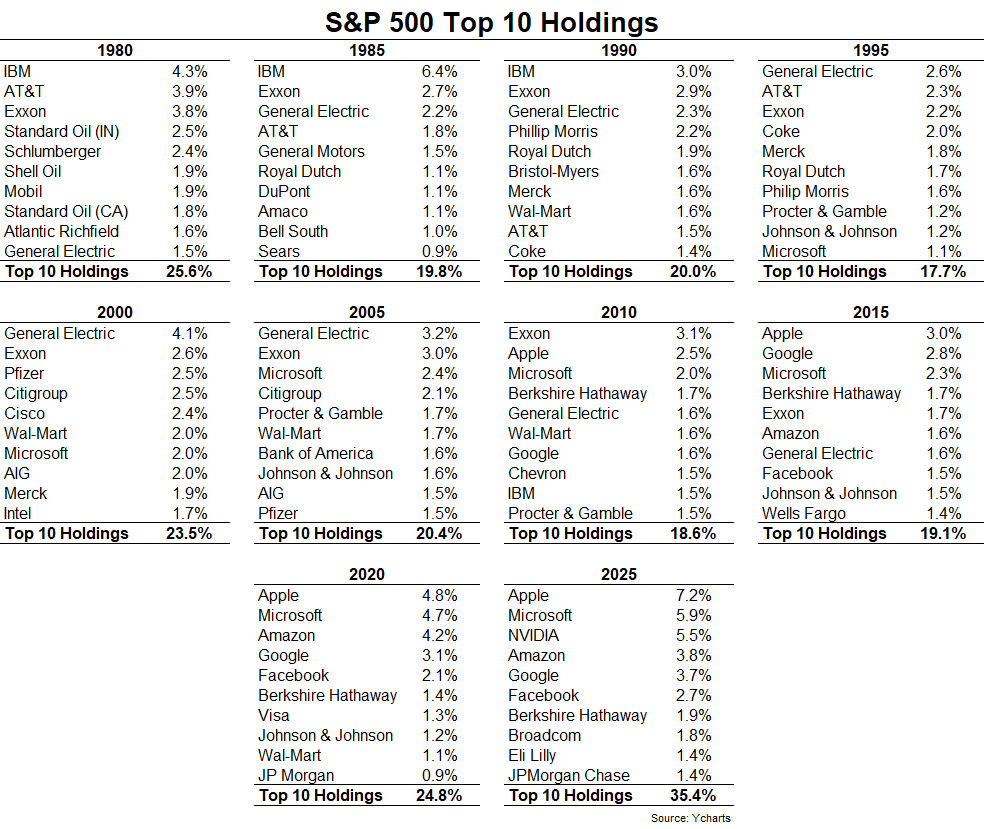

Either way, the Redditor has established a strong financial foundation that will give him plenty of options. If he is worried about losing money in the stock market, he may want to gradually shift from a 90/10 allocation to something less risky like an 80/20 allocation. However, it depends on the Redditor’s age, his risk tolerance, and other factors.

The post After Hitting $10M In Assets, What Can I Do To Make Sure It Lasts? appeared first on 24/7 Wall St..