3 Dividend Stocks Set to Soar In June

A court put President Donald Trump’s tariffs on pause recently. Many were elated that the stock market would soar even higher, since previous tariff reliefs translated into massive gains for certain stocks. However, it didn’t take long for the decision to be appealed and reinstated. This is a temporary reinstatement, but it would be unwise […] The post 3 Dividend Stocks Set to Soar In June appeared first on 24/7 Wall St..

Key Points

-

These dividend stocks are known for being safety-first.

-

As such, they are unlikely to fall in any downturn. That includes ones triggered by tariff concerns.

-

In fact, they could end up soaring as investors take refuge in them.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

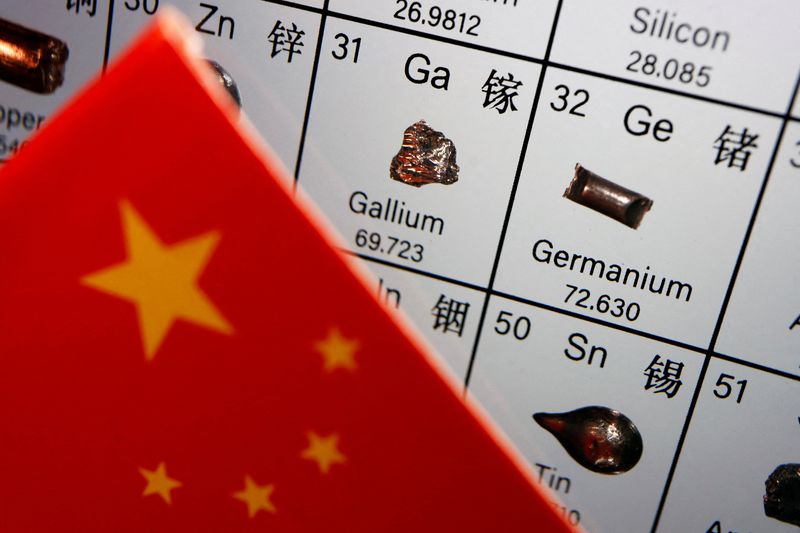

A court put President Donald Trump’s tariffs on pause recently. Many were elated that the stock market would soar even higher, since previous tariff reliefs translated into massive gains for certain stocks. However, it didn’t take long for the decision to be appealed and reinstated. This is a temporary reinstatement, but it would be unwise to assume it won’t be extended further as ongoing trade deals are sorted out and more court battles take place.

In the meantime, this also means that fully exiting your defensive positions and moving into aggressive plays isn’t appropriate just yet and our good dividend stocks to buy this June. Many of the stocks that declined due to tariffs are close to fully recovering after rallying over the past month and a half. If tariffs persist and the administration follows through on its promise to introduce more aggressive tariffs later, it could spark a flight to safety. Here are three dividend stocks to look into that will benefit from such an event:

Colgate (CL)

Colgate (NYSE:CL) is one of the most stable consumer staples stocks you can buy today. The company is very mature and sells a product that generates recurring cash flow even in the worst of times. The only downside is that the dividend yield is low in the current environment, and the business itself may seem boring. But boring is exactly what you want in difficult times.

CL stock climbed over 55% from its trough in October 2023 to a peak in September 2024 before correcting. It has been trading flat for the past couple of weeks, but if investors keep rotating into defensive assets, CL stock could soar once more. Its core products are toothpaste and other consumer staples with very sticky demand. These products don’t constitute too much of someone’s shopping cart and are also essential, so they’re unlikely to leave them out, regardless of the macro background.

CL stock comes with a 2.17% dividend yield and a dividend payout ratio of 55%. It also does share buybacks and has a 3-year average share buyback ratio of 1.1%.

Sempra (SRE)

Sempra (NYSE:SRE) is an energy infrastructure company that distributes electricity and natural gas to homes and businesses. Midstream companies are one of the most stable, since they use a fee-based business model and are detached from commodity prices. They also have long-term contracts, and the infrastructure is essential. As such, they’re unlikely to face much volatility if the rest of the market starts to tumble.

Moreover, if tariffs are the problem behind such a downturn, midstream companies are often among the top of investors’ lists since these businesses operate almost entirely domestically. That said, these companies do use some steel and specialized equipment that can increase costs, but the impact is not as significant as it is for most other companies.

Sempra’s stock is currently down 17% from its one-year high due to a disappointing Q4 2024 earnings report and lowered guidance after a rate case decision in California that came in below Sempra’s expectations. Utilities rely on rate cases to determine how much they can charge customers, so any negative outcome here will directly impact the bottom line.

Regardless, lower rates are now priced in, and the stock has solid potential for recovery if tariffs cause more fear. It also comes with a 3.19% dividend yield and a payout ratio of just 52%. There’s plenty of room for more dividend increases down the line.

Verizon (VZ)

Wall Street is starting to recognize telecommunications companies as ‘essential’ because of how important they have become. People are unwilling to sacrifice their access to the internet and communication services, no matter what, and this should stay true even during a tariff-driven spook.

Verizon (NYSE:VZ) is a telecom company that also has most of its operations centered in the U.S. Company executives have stated that only a “very small portion” of its capital expenditures for network infrastructure (like U.S.-centric fiber optics) is exposed to tariffs. Plus, Verizon has stated that if tariffs do increase costs, it will pass those costs on to its customers instead of taking a bottom-line hit.

On top of all that, Verizon pays some of the most solid dividends. It has a long and consistent history of paying and increasing its dividends, with 20 consecutive years of dividend increases. Its forward dividend yield is one of the highest among big-cap stocks at 6.16%. There’s still plenty of room for dividend increases down the line since its payout ratio is just 56.15%. If rate cuts continue as expected starting in September, cash flow should increase significantly, since debt servicing has been the main reason VZ stock has lagged in the past few years. VZ is likely to mirror AT&T (NYSE:T) as both pull off a full recovery in the coming years.

The post 3 Dividend Stocks Set to Soar In June appeared first on 24/7 Wall St..