6 Social Security Terms You Should Know to Plan Your Retirement

When the time comes to start thinking about how Social Security will factor into your life, understanding how the program works is crucial. Unfortunately, this program, however valuable, isn’t super straightforward and, in some cases, requires 12 college degrees to understand. As a result, it’s essential to know some of the most important terms used […] The post 6 Social Security Terms You Should Know to Plan Your Retirement appeared first on 24/7 Wall St..

When the time comes to start thinking about how Social Security will factor into your life, understanding how the program works is crucial. Unfortunately, this program, however valuable, isn’t super straightforward and, in some cases, requires 12 college degrees to understand.

The Social Security program is surprisingly complicated, full of terms most people don’t know.

It’s worth knowing what terms like Full Retirement Age and Primary Insurance Amount mean.

Spousal and survivor benefits are also increasingly important to know and understand.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Key Points

As a result, it’s essential to know some of the most important terms used when discussing Social Security. COLA, FRA, and PIA are all terms anyone about to receive Social Security benefits should know, but may not be able to explain.

6. Survivor Benefits

If you suddenly become a widow(er), Social Security doesn’t automatically disappear, which should be a very comforting fact to know. This means a widow can and should expect to receive 100% of the deceased’s benefits if a claim is made at Full Retirement Age. Eligibility depends on being married for at least 9 months or 10 years if divorced and having kids under 16 or disabled.

Why Survivor Benefits Matter

The hope is that this income provides a cushion during an uncertain time when people are trying to figure out how to get back on their feet. This benefit also overrides spousal benefits, so you would start to receive the higher of the two amounts. So, instead of a $1,250 spousal benefit, you would now qualify for the full $2,500 survivor benefit, which hopefully will keep the lights on and bills paid.

5. Spousal Benefits

Arguably one of the most critical Social Security terms to know, Spousal Benefits enable a married person to claim up to 50% of their spouse’s PIA if it’s higher than their own, beginning at age 62. This is especially useful for someone in a home who has been a caretaker for children and the home and hasn’t worked in some time. It’s essentially a safety net for lower earners or those who haven’t worked in a long time.

Why Spousal Benefits Matter

To qualify for a Spousal Benefit, you must be at least 62, and the higher-earning spouse must file for benefits first. Once you start receiving benefits, if the higher-earning spouse receives $2,500 from Social Security, the spouse would receive $1,200 at Full Retirement Age, a nice little boost in cash flow for retirees who otherwise might need additional money from savings.

4. Cost-Of-Living Adjustment (COLA)

The cost-of-living adjustment for Social Security, better known by its COLA acronym, has been in place since the 1970s. Except for three years, the government has used the Consumer Price Index (CPI-W) to provide an annual increase to Social Security benefits based on any increases from inflation. Every announcement occurs in October before a new year begins so recipients can plan accordingly.

Why COLA Matters

In 2025, the Social Security Administration provided a 2.5% cost-of-living or COLA adjustment for all Social Security benefits. While many retirees may not feel this is enough, there is no denying this is a critical term to be familiar with. At 2.5%, you are likely receiving around $50 more on a $2,000 monthly benefit check, or $600 annually, which is necessary to know as part of your retirement planning.

Unfortunately, COLA rarely matches up to medical cost increases, often 5% per year. Still, the hope is that COLA can reduce your reliance on savings to cover any price hikes you discover elsewhere from inflation, like the price of eggs, gas, and everyday purchases.

3. Primary Insurance Amount

With the Primary Insurance Amount, you should know this term as it defines the base monthly benefit you are set to receive as soon as you hit Full Retirement Age. This number is calculated based on your 35 highest-earning salary years, which are adjusted for inflation. To be clear, this term matters most about Social Security benefits and how much you can expect.

Why PIA Matters

If you’re trying to decide when to retire and how much you will have to live on during retirement from Social Security, the PIA is the first number you need to know. Knowing your PIA monthly and annually will help you plan for retirement and know precisely how much you can claim at 62 and or at 70, so you can see the range you have available through the Social Security website.

It’s also important to know that PIA affects any potential spousal claims or survivor benefits, so this is worth discussing with a spouse before you make any final decision on what age to begin taking benefits.

2. Delayed Retirement Credit

If you wait until 70 to claim your Social Security benefit, you earn a Delayed Retirement Credit. In reality, this means that you delay between 67 and 70 every year, and your benefit amount increases by 8%, which is automatic and permanent. If you were born in 1943 or later, you can qualify for this updated amount, though it’s worth noting it stops at 70 years of age.

Why DRC Matters

Some very simple math is involved here, showing why this term is so important. Suppose you expect to receive around $2,000 at age 67 as your Social Security benefit amount. This amount now becomes $2,160 at 68, $2,320 at 69, and $2,480 in retirement benefits at age 70 before you factor in any cost-of-living adjustments. It’s worth noting that the longer you wait to earn more, the more you may push yourself into a higher tax bracket, all while knowing that up to 85% of your benefits can be taxed depending on your income threshold.

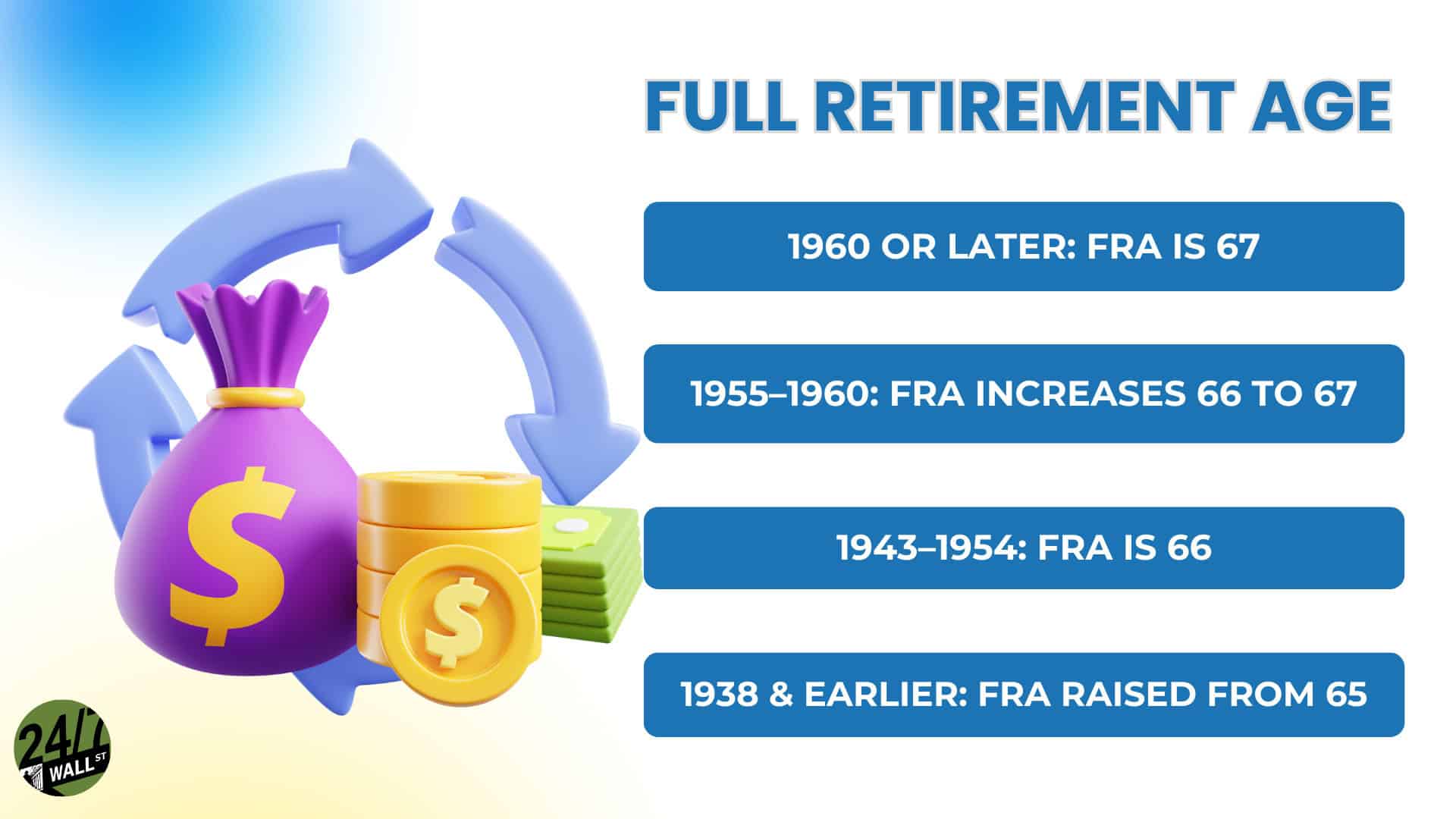

1. Full Retirement Age

Undoubtedly one of the most important Social Security terms to know and understand, Full Retirement Age is the age at which you’re eligible to receive 100% of your Social Security retirement benefit. As of 1960 and later, this Full Retirement Age has been in place since then, and the Social Security Administration uses your birth year to help assign your FRA, which can be found on your Social Security statement.

Why FRA Matters

It should go without saying that the timing of your Full Retirement Age is one of the most significant factors in determining when your Social Security benefits will begin. If you claim before 67, you will get less than 100% of your total benefit amount, and if you claim after 67, you could earn as much as 130% of your total benefit amount, which can help significantly in the long term.

The post 6 Social Security Terms You Should Know to Plan Your Retirement appeared first on 24/7 Wall St..