3 ETFs To Play Bitcoins “Acceleration” Phase

One of the biggest stories of the year is Bitcoin. At the start of 2024, the digital currency traded at $42,280. Today, it’s up to $111,166 and could run even higher on retail, government, and institutional interest. As noted by Reuters, “Asset managers, ranging from wealth management companies to hedge funds and pension funds, boosted […] The post 3 ETFs To Play Bitcoins “Acceleration” Phase appeared first on 24/7 Wall St..

Key Points

-

At the start of 2024, the digital currency traded at $42,280. Today, it’s up to $111,166 and could easily run even higher.

-

President Trump wants to see cryptocurrency regulation on his desk and ready to sign by this August.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

One of the biggest stories of the year is Bitcoin.

At the start of 2024, the digital currency traded at $42,280. Today, it’s up to $111,166 and could run even higher on retail, government, and institutional interest.

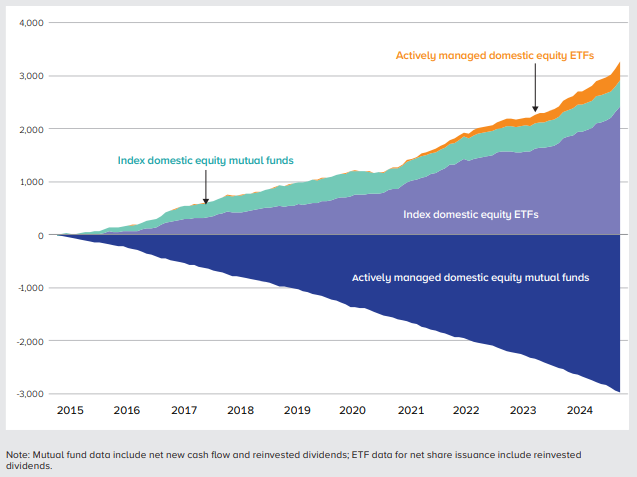

As noted by Reuters, “Asset managers, ranging from wealth management companies to hedge funds and pension funds, boosted allocations to U.S. exchange-traded funds tied to the price of bitcoin in the fourth quarter of 2024, as the price of the world’s largest cryptocurrency soared 47%, according to recent regulatory filings.”

There’s also new legislation in the works.

As noted by Barron’s, “As soon as Monday, the Senate plans to hold a key procedural vote on the so-called GENIUS Act. Among other provisions, the bill would require stablecoins, whose value is typically pegged to the dollar, to hold reserves of liquid, safe assets like Treasury bills. Issuers would also have to follow anti-money-laundering and terrorism finance rules and to give holders of coins priority to recoup their money in a bankruptcy.”

Two, President Trump wants to see cryptocurrency regulation on his desk and ready to sign by this August. We also have to remember the President just established a strategic Bitcoin reserve and stockpile for other cryptocurrencies.

Analysts at Standard Chartered say Bitcoin could rally to $500,000.

“The latest 13F data from the U.S. Securities and Exchange Commission (SEC) supports our core thesis that Bitcoin (BTC) will reach the $500,000 level before Trump leaves office as it attracts a wider range of institutional buyers,” wrote Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, as quoted by Bitcoin Magazine.

“As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in BTC.”

Even better, there a plenty more Bitcoin bulls in the market.

One of the best ways to trade upside in Bitcoin is, of course, to invest in Bitcoin. Or, you can invest in related stocks, like MicroStrategy, Marathon, or Riot. However, if you want even more exposure – and in some cases, yield – there are interesting exchange-traded funds (ETFs), too.

Here are three on the long side of the Bitcoin trade.

ProShares Bitcoin Strategy ETF

If you believe the value of BTC will push higher, you can invest in the Pro Shares Bitcoin Strategy ETF (NYSE ARCA: BITO). With an expense ratio of 0.95%, the ETF tracks the performance of spot Bitcoin, and is the world’s largest and most actively traded cryptocurrency ETF, according to ProShares.

BITO mimics the price of Bitcoin as closely as possible without investing in the cryptocurrency itself. As noted by Money, “Like all crypto ETFs, part of the allure of BITO is that investors don’t need to deal with cryptocurrency wallets and private keys but can instead invest through a broker they already use.”

Or, if you believe the value of Bitcoin could slip, investors could also jump into ProShares Short Bitcoin (BITI), which tracks the S&P CME Bitcoin Futures Index, with profitability computed daily (before fees and expenses) as the inverse (-1x) of the index’s daily performance.

YieldMax Bitcoin Option Income Strategy ETF

With an expense ratio of 0.99% and a distribution rate of 104.4%, the YieldMax Bitcoin Option Income Strategy ETF (NYSE ARCA: YBIT) does not invest directly in Bitcoin.

Instead, it will 0generate current income via a synthetic covered call strategy on one or more select U.S.-listed Bitcoin ETPs – a category of investment vehicle that is generally backed by an asset such as gold, a commodity, or a crypto token.

The best part – you don’t need to know much about options to buy the YBIT – which ran from about $7 in September 2024 to $11. Plus, it paid out a yield. It just paid a dividend of $0.8697 on May 16 to shareholders of record as of May 15. Before that, YBIT paid a dividend of $0.4110 on April 21 to shareholders of record as of April 17.

ARK 21Shares Bitcoin ETF

We can also take a look at the ARK21 Shares Bitcoin ETF (BATS: ARKB).

With an expense ratio of 0.21%, the ETF tracks the performance of bitcoin, as measured by the performance of the CME CF Bitcoin Reference Rate – New York Variant, adjusted for the Trust’s expenses and other liabilities. In addition, ARKB provides exposure to bitcoin which is kept in cold storage1 by one of the largest crypto custodians, offering greater protection than custody options available to individual investors.

Since bottoming out at around $75, the ARKB ETF just rallied to $111.13. Currently overbought, we do expect for it to temporarily reverse lower before turning higher.

The post 3 ETFs To Play Bitcoins “Acceleration” Phase appeared first on 24/7 Wall St..