7 Best Quantum Computing Stocks to Buy This May

Quantum computing technology utilizes the power of quantum mechanics. Unlike binary bits, qubits (quantum bits) can be in a superposition – a phenomenon that occurs at the subatomic scale, in which objects have no clearly defined state, and are abstractedly `between’ the two basis states. This area of research promises to accelerate computing speed by […] The post 7 Best Quantum Computing Stocks to Buy This May appeared first on 24/7 Wall St..

Quantum computing technology utilizes the power of quantum mechanics. Unlike binary bits, qubits (quantum bits) can be in a superposition – a phenomenon that occurs at the subatomic scale, in which objects have no clearly defined state, and are abstractedly `between’ the two basis states. This area of research promises to accelerate computing speed by an exponential order of magnitude beyond anything currently in existence.

Key Points

-

Progress is being made by a number of companies to make quantum computing a commercial reality, as it will easily outperform supercomputers once their operational issues are resolved.

-

The exponentially faster calculation speed of quantum computing is seen to be the key to making AI and many other microprocessor based operations practical tools for practically every industry’s application that currently deploys computers in some form or fashion.

-

Both long established tech companies and new upstarts are competing in a race to bring the first viable quantum computing product to market. Since the field is so new and wide open, each company is looking for its own niche.

-

Retirement concerns and objectives can be intimidating topics. SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer your questions today. These advisors are trained to help you understand all of the relevant factors and ensure your portfolio is prepared for the future. A call takes only 5 minutes. Don’t waste another minute – get started by clicking here.(Sponsor)

The primary obstacles in quantum computing that are slowly being resolved are mostly the result of quantum decoherence, which introduces a signal processing “noise” into calculations, due to insufficient qubit isolation. Once quantum decoherence has been resolved to a reliable level, quantum computing’s performance superiority and price advantage over supercomputers will make it the new gold standard.

A number of companies are heavily investing in R&D for their respective iterations of the quantum computing sphere. Some well-known ones are developing quantum computing in-house as a new internal department. Others are relatively new companies that launched specifically for quantum computing R&D to rush a commercial product to market that rivals the industry titans.

Microsoft

With billions in its R&D war chest, Magnificent 7 goliath Microsoft (NASDAQ: MSFT) is in a strong position to capitalize on quantum computing’s sector excitement. Ironically, the company known primarily for its software and cloud based business applications is exploring a quantum processing unit (QPC) for its first product launch.

Described as “powered by a topological core, designed to scale to a million qubits on a single chip,” according to Microsoft, it is being developed in partnership with the Defense Advanced Research Projects Agency (DARPA) Underexplored Systems for Utility-Scale Quantum Computing (US2QC) program. Microsoft predicts that it will be able to create a fault-tolerant prototype for a quantum computer “in years, not decades.”

IBM

International Business Machines (NYSE: IBM) has pledged $30 billion for quantum computing R&D and has already established an in-house IBM Quantum System One division, which is targeting 1,000+ qubit systems.The company has already deployed the 1,121-qubit Condor processor, which has registered a 50% qubit density increase, and the 133-qubit Heron processor, which is delivering 3x-5x higher performance over its earlier generations.

While Heron demonstrated circuit execution with 5,000 two-qubit gates in 2024, IBM’s even more powerful Starling processor is anticipated to achieve 100 million gates over 200 qubits by 2029 and its Blue Jay processor to reach 1 billion gates across 2,000 qubits by 2033.

IBM Cloud services is also offering Quantum as a Service (QaaS) for clients such as Mercedes Benz Group, Cerner, and Exxon Mobil. Arvind Krishna, IBM’s President, expects error correction and coherence speeds (how fast a qubit can maintain its quantum state) to reach commercial readiness levels by 2030. IBM presently owns the world’s largest fleet of quantum computing systems, although that can change as competition in the sector escalates.

IonQ

There are several pure play, start-up quantum computing companies that have emerged in recent years, but the first one to go public was IonQ (NYSE: IONQ). Seeking to develop its own quantum computer hardware, IonQ’s Aria computing systems are already on a wide number of public cloud services.

The IonQ Forte Enterprise quantum computer rollout is being marketed to big-spending key sectors like finance and life sciences and is making bold claims as to its capabilities – once it becomes available. Originally going public via SPAC merger with dMY Technology Group III in 2021, IonQ has major partnerships with SoftBank Group (also an IonQ investor), Microsoft, and Amazon Web Services for cloud computing and quantum computing potential. The company garnered new investor interest recently when it was named as one of the 15 quantum computing companies chosen for inclusion in the DARPA Quantum Benchmarking Initiative.

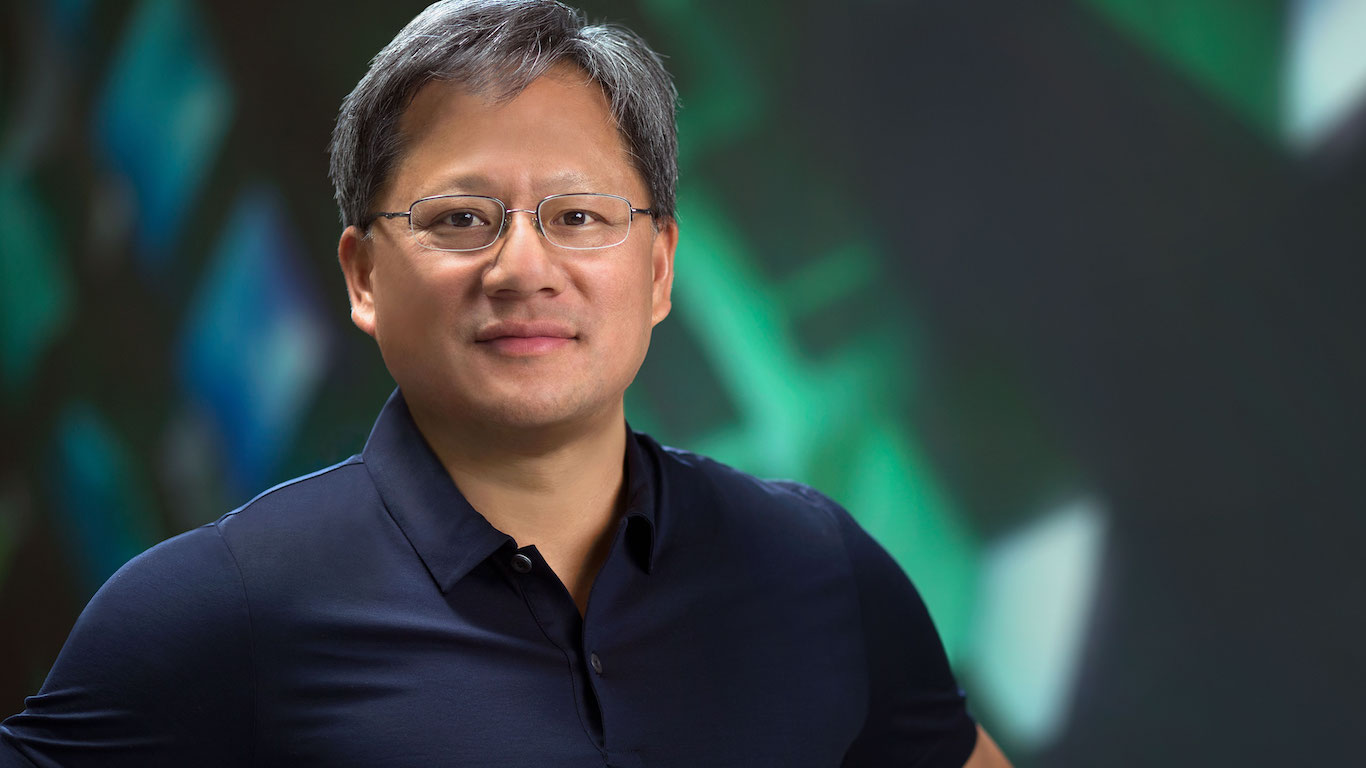

Nvidia

Jensen Huang’s leadership has steered Nvidia (NASDAQ: NVDA) and its highly coveted GPUs to become nearly synonymous with AI. Ironically, Jensen Huang is pessimistic about “a truly game-changing system” becoming a standalone reality in the near term.

Nvidia is focused on software and processes through The Nvidia Accelerated Quantum Research Center (NVAQC), which is tasked with integrating AI supercomputers with leading quantum hardware to achieve accelerated quantum supercomputing. In a statement, Nvidia announced, “The NVAQC will help solve quantum computing’s most challenging problems, ranging from qubit noise to transforming experimental quantum processors into practical devices.”

Nvida is already collaborating with Google Quantum AI by providing its Nvidia CUDA-Q platform to power quantum computing device simulations. Google’s engineers are already utilizing over a thousand Nvidia H100 Tensor Core GPus in the Nvidia Eos supercomputer for its simulations.

Alphabet/Google

As owners of the third largest public cloud computing platform, Alphabet (NASDAQ: GOOG, GOOGL) is already fully committed to quantum computing. Its R&D division is refining its homegrown Sycamore quantum computing chips, and its SandboxAQ quantum computing software unit spun off in 2022.

Google’s quantum engineers wowed the tech industry and investors with a November, 2024 demonstration. They performed a benchmark test with its Willow quantum chip that would take supercomputers 10 septillion years to process in just a 5 minutes.

Combining AI and quantum computing is a stated strategy for Google to maintain its cutting edge in internet search and data organization. While Jensen Huang thinks that commercialized quantum computing is two decades away, Google’s Harmut Neven, who is spearheading its quantum AI efforts, believes that quantum computing applications for healthcare and energy are achievable by 2030.

Amazon

While the majority of people familiar with Amazon (NASDAQ: AMZN) is due to its ubiquity in e-commerce, the company’s Amazon Web Services has been a major force to be reckoned with in the cloud computing sector. Amazon was an early entrant in the quantum computing arena, with its Amazon Braket quantum computing service. It served as a virtual pay-as-you-go entry portal to quantum platforms from Rigetti Computing, IonQ, and QuEra Computing. Researchers and developers were thus able to try the different quantum offerings on a low-cost “tasting menu” type of model.

Amazon’s foray into semiconductors was unveiled earlier this year with the Ocelot chip. Designed to reduce error-correction requirement costs by up to 90%, Ocelot is described as using a “cat qubit” (named after the Schrödinger’s cat thought experiment) to automatically suppress a menu of routine errors, thus freeing up resources that would otherwise need to be devoted to their correction. Ocelot is the first time that cat qubit technology and quantum error components were merged onto a microprocessor that can be mass produced.

Rigetti Computing

Another company on the 15 company list for the DARPA Quantum Benchmarking Initiative, Rigetti Computing (NASDAQ: RGTI) offers its full-stack quantum computing access via its Rigetti Quantum Cloud Services platform. With a design and function that caters especially to government, finance, and biotech sector users, Rigetti clients include NASA, HSBC Holdings PLC, and the US Air Force Research Laboratory, among others.

Rigetti’s proprietary quantum processing units and systems deliver cloud access for developers to work on quantum applications. Its Novera Quantum Processing Unit is a 9-qubit scaled down version of its quantum computer in a commercial format. The USAF and Horizon Quantum Computing are among the early adoptees of Novera, its $900,000 price tag making it an attractive and relatively cost effective way for a company to customize its own quantum computing setup.

A report from Boston Consulting Group estimates that the quantum computing sector will explode to between $90 billion and $170 billion in annual value from 2030-2040. Whichever companies can get their quantum computing system to market the fastest will have first dibs on that bounty. However, the niche approach, combined with reliable revenues from other products and services, will probably still add a sizable revenue and earnings boost to any of the aforementioned companies going that route.

The post 7 Best Quantum Computing Stocks to Buy This May appeared first on 24/7 Wall St..