4 Red-Hot Technology Stocks Trading Under $10 Have Massive Upside Potential

These four red-hot technology stocks that trade for less than $10 a share have considerable upside potential. The post 4 Red-Hot Technology Stocks Trading Under $10 Have Massive Upside Potential appeared first on 24/7 Wall St..

While most of Wall Street focuses on large and mega-cap stocks, as they provide a degree of safety and liquidity, many investors are limited in the number of shares they can buy. Many of the most significant public companies, especially the technology giants, trade at prices up to $1,000 per share, while many are in the low to mid-hundreds. It is tough to get decent share count leverage at those steep prices.

24/7 Wall St. Key Points:

-

Tariff resolutions with China sent the stock market on a parabolic move higher.

-

Stocks trading under $10 allow traders to put together sizable positions.

-

Many well-known companies once traded under $10.

-

Are aggressive stocks under S10 a good idea for you? Why not meet with a financial advisor near you for a complete portfolio review? Click here to get started today. (Sponsored)

Many investors, especially more aggressive traders, seek lower-priced stocks to generate a profit and increase their share count. That can help the decision-making process, especially when you are on to a winner, as you can always sell and keep half.

Low-price stock skeptics should note that many of the world’s biggest companies, including Apple, Amazon, Netflix, and Nvidia, once traded in the single digits.

We screened our 24/7 Wall St. research database, looking for smaller-cap companies that could offer patient investors enormous returns for the rest of 2025 and beyond. Four stocks that appeared on our screens have considerable upside potential, and all are rated Buy at the top Wall Street firms we cover. It is worth noting that these stocks were trading below $10 at the time this post was written.

Why do we cover stocks under $10?

We enjoy scouring the stock market for the next big winner, as it allows us to buy a larger position in lower-priced stocks and potentially achieve a parabolic home run, similar to Nvidia or Netflix. Over the years, we have written about stocks like Zynga, which was acquired by Take-Two Interactive. Northern Oil & Gas was under $3 when we started covering the company. It had a reverse split and has traded close to $30.

Snap

Trading below $10, this social media favorite was as high as $75 a few years ago. Snap Inc. (NYSE: SNAP) is a technology company. Its flagship product, Snapchat, is a visual messaging application that enhances relationships with friends, family, and the world.

Snapchat is the company’s core mobile device application, containing five tabs, complemented by additional tools that function outside the application. Snapchatters can interact with any or all of the five tabs.

Additionally, it offers Snapchat+, its subscription product, which provides subscribers with access to exclusive, experimental, and pre-release features.

Snapchat+ offers a range of features, from allowing Snapchatters to customize the look and feel of their application to giving special insights into their friendships.

The company also offers Snapchat for Web, a browser-based product that brings Snapchat’s calling and messaging capabilities to the Web. Its advertising products include AR Ads and Snap Ads.

Snap Ads include:

- Single Image or Video Ads

- Story Ads

- Collection Ads

- Dynamic Ads

- Commercials

- Sponsored Snaps

BMO Capital Markets has assigned an Outperform rating with a target price of $13.

Big Bear.ai

This small-cap artificial intelligence (AI) technology company may be a potential takeover candidate. Big Bear.ai Holdings Inc. (NYSE: BBAI) is a provider of AI-powered decision intelligence solutions for national security, supply chain management, and digital identity.

The company is a technology-led solutions organization, providing both software and services to its customers. It combines subject-matter expertise with technology to connect the enterprise, provide insights into process performance, and offer recommendations for managing risk.

It offers computer vision, anomaly/event detection, and descriptive and predictive analytics to support operations and break down silos between vendors and systems.

The company’s customers span the public and private sectors, including:

- United States defense and intelligence agencies

- Border protection

- Transportation security

- Manufacturing, distribution, and logistics

- Travel, entertainment, and tourism

It also offers software assets that are tailored for digital identity and biometrics, leveraging advanced vision AI technology.

Cantor Fitzgerald has an Overweight rating with a $6 target price.

HiMax Technologies

Down over 50% from 52-week highs and trading at a respectable 16 times earnings, this is a top stock to look at now. HiMax Technologies Inc. (NASDAQ: HIMX) is primarily engaged in the development of fabless semiconductor solutions.

The company offers comprehensive automotive integrated circuit (IC) solutions, including:

- Traditional driver ICs

- In-cell touch and display driver integration

- Large touch and display driver integration

- Local dimming timing controllers.

The company’s principal product lines include:

- Display drivers and timing controllers,

- Touch controller ICs

- Thin-film transistor liquid crystal display

- Television and monitor semiconductor solutions

- Intellectual property (IP) and application-specific integrated circuit service

- Liquid crystal on silicon

- Micro-electro mechanical systems products

- Power ICs

- Complementary metal-oxide-semiconductor image sensor product

- Wafer-level optics products

Baird has an Outperform rating with a $15 target price objective.

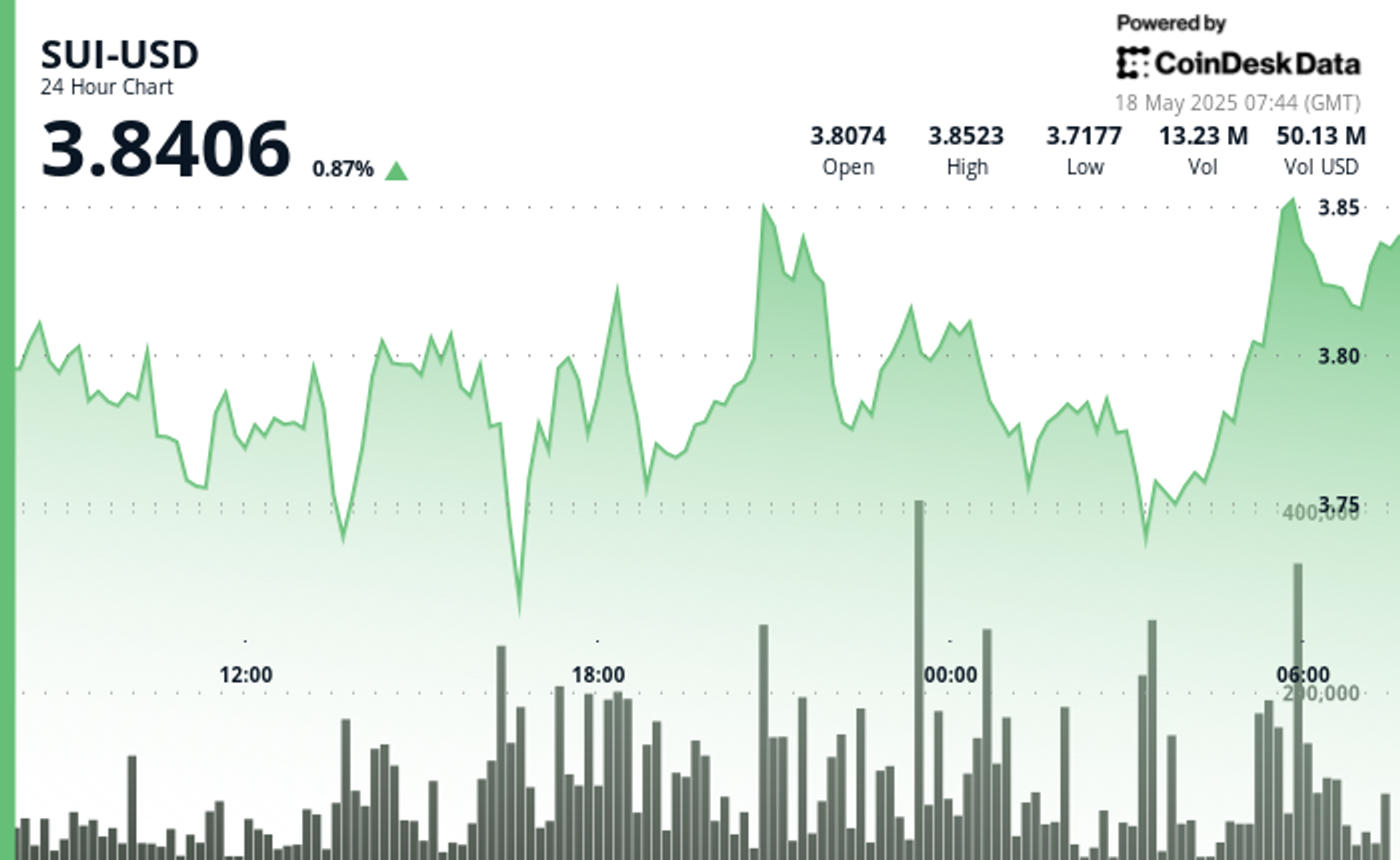

UP Fintech

Based in China, this stock appears poised to break out to new highs and could be a significant tariff trade winner. UP Fintech Holding Ltd. (NASDAQ: TIGR) is primarily engaged in operating an integrated financial technology platform that provides a cross-market, multi-product investment experience for investors worldwide.

The company offers comprehensive brokerage services through its integrated single-account structure, which empowers users in trade execution, margin financing, and securities lending across different global markets.

The company also provides value-added services, all within a few taps or clicks through the application on smartphones, tablets, and personal computers (PC), such as:

- Investor education

- Community engagement

- IR/PR platform

UP Fintech Holding also offers ESOP management services to companies that are soon to be listed or already listed. The company primarily operates its business in New Zealand, Singapore, and the United States.

Bank of America has a Buy rating and a $7.76 target, which looks to be going higher soon.

Boomers Are Buying Five Safe Monthly Dividend Stocks Delivering Huge Passive Income

The post 4 Red-Hot Technology Stocks Trading Under $10 Have Massive Upside Potential appeared first on 24/7 Wall St..