86% of American Want a Major Overhaul of the Tax Code – Why Won’t It Happen?

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. About 86% of Americans say the tax code needs reform, according to the Tax Foundation. That’s because it’s ridiculously confusing. About This Article About 86% of Americans say the tax code needs […] The post 86% of American Want a Major Overhaul of the Tax Code – Why Won’t It Happen? appeared first on 24/7 Wall St..

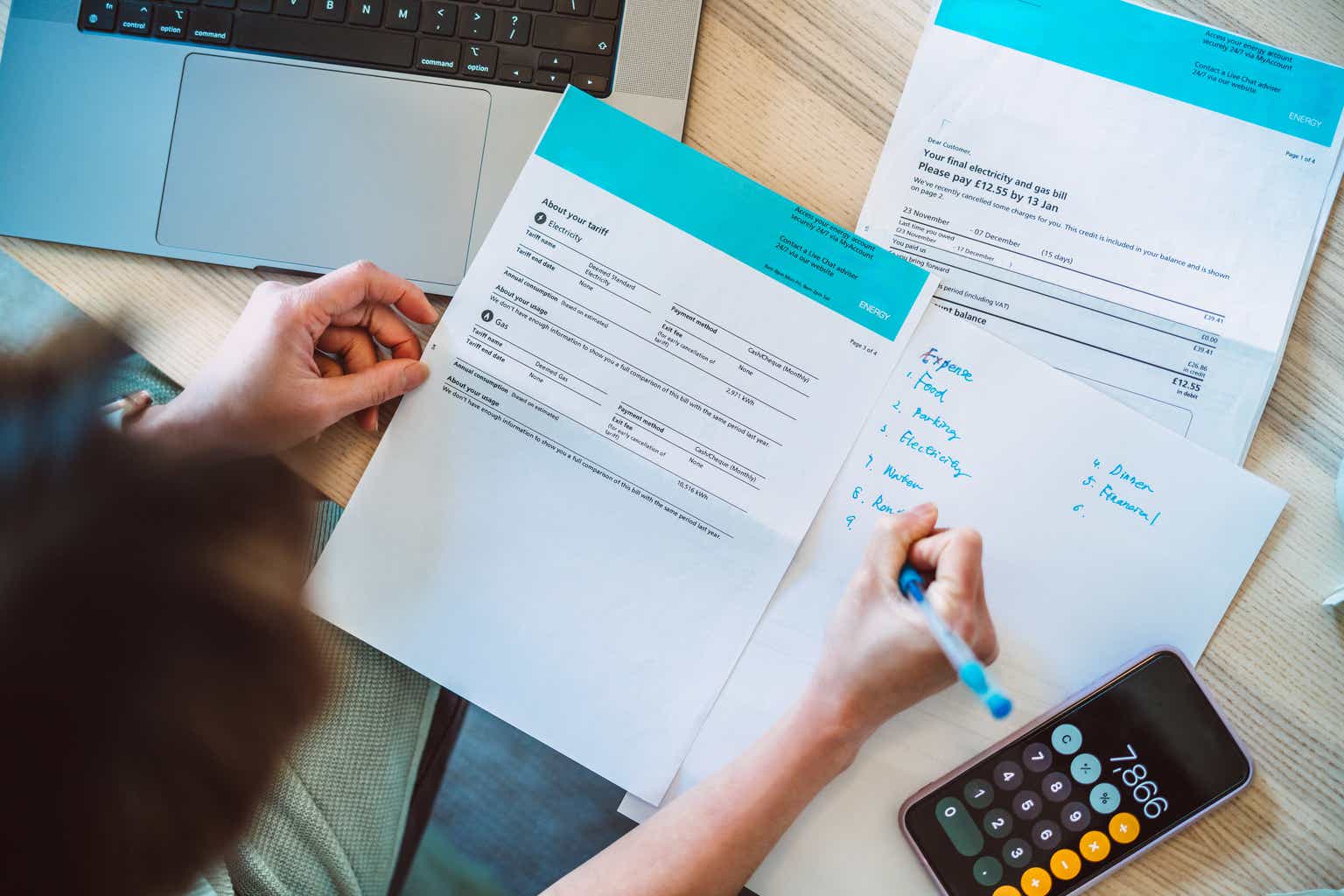

About 86% of Americans say the tax code needs reform, according to the Tax Foundation.

That’s because it’s ridiculously confusing.

Key Points About This Article

- About 86% of Americans say the tax code needs reform. Seventy percent prefer a simpler tax code instead of the current overcomplicated and stressful tax system.

- Americans want a tax code that is simpler to understand, fair, and designed to benefit the greater economy.

- Many Americans want to see tax rates reduced, particularly for middle- and lower-income earners.

- Over 4 Million Americans are set to retire this year. If you’re one, don’t leave your future to chance. Speak with an advisor and learn if you’re ahead, or behind on your goals. Click here to get started. (Sponsored)

In fact, according to another, March 2025 study done by research firm Savanta, as noted by CPA Practice Advisor, 70% prefer a simpler tax code instead of the current overcomplicated and stressful tax system. About 50% of Americans don’t know how to fill out tax forms. And, about 36% aren’t confident they’re maximizing deductions and credits.

“The data we’ve uncovered underscores a major issue: the U.S. system is unnecessarily complex, and it’s taking a toll on everyday Americans,” Kyle Gollins, head of commercial, Americas at Savanta, said in a statement. “When nearly half of the population doesn’t fully understand how to file their taxes and more than a third fear making mistakes, it’s clear that simplifying the process could alleviate stress and reduce errors.”

In short, the current tax code needs to be made easier.

The Most Recent Proposals for Tax Reform

Most recently, the Trump administration put forth several tax proposals.

That includes the extension and restoration of the expiring provisions of the Tax Cuts and Jobs Act of 2017, tax cuts for Americans who receive Social Security, no taxes on tips or overtime, and removal of the state and local tax deduction caps.

In addition, according to Thomson Reuters, “Individual income tax rates (10%, 12%, 22%, 24%, 32%, 35%, and 37%) will expire after 2025 and revert to pre-TCJA rates. Trump has proposed to extend or make permanent these rates and replace individual income tax with increases in tariffs. Trump has proposed to reduce the corporate income tax rate from 21% to 20%; 15% for companies that manufacture in the U.S.”

Before the Tax Cuts and Jobs Act, the last time we saw tax reform was in 1986, with the Tax Reform Act – which took two years to accomplish. Under President Reagan, it lowered federal income taxes, decreased the number of brackets, and cut the top tax rate from 50% to 28%. It raised the bottom tax rate from 11% to 15%.

Americans Want Simplification and Fairness with Tax Reform

For one, Americans want a tax code that is simpler to understand, fair, and designed to benefit the greater economy.

Two, many Americans want to see tax rates reduced, particularly for middle- and lower-income earners. They argue that lower taxes could stimulate the economy by increasing disposable income and helping individuals and families. Three, they want simplification. At the moment, Americans want tax reform that simplifies tax filings, making it easier to understand.

Fourth, Americans want to see a fair system.

They want to ensure that companies and the wealthiest people are paying their fair share. That includes addressing loopholes that allow companies and the wealthy to reduce tax burdens.

They also want to see an increase in corporate taxes, which isn’t likely to happen any time soon. According to the Tax Foundation, “Studies have shown that the corporate income tax is the most harmful tax for economic growth. And conversely, studies are now confirming the benefits of reducing the corporate income tax, finding the TCJA’s [Tax Cuts and Jobs Act] corporate tax reforms significantly boosted domestic investment.”

Also, simplification of tax code is feasible, but requires cooperation from both sides of the aisle.

Unfortunately, that’s tough to achieve, as we’re seeing with the potentail TCJA extension.

The post 86% of American Want a Major Overhaul of the Tax Code – Why Won’t It Happen? appeared first on 24/7 Wall St..