Will $30K in annuity income offset my $60K RMD?

The IRS uses required minimum distributions to ensure people take money out of their traditional retirement accounts as they get older. The agency has to collect tax revenue, but beyond that reason, withdrawing from your traditional 401(k) or IRA now can make it less of a headache for your heirs, who would have to pay […] The post Will $30K in annuity income offset my $60K RMD? appeared first on 24/7 Wall St..

The IRS uses required minimum distributions to ensure people take money out of their traditional retirement accounts as they get older. The agency has to collect tax revenue, but beyond that reason, withdrawing from your traditional 401(k) or IRA now can make it less of a headache for your heirs, who would have to pay taxes on it.

However, there are some strategies you can use to minimize how much you have to withdraw from your account. Having $30,000 in annual annuity income will reduce a high RMD. These are some of the things to consider before following this strategy.

Key Points

-

Receiving $30,000 in annuity income can reduce your RMD if the annuity is in a traditional retirement account.

-

It’s important to consider your risk tolerance and long-term goals before committing to an annuity.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

The Secure 2.0 Act Led To Improvements

The Secure 2.0 Act of 2022 resulted in several improvements to the U.S. tax code, including how annuity income affects your RMD. The new policy allows you to group all of your retirement accounts together to determine a collective RMD. Any annuity income counts toward the RMD.

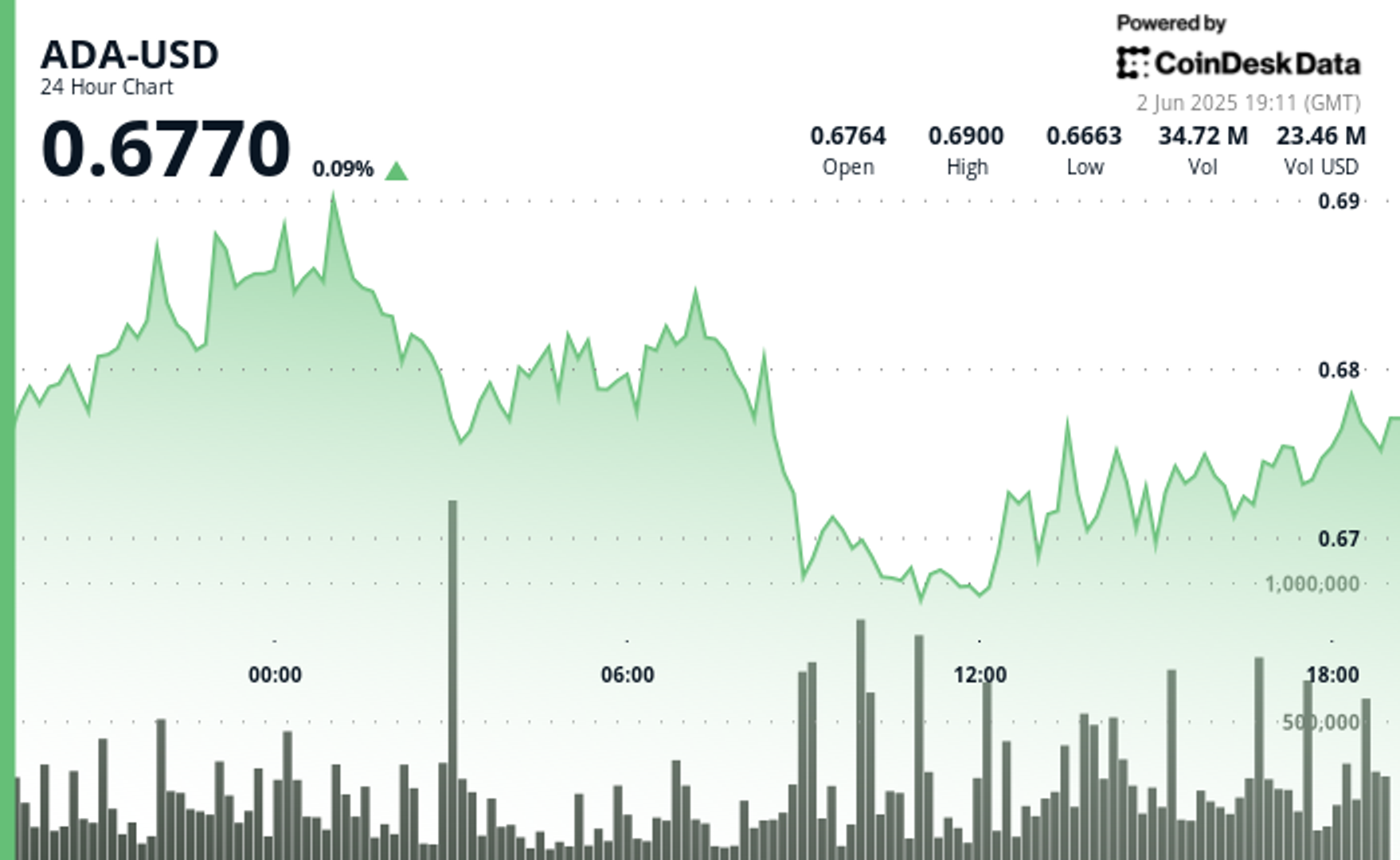

For instance, if you have a $60,000 RMD and earn $30,000 in annuity income each year, your remaining RMD turns into $30,000. If the annuity income came in at $20,000, then the remaining RMD would be $40,000.

Using annuities can generate stable income while protecting the growth-oriented assets in your retirement account. You won’t have to sell those stocks and mutual funds just to fulfill the RMD requirement.

You Must Hold The Annuity In Your IRA

An annuity will only count toward your RMD if you hold it in your IRA. For instance, if you open an annuity that isn’t in your IRA and receive $30,000 per year, it won’t offset the $60,000 RMD.

However, holding an annuity in a Roth IRA won’t do you any good. Roth retirement accounts are not subject to RMDs, and any annuity income in these accounts will not offset RMD requirements for your traditional retirement accounts.

Calculate Your Annuity’s Year-End Value

If you have a deferred annuity, you have to calculate its year-end value to determine its impact on your RMD. You can also move funds into a qualified longevity annuity contract to delay cash distributions and reduce your RMD requirement. That’s because contributions to a qualified longevity annuity contract artificially reduces your portfolio’s balance.

Monitoring your annuity’s year-end value can also help you gauge how your portfolio’s balance is changing. A lower balance will translate into lower RMDs in the future.

Should You Use Annuity Income To Offset RMDs?

Using annuity income to offset RMDs can reduce risk since annuities provide steady cash flow. Annuities are less risky than buying individual stocks and may make more sense for retirees. Trimming your RMDs with annuity income also allows you to protect your growth-oriented assets and give them more time to grow in a traditional retirement account. Prolonging withdrawals gives your cash more time to grow before it is inevitably taxed.

The post Will $30K in annuity income offset my $60K RMD? appeared first on 24/7 Wall St..